What do you understand by the term Preferred Share?

Preferred shares, more commonly known as preferred stock, are prioritised over common shares concerning dividends by the company/share issuer. As a result, preferred shares have priority claims over common shares regarding the company’s earnings and assets.

In case of default, those holding preferred stocks are entitled to be paid before the common stockholders from the assets owned by the company. Usually, preferred shares have a fixed dividend, whereas dividends can vary for common stocks. It is to be noted that preferred shareholders do not have any say in voting rights; however, common shareholders possess voting rights. In terms of claims on assets, preferred shares are senior to common shareholders but junior to bonds.

Summary

- Preferred shares are prioritised over common shares concerning dividends by the company/share issuer.

- Preferred shares have priority claims over common shares regarding the company’s earnings and assets.

- Preferred shareholders do not have any say in voting rights; however, common shareholders possess voting rights.

Frequently Asked Questions

What are the characteristics of Preferred Shares?

- Gets prioritise assets during liquidation: Preferred shareholders get higher priority than common stockholders over a company's assets when a company becomes bankrupt.

- Payment of dividends: Usually, preferred shares provide fixed dividend payments to the shareholders. However, whether the payments are fixed or not depends on an interest rate benchmark like LIBOR.

- Preference in dividends: Preferred shares provide the shareholders with a priority in dividend payments over the common shareholders.

- Non-voting: Mostly, preferred shares do not give voting rights to their shareholders. However, there can be few exceptions.

- Can be converted into common stock: Preferred shares can be converted to a prespecified number of common shares. Preferred shares, like convertible preferred stock, specify the date at which the shares can be converted, whereas others require permission from the corporation.

- Callability: The issuer or the corporation can repurchase preferred shares at specified dates.

Image Source: © Rummess | Megapixl.com

What are the different types of Preferred Stock?

There are four categories of Preference shares.

- Cumulative preferred stock

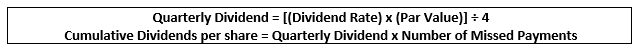

Cumulative preferred stock refers to those preferred stocks that include a provision wherein the company is required to pay preferred shareholders all dividends, including those that were excluded in the past, much before the common shareholders receive their dividend payments. Though these dividend payments are usually guaranteed, they are not always paid out when they are due. When a company fails to pay the preferred shareholder, the unpaid dividends are recorded in its books as "dividends in arrears" and must legally reach the current stockholder at the time of payment. Often, additional compensation (interest) is awarded to the holder if the preferred shares are cumulative.

There is less risk involved in the cumulative preferred stock due to its cumulative feature; they can be offered a lower interest rate. Given the lower cost of capital, most companies prefer to issue stock offerings with the cumulative feature.

Blue-chip companies usually issue non-cumulative preferred stocks with a strong dividend history.

- Non-cumulative preferred stock

Non-cumulative preferred stock refers to a type of preferred stock that does not issue any unpaid dividends. In these kinds of stocks, dividends are not accumulated over time. This means that if a company fails to pay dividends in any particular year, the shareholders of the non-cumulative preferred stock cannot claim such forgone dividends in future. One reason to choose cumulative stock over non-cumulative stock is that cumulative shareholders have the right to collect previous unpaid dividends.

- Participating preferred stock

Participating preferred stock is a type of preferred stock wherein shareholders are entitled to receive dividend payment equal to the generally specified rate of preferred dividends and an extra dividend based on a previously determined condition.

Participating preferred stocks are prioritised over common stocks in a firm's capital structure. Moreover, they are entitled to the additional dividend only if the dividends paid to the common shareholders exceed a certain per-share amount. Finally, it is to be noted that the holders of the participating preferred stock have the choice to transform their shares into common stock.

- Convertible Preferred Stock

Convertible preferred stock is a preferred share that permits a shareholder to convert their preferred shares into a definite number of common shares, usually after a pre-set date. Though mostly convertible preferred shares are exchanged at the shareholder's request, however, there is a provision that permits the issuer to force this conversion. It is to be noted that the value of the convertible preferred stock depends on how well the common stocks perform.

Besides, these stocks have both the debt and the equity features and are mostly used by corporations to raise capital.

What will be the impact on Preferred Shareholders if the company becomes bankrupt?

Image Source: © Eric1513 | Megapixl.com

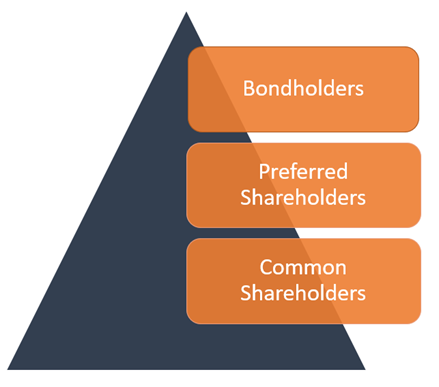

If a company becomes insolvent, all its stockholders will exert their rights on its assets. However, the priority based on which the shareholders will get their share will depend on their specific rights in the security agreement. As discussed above, preferred shareholders will get higher priority in such a situation than the common shareholders. Though preferred shareholders will be paid before the common shareholders, they will have lower priority than bonds, fixed income securities, and debentures. Therefore, we can say that the preferred shareholders will occupy a mid-position in this priority list, as they are prioritised over common shareholders but below bonds.

Priority claim on assets

Source: Copyright © 2021 Kalkine Media

Discuss the advantages of Preferred Shares for both the issuer as well as the investor?

Preferred shares can be advantageous for both the issuers as well as the holders of the securities. These shares can be beneficial to the issuers in the following ways:

- More power with Issuer: Preferred shares allows the corporations issuing these shares to avoid the dilution of control. This is primarily because these shares do not give voting rights to the shareholders usually.

- No obligation to pay dividends: Preferred shares do not compel issuers to pay dividends to shareholders. For instance, if the company does not have adequate funds to pay dividends, it can defer the payment.

- The flexibility of terms: The preferred shares allow the company’s management to define any terms for the shares.

Preferred shares are also beneficial for investors in the following ways:

- Secure position in case a company becomes bankrupt: Preferred shareholders enjoy a much more secure position than common shareholders in the event of liquidation.

- Fixed return: Preferred shareholders get fixed payments in the form of dividend payments.

Please wait processing your request...

Please wait processing your request...