What are small-cap stocks?

Small-cap stocks, also known as small-cap equity, are equities of small-cap firms with a market capitalisation of $300 million to $2 billion publicly listed on a stock exchange. The market capitalisation of a corporation is referred to as "cap."

Small-cap stocks are a good choice for investors who want to get a more significant return on their money, have a high-risk tolerance, and are willing to take market hazards.

Small-cap stocks are vulnerable to market risks and are very volatile when the market is in a downturn. There are, however, ways for investors to mitigate the risk associated with small-cap companies by diversifying their portfolios with market-friendly investments.

Moreover, every large-cap stock started as a mid- or small-cap stock. Therefore, individuals must seek out such exceptional small-cap stocks and hold them long-term to build wealth, and they will eventually join the large-cap stock list.

Summary

- A corporation with a market capitalisation of $300 million to $2 billion is a small-cap.

- The benefit of investing in small-cap stocks is the chance to outperform institutional investors by taking advantage of growth possibilities.

- Small-cap companies have outperformed large-cap firms in the past, but they have also been more volatile and risky investments.

Frequently Asked Questions (FAQs)

What are the characteristics of small-cap Stocks?

Individuals should become familiar with the following characteristics before investing in small-cap stocks:

Risk factor: Small-cap companies are so reliant on the market that they are vulnerable to market fluctuations. Small-cap stocks are more prone to being influenced by market downturns and taking longer to recover, making them a hazardous investment option for investors.

Returns: Small-cap companies are among the highest-yielding investment options, with the potential to become multi-baggers by achieving returns of more than 100%.

Volatility: Small-cap stocks are very volatile during market fluctuations. For instance, when the market performs well, these stocks outperform, but they underperform when the market is struggling.

Source: © Reckoning | Megapixl.com

Investment horizon: Individuals can invest in small-cap companies for long and short periods, depending on their investment horizon. Small-cap stocks with a long investment horizon, on the other hand, should be chosen by investors to spread the risks while still making significant rewards.

Investment cost: Investors must pay an annual fee known as the expense ratio in addition to the original cost of purchasing small-cap stock. The top limit for this is 2.5% of the AUM average.

Taxation: Returns produced on the redemption of small-cap shares are subject to taxation. The gains are subject to a 15% short-term capital gain tax if kept for less than a year. Gains from shares held for more than a year, on the other hand, would be subject to a 10% long-term capital gain tax.

Low liquidity: Small-cap stocks are often less liquid than mid or large-cap stocks since few investors invest in small-cap stocks. However, with more stock ownership and greater price discovery, a stock can become more liquid over time.

Source: Copyright © 2021 Kalkine Media

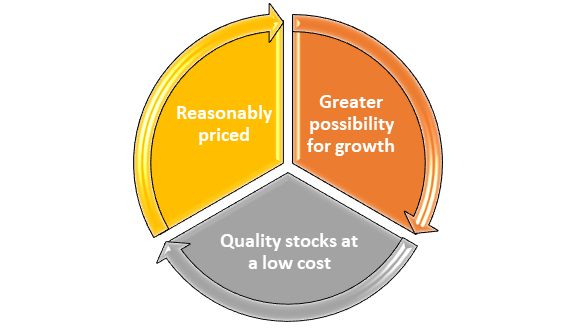

What are the main benefits of investing in small-cap stocks?

Individuals who invest in the top small-cap stocks gain from the following advantages.

Greater possibility for growth

In comparison to large-cap corporations, small-cap enterprises have a higher organic growth rate. A few factors favour small-cap stocks and boost their growth significantly, such as the fact that small-cap companies acquire cash more quickly and have higher growth potential.

Because most small-cap companies have a larger room for future growth than large-cap companies, they are more appealing to investors. Although there is a risk connected with these companies, investors are willing to take a chance to invest because of all these attributes. As a result, buying the correct small-cap stock might be a lucrative investment.

Reasonably priced

Major institutional investors must comply with specific restrictions when investing in the finest small-cap stocks; this limits their ability to drive stock prices higher. On the other hand, small investors get a competitive edge over institutional investors by being able to purchase small-cap stocks at reasonable prices.

