What is quality of earnings?

Quality of earnings is shown from the relation between income earned and the core operating activities of a corporation. If the earnings of a business can be attributed to improved operational efficiency, revenue, or cost reductions, it usually means the quality of earnings is high. On the flip side, a business is said to have low earnings; quality earnings change because of issues like accounting policies, inflation, one-time gain on any asset sale, etc. In addition, businesses are often transparent about sources of their earnings, accounting practices, relevant expenses, cash flows, etc. If investors can understand the quality of earnings using these, more investors will likely buy the stock, taking stock prices higher.

Highlights

- If the earnings of a business can be attributed to improved operational efficiency, revenue, or cost reductions, it usually means the quality of earnings is high.

- Unrelated, third-party organisations often prepare a quality of earnings report during due diligence for a possible merger or acquisition.

- Earnings quality shows if a business is genuinely doing well. It results from operational efficiency and doesn’t rely on accounting changes showing a made-up rise in earnings.

Frequently Asked Questions (FAQ)

What is the purpose of quality of earnings?

A company’s earnings are easy to manipulate using numerous accounting and reporting tactics. It is easy for a company’s management to make earnings appear good or bad.

A prevalent way is buying back shares. When a company buys back existing shares from the market, the number of shares outstanding gets reduced. As a result, it boosts the earnings per share (EPS) even if there is no growth in net income.

When EPS goes up, the price-earnings ratio comes down; such stock is often interpreted as undervalued. It pushes the stock prices higher by making investors believe the company is financially sound, although the earnings are poor or low.

Therefore, investors prefer to rely on earnings quality. Earnings quality shows if a business is genuinely doing well. It results from operational efficiency and doesn’t rely on accounting changes showing a made-up rise in earnings.

Source: © Richelle538 | Megapixl.com

What is the quality of earnings report?

Since it is clear that the quality of earnings is related to core operations, the quality of the earnings report also highlights the same. It measures from where a business is generating revenues. Are the earnings recurring or nonrecurring and cash or non-cash?

Unrelated, third-party organisations often prepare a quality earnings report for a potential merger or acquisition during due diligence. Each component of the revenue side and the expense side are included in the earnings report. The detailing helps assess the accuracy of earnings. In addition, it also helps assess the effectiveness of past earnings, which helps formulate future projections.

Few essential things highlighted include-

- earnings are coming from one-time events or items.

- Sources of earnings and uses of funds.

- Expected changes in the earnings and their sources.

- Accounting practices followed, their accuracy for reporting.

- Many types of analysis can be done using a quality of earnings report.

Types of quality of earnings report?

Quality of earnings (QoE) report helps assess the value of a business. It is possible from the detailing inherent to the report. The utility is higher for analysis as it highlights aspects not easily identifiable otherwise from financial statement analysis. By nature, it is not a valuation report. However, it helps negotiate and structure a business combination or takeover. The common types of quality of earnings report are-

- Sell-Side QOE Report

The quality of earnings is assessed to sell a business for an apt valuation. It also enables business managers to take remedial actions required to advance the sale of a business or fast pace due diligence, with details about revenues, their nature, sources, uses, etc. QOE helps increase the potential selling price for an entity.

- Buy-Side QOE Report

It is helpful for a potential buyer, investor, sponsor, lender, or financial institution. Buy-side QOE reports dive deeper into each account, cash flows, and the operational efficiency of businesses. The recurring nature and quality of operations, cash flows, assets, and liabilities are all assessed.

How can one gauge the quality of earnings?

By collectively analysing income statements, balance sheets and cash flow statements, a lot of things can be understood about a business. The only point of view here is the growth in net income and other earnings metrics. However, the quality of the earnings report gives a more detailed top-down analysis. It answers in detail the what, why, how, where and when questions for users. Using the QOE report following things can be gauged-

- Any unusual trend in earnings or one-time inflation to revenues.

- Significance of accounting policies used and any changes in the reflected in earnings.

- Impact of closing adjustments recorded in books of accounts and how these can be reconciled.

- Any transactions with related parties are not explicitly stated.

- All cash and non-cash sources and use of earnings and sales.

- It also helps in getting a better understanding of reserves and allowances recorded.

- Aging and gap analysis is also possible with a QOE report.

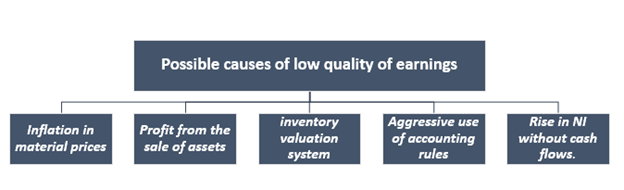

Source: Copyright © 2021 Kalkine Media Pty. Ltd

Is there a formula for determining the quality of earnings?

Quality of earnings focuses on internal factors generating earnings. Although quality of earnings is a subjective concept, still a standard formula is used to determine it by dividing the net cash from operating activities with the net income. Thus, it helps express the quality of earnings as an earnings ratio.

The independent organisation assessing the quality of earnings can get the net cash from operating activities using the cash flow statement. Meanwhile, the net income amount is a readily available number on the income statement. Now, after using this formula, if the ratio is less than one, it can be said that earnings are more than the cash flow generated. It is not possible unless an accounting trick is used to inflate the net income. So, a higher than one ratio will indicate a better QoE, backed by cash generation and operational efficiency.

Please wait processing your request...

Please wait processing your request...