What is a reverse merger?

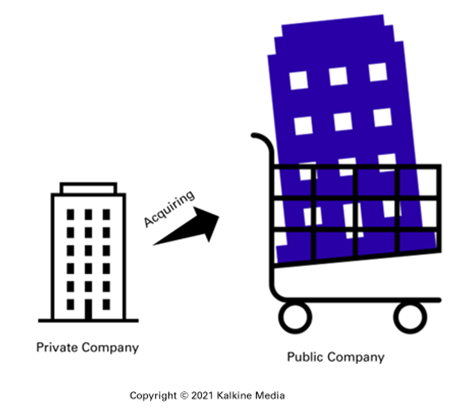

A reverse merger (RM) is a type of merger where a private company acquires 100 per cent or majority control of an already publicly listed company. Upon completing an RM, the private company gets listed on the stock exchange and changes its name as decided under the merger agreement.

The acquired public company, meanwhile, gets delisted from the stock exchange and operates as the subsidiary of the newly formed public company (earlier private company).

The acquired public company could have operations or exist as a shell company without significant operations before an RM is completed. The financial institutions prefer shell companies for this type of merger as they make the registration process with the Securities and Exchange Commission (SEC) easy and less expensive.

A reverse merger is also known as Reverse Initial Public Offering and Reverse Takeover (RTO). If the parent (public company) and a subsidiary (private company) execute a reverse merger, it is considered a part of Internal Restructuring.

What are the challenges faced under a reverse merger?

Mentioned below are the challenges faced while opting for a reverse merger:

- High due diligence is required because the private companies’ shareholders’ money is exposed to risk. There could be a possibility that a public company, which is set to get acquired, is going through litigation or dishonest corporate governance.

- The merger agreement includes specific disclosure requirements, which the parties involved adhere to. These disclosure agreements limit management’s flexibility, and there could be repercussions if the valuable information is leaked to competitors, suppliers, etc.

- The private company’s management may not hold enough experience in handling the operations of a publicly listed company.

Summary

- A reverse merger happens when a private company acquires 100 per cent or majority control of an already publicly listed company.

- The acquired public company gets delisted from the stock exchange and operates as the newly formed public company subsidiary.

- A reverse merger is considered better in terms of cost to go public when compared to an Initial Public Offering.

Frequently Asked Questions (FAQs)

- What are the advantages of a reverse merger and how is it better than an Initial Public Offering (IPO)?

Advantages that make reverse merger an attractive option for many private companies are:

- Simpler process: Reverse merger enables the private company to go public without raising capital, making it simpler when compared to traditional IPOs. To consummate an IPO takes months or even a year, whereas an RM could be completed in a few weeks or a month. It saves the management’s time which can be prioritized in understanding the functioning of a public company.

- Less Risky: Opting for a traditional IPO to become a public company is not guaranteed. The process of launching an IPO demands a lot of planning done by the management. If an IPO fails due to unfavorable market conditions and an inadequate response, the deal might get canceled.

On the other hand, if a private company goes public by signing up for a reverse merger, the risk of it getting canceled and time wasted is mitigated.

- Less vulnerable to market conditions: Conducting an IPO is a laborious task that includes gauging the market acceptance of the offer and persuading the potential investors to subscribe. Contrary to this, a reverse merger is a mechanism to convert a private company into a public company wherein the market condition is almost a negligible factor.

- Less expensive: Execution of a reverse merger does not involve heavy costs like big payments to bankers, prospectus preparation, and lengthy registration processes like with IPOs.

- Advantage of a public company: Once the private company goes public, its shares will start trading in the secondary market, providing better chances to add liquidity, and the private companies’ promoters can also sell their stake.

- What are the disadvantages of a reverse merger?

A reverse merger is considered simpler than other traditional methods of going public, but it also requires following specific regulations and due diligence.

- Liquidating the stock: Once the reverse merger transaction is completed, if the investors sell the public company’s stock immediately, it will negatively hamper the stock price. Therefore, it is suggested to add a clause of holding period or escrow period in the merger agreement to avoid this risk.

- Due diligence: Managers of the private company must conduct thorough due diligence to ensure the shell company is clean, the status of its liabilities, etc. Similarly, the public company's investors should also investigate the private company’s investors, operations, management, financial position, liabilities, etc. A transparent disclosure should be made by the parties involved in the transaction.

- Low demand for shares post-merger: The management of the newly public company might not be experienced enough to run a public company as the existing investors might find less demand for their shares. To attract potential investors, a company should look sound financially and operationally, which can be done by experienced management.

- Regulations and compliance: An inexperienced management can consume more time and money in understanding the regulations and compliances to operate a public company. The time invested in dealing with these regulations could have been used in operating the company.

- Name a few examples of reverse mergers.

- Cosmos Capital Limited agreed to acquire Wize Pharma, Inc. (OTCQB: WIZP) in a reverse merger transaction.

- Avisa Pharma Inc. acquired Fogchain Corp. (OTCB: FOGCF) (CSE: FOG.X) (FRA: MUU3) in a reverse merger transaction.

Please wait processing your request...

Please wait processing your request...