What is Risk Tolerance?

Risk tolerance reflects the ability of an investor to observe the variability between the expected outcome and observed outcome. Thus, risk tolerance plays a vital role in investment planning, and a better understanding of risk provide investors with psychological calmness in the event of extreme volatility in the market.

Summary

- Risk tolerance reflects the ability of an investor to observe the variability between the expected outcome and observed outcome.

- One of the most important factors that indicate risk tolerance is age.

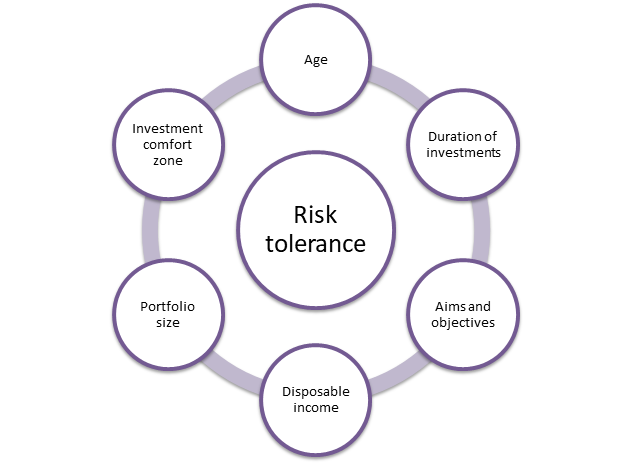

- There are several factors that determine the risk tolerance in investors, such as age, disposable income, portfolio size, duration of investments, etc.

- Investors in the financial market are mainly classified into three types of risk tolerance, conservative, moderate, and aggressive.

Frequently Asked Questions (FAQs)

How can the concept of Risk Tolerance be explained?

Risk tolerance can be defined as the development of mental strength for investors when they suffer from losses. Particular investments are genuinely involved with high risk, and thus, investors need to develop mental strength to overcome the stress. One of the most important factors that indicate risk tolerance is age. Generally, younger people tend to be better at dealing with investment risk and handling stress than aged people.

Higher risk tolerance is also equivalent to equity and equity fund and ETFs. On the other hand, bonds, bond funds and ETF are involved with lower risk tolerance. Thus, age is not only the only factor that determines risk tolerance.

Image source: © Stokdrozdirina | Megapixl.com

What are the factors that determine Risk Tolerance?

Risk tolerance could be a result of a lot of factors. The significant factors that determine risk tolerance are as follows:

- Age

One of the primary factors that determine risk factor is age. The younger you are, the easier it is for you to take more significant investment risk and handle stress. Moreover, the young people can also work more to earn money and have much more time for recovering the loss.

On the other hand, a person on the verge of his retirement would have fewer opportunities to work and recover his losses.

- Time duration of investments

Another primary factor that determines the risk factor is the time duration of the investment. Any investment that matures over a more extended period say 10-15 years, involves a more prominent risk tolerance than short-term ones. The reason behind this is mainly the highly volatile nature of the financial market. This is the only reason why investors with low-risk tolerance opt for short-term investments.

- Aims & Objectives

Every individual has got different aims and objectives to achieve when it comes to financial planning. Thus, not everyone desires to earn the maximum amount of money through investing. Therefore, people plan their investments as per their aims and take different types of risks to achieve them. So, we can also say that investing goals is another important factor that determines an investor's risk tolerance.

Image source: Copyright © 2021 Kalkine Media

- Disposable income

Another prominent factor that determines risk tolerance is disposable income. The more the disposable income, the higher is the risk tolerance. This is because the investor has got enough backup of cash to overcome the volatility of the market or overcome any loss.

- Portfolio size

Another essential factor to consider while determining the risk tolerance of an investor is the portfolio size. The greater the portfolio size, the higher is the risk tolerance level. For instance, an investor with AU$ 50 million portfolios will have higher risk tolerance than an investor with AU$ 5 million as the loss percentage is much less with higher portfolios.

- Investment comfort zone

Every investor has a comfort zone where he is most comfortable when it comes to financial investments and taking risks. Stepping out from that comfort zone might become stressful for the investor and lower his risk tolerance. Therefore, it can also be said that investment comfort zones also play a significant role in determining an individual's risk tolerance.

Source: © Fhphot | Megapixl.com

What are the different categories of Risk Tolerance?

The investors of the financial market are widely classified into three categories concerning risk tolerance. The three categories of risk tolerance are:

- Conservative

In this category, the investors prefer corpus securities more than wealth appreciation. Investors of this type mainly contain debt instruments and debt-based mutual funds in their portfolios. An instance of their lost risk tolerance would be selling off the securities as soon as their prices slightly drop.

- Moderate

In this category, the investors prefer taking moderate risks. Hence, they go ahead and investing in wealth accomplishments that involve moderate risks. There are various subcategories of moderate risk tolerance investors as there are numerous levels of risk-takers. These investors would generally wait for the market to volatilise than simply selling their securities in the first place.

- Aggressive

This category of investors is known to be the ones with maximum risk tolerance and are therefore the ones who take more enormous risks. They generally invest in long-term investment plans. This is because they are expert market analysts and can make accurate predictions about market trends.

How can Risk Tolerance be evaluated?

Factors such as age, disposable income, portfolio size, and duration of investment roughly help evaluate an investor's risk tolerance. However, for obtaining a precise evaluation on an individual level, financial institutions use questionnaire. Thus, a questionnaire empowers an expert to study individual choices of people when investing in the financial markets.

For example, questions such as 'What would your immediate reaction be after noticing a drop in the market prices of the securities? The given options for answers could be.

- Sell them off

- Wait and observe the trends for a while

- Buy new stock

The answer given by the investor might analyse the risk tolerance of an individual. For example, if the person chooses to sell it off, he has low-risk tolerance; if he chooses to wait and observe, he chooses a moderate risk level, and if the person chooses to buy new stocks, he has a high-risk tolerance.

Please wait processing your request...

Please wait processing your request...