For example, large financial entities such as hedge funds and mutual funds desire to invest more capital in small-cap equities. Still, they must adhere to specific restrictions that prohibit them from doing so. As a result, it's unlikely that big investments from these major financial organisations will artificially inflate stock prices.

Quality stocks at a low cost

Due to certain market inefficiencies, small-cap enterprises are under-recognised, and their stocks are under-priced. However, with a bit of research and market analysis, investors can profit from such inefficiencies by purchasing high-quality equities at a reduced price.

Source: Copyright © 2021 Kalkine Media

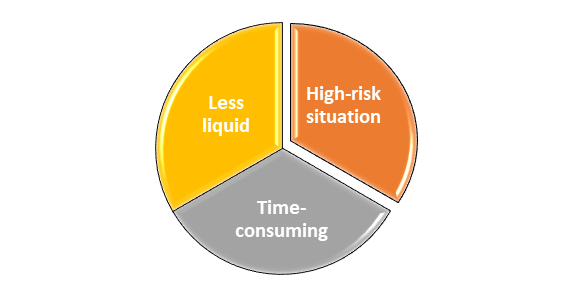

What are some of the drawbacks of owning small-cap stocks?

Less liquid

Small-cap stocks are less liquid than their larger equivalents, which increases the stock's overall risk. Low liquidity means that the stock may be unavailable for purchase at a reasonable price or that selling the stock at a good price may be difficult.

High-risk situation

Investing in small-cap stocks carries a higher risk. Small-cap enterprises, for example, may have a flawed and unpredictable business plan. If the company's management cannot modify the business model in this circumstance, bad operational and financial results will occur.

Furthermore, small-cap enterprises have few options for obtaining additional cash and sources of financing. As a result, it is more probable that the company will be unable to bridge cash flow gaps or develop its business due to its inability to make the necessary investments.

Time-consuming

Trading in small-cap companies can be a lengthy process. The amount of research on small-cap firms is frequently limited due to analysts and financial institutions' under-coverage of small-cap equities.

If you want to invest in small-cap stocks, you need to spend some time analysing the firm to see if it's a good investment that will pay off in the future.

Source: Copyright © 2021 Kalkine Media

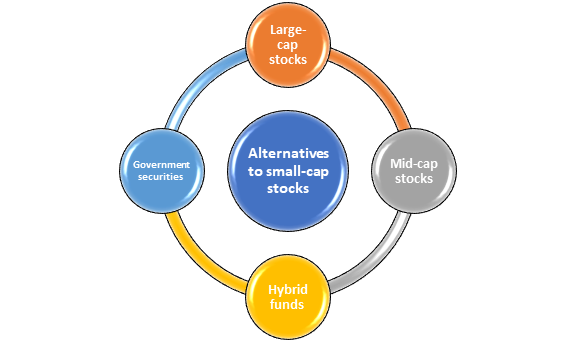

What are the alternatives to small-cap stocks as an investment?

Large-cap stocks

A corporation having a market capitalisation of more than $10 billion is referred to as a large-cap. Large-cap stocks are less vulnerable to market changes, making them a good choice for long-term investors with a moderate to low risk tolerance and a longer investment horizon. In addition, these equities have better liquidity since large-cap shares are in strong demand in the stock market, but they have weaker growth potential.

Mid-cap stocks

Companies with a market value or market cap of between $2 and $10 billion are mid-cap. Thus, if an investor's risk appetite is moderate, they can invest in mid-cap equities, which are somewhat more volatile, have slightly larger growth potential, and entail slightly more risk. Furthermore, because demand for their stocks is slightly lower, it has less liquidity.

Source: Copyright © 2021 Kalkine Media

Hybrid funds

As an alternate investing choice, investors can look into hybrid funds, which offer a good balance of equities and debt. It enables investors to diversify their portfolios to obtain guaranteed returns.

Government securities

Government securities are available to individuals as well. They are often government-issued debt securities that are appropriate for risk-averse investors searching for consistent and predictable returns.

Please wait processing your request...

Please wait processing your request...