What is Sole Proprietorship Business?

The word sole means single or only and the word proprietorship means ownership. Sole proprietorship therefore is a form of business organisation owned and managed by one individual. This individual is the sole person taking the risks and enjoying the profits or suffering losses. This is the simplest form of business organisation. Here the business and the owner are not considered separate legal entity as is the case of partnership organisations or corporations. Sole proprietorship is also said to be the oldest form of business organisation. It is an ideal choice to run a small scale business.

Summary

- Sole proprietorship is a form of business organisation owned and managed by one individual.

- The business and the owner are not considered separate legal entity

- The ease of entry and exit makes it highly suitable for small scale business

Frequently Asked Questions (FAQs)

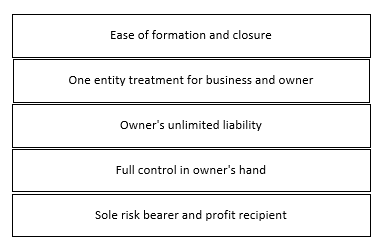

What are the Key Characteristics of Sole Proprietorship Business?

The entry and exit into sole proprietorship form business is not governed by stringent laws. However, some may need licenses depending on the type of product or service chosen.

In the eyes of law, the owner and business are the same. This is in contrast to other forms of business organisations like limited liability partnerships or limited liability companies.

Since the owner and business are not separate legal entity, the owner has unlimited liability i.e. if the assets of the business do not suffice to clear off the debt, the owner’s personal property and finances would be sold off for the purpose.

All the losses or profit are for the owner alone and are not divisible.

The owner has absolute control over the business and thus can make decisions regarding operations, finances, logistics etc.

Copyright © 2021 Kalkine Media Pty Ltd

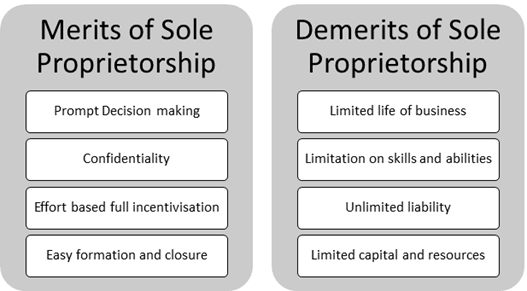

What are the Advantages of Sole Proprietorship Business?

Formation and closure of sole proprietorship business is easy. The decision making process is relatively faster since the owner can choose whether or not to consult others. As a result, the opportunities arising in the market can be leveraged at the earliest. Even problems or conflicts can be resolved promptly in the best interest of the business. Like the organisational structure, the accounting procedure and tax process is also easier. There is scope for the owner to maintain confidentiality in the decision making process. All the rewards for all the efforts are reaped by the owner alone and thus he/ she may feel a greater sense of accomplishment and feel more incentivized to put in better efforts for the business to grow more and more. The simplicity of this form of business allows people across age groups and gender to have their own business without having very high capital requirements of establishment expenditures. It is a good window for women and the youth to become self-sufficient and empowered. Such firms also allow the creation of employment opportunities for people who may not be very highly educated or well off but have skills like grooming, carpenter, plumbing, cooking etc. Several individuals who start off small sole proprietorship businesses grow to end up becoming multinational corporations and global name like Coco Cola.

What are the Disadvantages of Sole Proprietorship Business?

Unlike other forms of business where capital is raised by multiple partners or by issuing shares to several shareholders and generating share capital, sole proprietorship has only one owner and thus there is a constraint on the extent of capital that can be brought in by one person alone. Similarly, this person’s skills and managerial abilities may not be as good as that of a professional trained in management thus the decision making may be difficult and may lack effectiveness at time. Also, due to the small size of operations it may not be feasible to employ professionals who are to be highly paid. Another demerit of sole proprietorship is that, in case of death or bankruptcy or physical ailment of the owner, the business will cease to exist. Added to all these concerns is the owners unlimited liability which may even erode his/her personal finances and assets.

Copyright © 2021 Kalkine Media Pty Ltd

Are there any firms that started as sole proprietorship and became global names?

Headquartered in Mumbai, India, Reliance Industries Limited (RIL) is an Indian multinational conglomerate company which had humble origins when, in the late 1950s, Dhirubai Ambani stated as a spice trader. He later established Reliance Commercial Corporation, a spice trading company. He quickly expanded into other commodities, providing higher-quality goods at a lower profit margin than his rivals. As a result, his company grew rapidly. Ambani switched to synthetic textiles after determining that the company had gone as far as it could with commodities. He started the first Reliance textile mill in 1966. He eventually transformed Reliance into a petrochemicals behemoth, later adding plastics and power generation to the company's businesses, continuing a strategy of backward integration and diversification. Over the years the company grew by leaps and bounds and last it was ranked among the top 100 on the Fortune Global 500 list of the world's biggest corporations.

© Designer491 | Megapixl.com

What are other common forms of business?

Other than sole proprietorship, two most commonly found forms of businesses are partnership form of business and joint stock company.

Partnership form of business

A partnership is an agreement between two or more people to carry on a legal business together and split the profits. Individuals that engage in such an agreement are referred to as "partners." All partnership terms and conditions are written down to avoid any misunderstandings or disagreements between the partners. A Partnership Deed is a formal agreement between partners. All partners must sign it, and it must be appropriately stamped. It can be changed with the agreement of all partners. A partnership caters to the need to raise more funds, employ specialized knowledge and take advantage of larger manpower.

Joint Stock company

Joint stock company was the form of business that aimed to overcome the limitations of sole proprietorship and partnership form of business in the form of limited managerial and financial abilities. In the current times, joint stock companies are the main forms of large businesses- this is because it helps to raise large amount of funds and also brings together large amount of manpower with varied expertise. A joint stock company is characterised by distinct name, distinct legal identity, perpetual succession, common seal, limited liability for owners and capital divisible into shares of fixed value.

Please wait processing your request...

Please wait processing your request...