Have you ever thought about becoming financially independent or creating a decent wealth or maybe making your life worry-free from a financial standpoint? If the answer to any of these is Yes, then you probably need to focus on this vast subject of personal finance.

So, what exactly is personal finance and how it may help you to achieve your financial goals?

Personal finance is a very vast yet quite simple subject which covers everything that affects the financial health of an individual. It guides an individual on how to save money, the importance of an emergency fund, how and where to invest, how to achieve your retirement corpus etc.

Below we will be touching upon a few of the essential aspects of personal finance that are a no-brainer to increasing your financial stability.

Is savings the foundation of your financial stability?

Savings to your financial goals is what food is to your body. Without the habit of savings, it isn't easy to achieve financial goals. Without the fundamental habit of saving, any level of income would be spent recklessly, and initial corpus to grow would get hammered constantly.

One thumb rule of savings is “Pay yourself first” which has been described in Robert Kiyosaki’s book ‘Rich Dad Poor Dad’. This rule states whatever you are earning be it $1 or $1 million, always save a specific amount first and then look for spending the remaining income, instead of doing the opposite. In other words, spend what’s left after saving instead of saving what’s left after spending.

Are multiple sources of income really helpful?

Most people are having a single source of income, i.e. their salary to rely upon. But what if you could have two or more sources of income? Wouldn’t you be able to save at a higher rate or maybe achieve your goals well before projected time?

This is the purpose of different sources of income, and in today’s world of internet, it’s not that difficult to create another source. Like if you are a good writer, you can write and self-publish your e-book or even start a blog. Love travelling? Start a vlogging channel on YouTube. Have any specialized skill? You can leverage it to others on freelancing sites.

Perhaps, you can invest in equity, bonds, currency, commodity, derivatives or other different forms of assets. Judicious portfolio investment calls for sound qualitative and quantitative analysis.

Emergency fund – Your umbrella on a rainy day?

Life is uncertain and is full of both good times and bad times, but it is often the bad times for which we need to be prepared. Same goes for the financial stability of any individual which can take a hit at any point of time. To safeguard yourself for any uncertainty in the future, the creation of an emergency fund is mandatory.

An emergency fund is also your savings which is kept isolated from the day-to-day reach so that by any means it cannot be dipped into for your normal expenditure. The sole purpose of this form of savings is to get a backup in the time of absolute need which is unforeseen like hospital bill for an accident or to keep you afloat for a few months in case the only source of income goes for a toss. Ideally, a person should have around 3 to 6 months’ worth of living expenses in his/her emergency fund.

Does a budget provide enough worth as compared to the effort to create one?

Most people are not into budgeting mainly because of the amount of efforts to constantly track the expenses, need for making a plan to tackle those and updating it with respect to changes in either income or expenses. Is it worth it after all of these constant efforts?

To answer it in one line “What cannot be measured, cannot be improved”. If you are unaware of where your money is going, how much could be saved, what is the essential spending, then it is really difficult to optimize your expenses.

Is Compounding the real gamechanger?

Compounding, in its basic essence, is getting a return on an asset and reinvesting that return with the initial investment to generate an additional return. This way, the returns gradually becomes exponentially higher than any linear method.

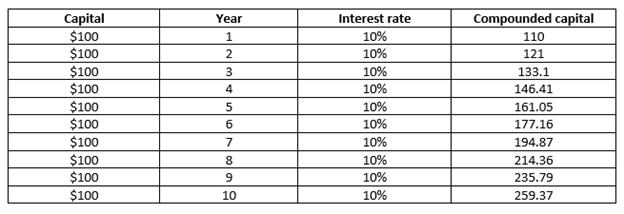

For example, If you invest $100 for a 10% compounded return, in the first year your return would be $10, but in the second year with the same 10% return, you would be getting $11 as your initial capital has also increased.

But the real benefit of compounding is seen after a few years. To continue with the example above, look at the table below to get the real essence of compounding.

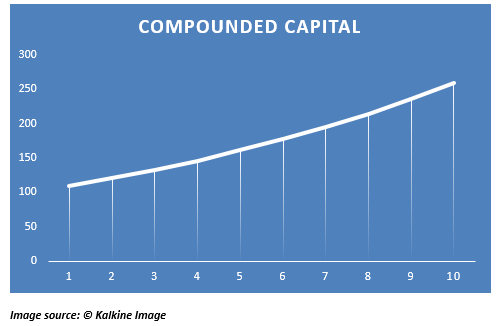

As can be seen from the above table, after 10 years, the initial capital has grown more than 2.5 times with just 10% return per annum. This exponential growth is projected graphically on the chart below.

Now comes the most asked question on how and where to invest? Is investing for a decent compounded return within the competence of an average individual having no expertise in this domain?

First of all, investment is not rocket science; anyone with the basic understanding of the business and finance can invest on his own with proper due diligence. Mix of quantitative and qualitative analysis in the attractive assets, keeping in mind risk appetite and return expectations seem to be the key to successful investing.

Apart from that, nowadays, a lot of financial/investment advisors are available who are better equipped with the knowledge and experience to do the job for you.

A mutual fund is another example of outsourcing your investment-related work to a fund manager. Mutual funds are a pool of investment coming from retail investors which is invested in different assets. All the decision making is done by a dedicated fund manager on where to invest, how much to keep in cash etc.

To sum it all up, always make sure that your income is always greater than your expenses and whatever means help you to achieve this basic principle, comes under the domain of personal finance.

Please wait processing your request...

Please wait processing your request...