Supply chain finance (SCF) is an expression for a set of technology-based solutions aiming to reduce financing charges and improve business competence in a sales deal. SCF works by automating initial sales dealing, invoice approvals and settlement procedures. Using this, buyers approve their suppliers' bills for financing by bank or financier, known as "factors". Suppliers gain quicker access to money receivable, and buyers get more time to pay. The parties can hence utilize the available cash for other projects or operations. SCF thus provides short-term credit, optimizes working capital and provides liquidity to buyers and sellers. All of this is achieved at minimal risk and fees as compared to factoring transactions.

Summary

- Supply chain finance (SCF) uses technology to reduce financing charges on a business and improve the competence of buyers and suppliers.

- Suppliers gain a faster right to use the money earlier lying as receivable, and buyers get extra time to pay.

- Its mechanism helps avoid Cash blockages at businesses, ensuring smooth flow of material supply.

Frequently Asked Questions (FAQs)

What are SCF’s Features?

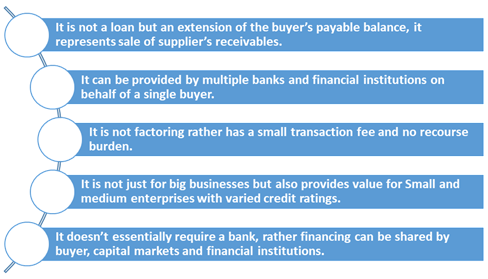

Few features of a Supply Chain Financing -

Copyright © 2021 Kalkine Media Pty Ltd.

How does Supply Chain Finance work?

Supply chain finance works well for buyers with a better credit rating than the seller, who can thus source funds from a bank or financier at a lesser cost.

A good credit history lets buyers negotiate better on terms like stretched payment timelines. Usually, buyers delay payment, while sellers ask for immediate payment. Using the SCF mechanism, the supplier does nothing, and funds settle directly in its bank account maximum by the bill maturity date, from the financier’s side. If dealt before maturity, full invoice value less a minor financing fee (discount) is transferred electronically to the supplier’s bank. The supplier gets paid on the next working day itself.

SCF sometimes termed as "supplier finance" or "reverse factoring," boosts cooperation amongst buyers and sellers and counters the competitiveness typically arising in these two parties. Even the seller can deliver its merchandises quicker to receive instant payment from the intermediary financier. As funds from the financier are given based on the buyer’s credibility, financing rates are also based on the buyer’s risk. This makes financing rates attractive and up to 10 times lesser than a factoring or traditional financing routes.

Why does a business need Supply Chain Finance?

A fair share of any company’s profits is derived from its’ payments and receivables management systems. Most organizations also have specialized teams working on this. Often, a business may get overdue payments from debtors. This blocks a reasonable volume of incoming cash flows for a period, which otherwise might have been used for an upcoming new project. To avoid such cash block situations, Supply Chain Finance becomes necessary. It also becomes useful when other arrangements of short-term credit are not possible or available to an enterprise. The Supply Chain Finance services are offered to accomplish streamlining of working capital needs of any industry. Supplier finance benefits companies in various sector, comprising automotive, electronics, industrial and retail. Buying groups get extended payment terms, and suppliers get earlier payments.

Example

For instance, if the company ‘Star’ buys raw materials from company ‘Moon’. In a classic payables transaction. The buyer, Star, purchases goods from supplier Moon. Supplier Moon ships the material, then submits an invoice to Star, which approves payment as per standard credit terms, say 30 days. But if Moon is in terrible need of cash to pay for logistics and shipping needed for delivery, it may call for instant payment. Here Moon will ask for payment at a discount from Star's associated financial institution/ bank. If this is approved by Star’s financier/bank (based on Star’s creditworthiness), it shall issue payment to Moon. In return, asking for an extended payment term, say 15 more days. Thus, by means of the Supply Chain Finance Concept, Moons’ supply will be financed by Star’s (buyer’s) bank/financier for a total term of 45 days, rather than 30 days, for a small fee.

In another case where an exporter based in a developing market supplies to a buyer based in a developed nation. In this case, SCF shall provide this small supplier with an array of choices for accessing cheap financing, reducing the collection time and thus improving the supplier’s cash flows.

How does SCF benefit every party involved?

SCF seems like a no complaints solution for both trading partners. Invoices are usually raised virtually on by suppliers to gain credit instantly. SCF helps in removing receivables owed from balance sheets. It also allows a third trusted party to assume payment risk.

Copyright © 2021 Kalkine Media Pty Ltd.

Generally, there is a distinct Supply Chain Unit with all the top banking and financing institutions. They cater to online as well as offline supply chain partners. It is a service product that brings a humungous customer base for such financiers. The financiers also get access to networked firms and enterprises of a single business. It also makes them a trusted choice for various other transactions as it readily assumes the risk of the buyer organization. Since SCF is based on credit rating, the risk of default is also less for financiers.

Please wait processing your request...

Please wait processing your request...