What is Payroll Tax?

Payroll tax refers to the tax that is paid by an employer on his/her employee’s payroll. It includes remuneration, wages, perks, and gross salary that are received by an employee. Payroll tax is the tax, which has to be held or paid by an employer on behalf of his/her employees.

Source: Copyright © 2021 Kalkine Media

Understanding Payroll Tax

Payroll taxes are the taxes which are paid on the wages and salaries of employees. The tax amount is used by the government to support social insurance programmes, providing income to older people, social security and medicare. The local and state government levied local payroll tax to maintain and developing local infrastructure and services.

Payroll taxes defined those taxes which are levied by government on both employers and employees, in the proportion (percentage) of the salaries that employers pay their employees. Payroll tax is one of the largest sources of income of a government. Payroll taxes may include federal income tax, unemployment tax, social security and medicare tax and other tax imposed by government.

Frequently Asked Questions (FAQs)

What are the different categories of payroll tax?

If an employer or a group of employers who are responsible to pay previous year payroll taxes, in such a case, an employer or a group of employers are not able to apply on incentive scheme of payroll taxes. Payroll Tax is defined in two categories:

- Deductions from an Employee’s Salary: Under this category of payroll tax, employer has to withhold a percentage from his/her employee’s wages and salary. This is also called as withholding tax.

- Taxes Paid by the Employer instead of Employee: Under this category of payroll tax, an employee has to pay the tax from his own funds. It is related to employment of a worker and including certain charges that can be proportionally linked to the salary of a worker.

What are the objectives of payroll tax?

There are various objectives of payroll tax are as follow:

- To provide contribution in the growth and development of the business sector.

- To make rebate provision’s easier, which is paid by the employer on the behalf of their employees.

- To facilitate in preparing businesses in the formative years of functioning and developing.

- To provide help to the businesses which are looking to expand and undertake the payment liability of payroll taxes.

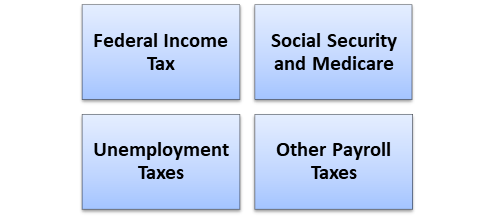

What are the types of Payroll tax?

There are four types of payroll taxes:

Source: Copyright © 2021 Kalkine Media

- Federal Income Tax

Federal income tax is defined as a progressive tax, higher salaried person must pay higher taxes. It is levied by the Internal Revenue Service (IRS) on the annual earnings. The earnings received by workers either in the form of gross income or net income. The employer has to pay or withheld the tax to the government on the behalf of his/her employee’s net income. Net income refers to the income earned after deducting federal tax.

In case of gross income, the employee has to the tax what is owned. All earned money is used for federal tax purposes includes business income, gambling income, a wage, gambling income, unemployment compensation, a salary, and bonuses. Federal Income tax is the income after deducting from tax.

- Social Security and Medicare

Social Security and Medicare are two different taxes, which include the retirement tax and Medicare tax. Employees have to pay a certain percentage of their gross pay as Social Security retirement tax. The annual cap is set by the Social Security Administration. In Medicare tax, tax has to paid on the gross income and it has no income cap for the Medicare tax.

- Unemployment Taxes

Federal and state unemployment insurance taxes have been paid by employers on the behalf of its employees. The federal tax is known as Federal Unemployment Tax Act (FUTA). The tax rate is fixed and defined by government. States decided its percentage of tax rate and charged as a credit against SUTA, which is state unemployment tax. These taxes are paid by employer only without any deduction of an employee’s pay.

- Other Payroll Taxes

The state and municipal governments or councils charge other income taxes. The employers have to deduct as payroll taxes. Both the government state and municipal set their rules and tax rates, and these taxes treated as local payroll taxes.

How payroll tax is different from Income tax?

Income tax refers to the tax paid by an individual on his/her income according to the different income slab brackets that are decided by the government. Income tax also includes several deductions including house rent allowance, deduction in capital gain, education, and so on. On the other hand, payroll tax refers to the tax paid by the employer or employee with a simple flat rate.

Income tax is more complicated and complex process as it includes so many exemptions and deductions, and rules. Whereas payroll tax process is easier and has specified rates. In payroll taxes, mostly taxes are paid by the employer on the behalf of its employee. The burden of the tax can be shifted but in the case of income tax, burden cannot be shifted to the other. Income tax has to be paid by the same person on whom it is levied.

Governments set the payroll taxes for the specific purpose such as funding Social Security, transportation infrastructure and finance social insurance programmes. On the other side, income tax directly goes into the general funds of city, state or federal government. Income tax is paid by an individual based on the amount of his/her income and depending on the sources of income. Contrary, payroll taxes are paid under the Federal Insurance Contributions Act (FICA).

Please wait processing your request...

Please wait processing your request...