What is Sharpe Ratio?

Initially developed by Nobel Laureate William F. Sharpe, the Sharpe ratio is used to evaluate the risk-adjusted return of a portfolio. The ratio comes very handy for risk analysts in measuring the risk-adjusted performance of a portfolio, and it basically informs how much extra return an investor would receive on holding a risky asset.

Risk-adjusted returns are usually defined as the return earned by an investor above the prevailing risk-free rate in the market, i.e., return delivered by risk-free assets such as fixed deposits, supranational bonds, government bonds.

The standard measure of risk inherited by an investor by putting the money in a risky asset such as equity is typically measured in terms of Standard Deviation, i.e., the square root of variance.

To gauge the risk through Sharpe ratio, investors ideally look for a higher Sharpe ratio as a higher ratio indicates better return yielding capacity of a portfolio for an additional unit of risk taken.

For example, if a fund is showing a Sharpe ratio of 2 per cent, it implies that the portfolio would generate 2 per cent extra return on every 1 per cent of additional annual volatility.

Calculating Sharpe Ratio

Ideally, a portfolio with higher standard deviation should maintain higher Sharpe ratio to convey the idea that the additional unit of risk undertaken by the portfolio is generating a higher return.

However, a portfolio with a lower standard deviation of returns could maintain a higher Sharpe ratio by generating consistent returns to convey a better performance in terms of risk-adjusted returns.

The ratio has become one of the most widely adopted methods for reckoning the risk-adjusted return of a portfolio.

Interpreting the Sharpe Ratio

The Sharpe ratio is mainly used to compare the change in the overall risk-return characteristic of a portfolio upon the addition of a new asset or asset class in the portfolio.

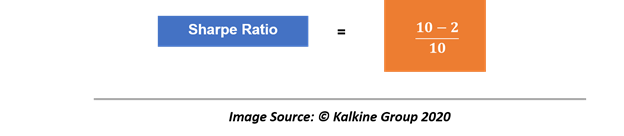

For example, suppose a portfolio of equity and bonds has delivered an annual return of 10 per cent over the last one year with a 10 per cent standard deviation in returns, and the prevailing risk-free rate is at 2 per cent.

The Sharpe ratio for the above profile would be:

I.e., 80 per cent.

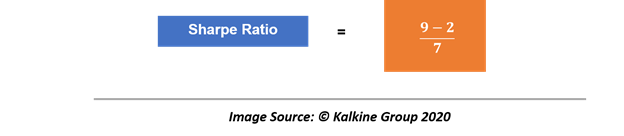

Now let’s assume that the investor is considering adding another stock in the portfolio, and he/she believes that adding the stock into the portfolio would reduce the expected return to 9 per cent but would also reduce the standard deviation of the portfolio return by 3 per cent at 7 per cent.

For simplicity, assume that the risk-free rate remains constant at 2 per cent. The new Sharpe ratio for the portfolio would be:

I.e., 100.00 per cent.

From the above example, it could be interpreted that through by adding the new stock into the existing portfolio, the investor has reduced his/her annual return from 10 per cent to 9 per cent, on a risk-adjusted basis, the new portfolio is optimised as compared to the previous one.

In the previous portfolio, for every 10 unit of risk, the portfolio was earning the effective return of 8 per cent (post-netting against the risk-free rate), leading to a Sharpe ratio of 80.00 per cent.

However, with the addition of the new stock into the portfolio, the new portfolio now delivers 1 unit of reward for every 1 unit of risk, leading to a Sharpe ratio of 100.0 per cent.

Thus, the addition of the new stock into the portfolio has optimised the portfolio for a better risk-adjusted return.

- In general, a Sharpe ratio below 1 is considered as bad;

- Between 1-2 is considered as good.

- And, higher than 2 is considered as excellent.

Ideally, some investors look for a portfolio with a Sharpe ratio above 1 to reach the investment decision as higher than 1 Sharpe indicates more units of reward for every additional unit of risk.

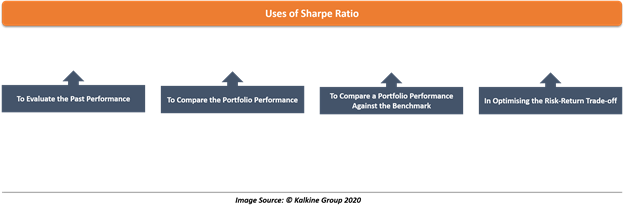

Uses of Sharpe Ratio

The ideology behind using the Sharpe ratio as a measure of risk-adjusted return is the diversification benefits. Ideally, adding diversification into a portfolio should increase the Sharpe ratio compared to similar portfolio size with lesser diversification.

Adding diversification into a portfolio usually reduces the systematic risks or beta of a portfolio, which, in tandem, reduces the standard deviation of returns, leading to a higher Sharpe ratio.

- To Evaluate the Past Performance

The Sharpe ratio can be used to estimate the ex-post return or the past performance of a portfolio, and it does so by using the actual historical return of the portfolio into the calculation.

However, the Sharpe ratio could also be used to estimate the ex-ante return or the future performance of a portfolio by replacing the actual historical returns in the calculation with the expected return and expected risk-free rate.

- To Compare the Portfolio Performance

The Sharpe ratio can be used as a measure to compare the performance of two portfolios with similar size, allowing investors to choose a portfolio or a fund offering a better risk-adjusted return.

- To Compare a Portfolio Performance Against the Benchmark

Not just is comparing the performance of various portfolios or funds; the Sharpe ratio can be used to compare the performance of a portfolio or a fund against its benchmark, allowing investors to reckon the performance of a portfolio against the overall market.

- In Optimising the Risk-Return Trade-off

Ideally, a portfolio or a fund with higher Sharpe ratio is desirable as it suggests a better risk-adjusted return, but this might not always be fruitful if a fund takes a lot of additional volatility to generate a higher Sharpe ratio.

Thus, a portfolio delivering 10 per cent return with moderate standard deviation in returns might be a better choice as compared to a fund with 12 per cent return but with considerable volatility in returns.

Drawbacks of Sharpe Ratio

- As the measure is a ratio, it doesn’t work on a standalone basis and often requires time-series or cross-sectional comparison.

- It often does not purely account for the diversification risk.

For example, a fund or a portfolio focused on a single sector might be showing a high Sharpe ratio, but it might still be carrying systematic risk for focusing on just one sector of the market.

Please wait processing your request...

Please wait processing your request...