Tranche in French means a ‘slice’ or a ‘portion’. It is a term most commonly used in structured finance. When a number of securities are pooled and offered as collateral, each security becomes a ‘slice’ of that offering i.e. a ‘tranche’. Each security may have a different credit rating, maturity date and interest yield. Therefore, they are classified into tranches or portions. Tranching of a pool of securities provides transparency to parties involved in the transaction. Tranching or asset pooling is what differentiates structured finance from traditional securitisation.

Summary

- Tranche in French means a ‘slice’ or a ‘portion'.

- Tranches are often used in debt markets and for credit instruments.

- Classification based on Tranching helps understand risk and credit rating associated with each part of an asset pool.

Frequently Asked Questions (FAQs)

Where are they Used?

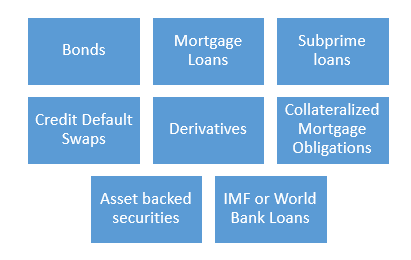

Tranching is often used in debt markets and for credit instruments, including Subprime loans and Derivatives. It is a part of securitisation process.

Uses of Tranche, Copyright © 2021 Kalkine Media Pty Ltd.

They can all be broken up into tranches. Investment bankers can create one basket of loans with similar features to appeal to a certain group of investors. Different types of debts are categorised and sold to investors to earn the interest suitable to them. Credit is released in tranches in case of loans offered by international institutions like IMF or Asian Development Bank.

Often tranches are used with grouped derivatives to repackage debt. It allows the lender to get mitigate default risk up to a certain level.

Every part shall yield differently depending on its maturity and credit rating. It can also act as a risk measurement parameter for investing in such loans. Tranches also offer varied payout set-ups if the issuer defaults. They allow investors to avail different risk and reward options in a single offering.

Image Source: © Rummess | Megapixl.com

For example, a Mortgage backed security of US$ 500 Million issued by company ‘Big’. A single investor/lender cannot raise the amount, and no single mortgage of this worth can be made. So, it is backed by a mortgage consisting of various bonds with different credit terms. Now to raise money, the instrument will be broken into tranches/ parts. Each part shall be backed by a mortgage of securities/ bonds providing differing risk & return. These tranches will be classified as Junior, senior or with ratings like AA, BBB, etc. Lenders or investor in this transaction can thus, choose to invest or lend money for the specific tranche. This decision will depend on the maturity period, cash flows offered, risks involved, etc.

How are Tranches Classified?

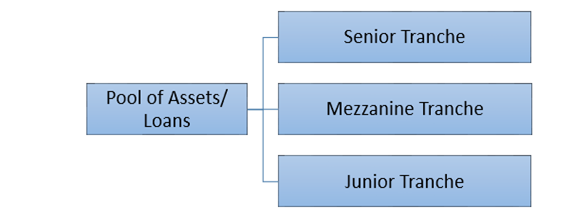

The tranches of an asset pool are classified as below-

Copyright © 2021 Kalkine Media Pty Ltd.

The above slicing is based on loss absorption capacity. The junior tranche absorbs initial losses, followed by the mezzanine tranche and then the senior slice. Senior tranche is generally insulated from default risk as they are part of the first lien. Major loss absorption is from the underlying asset pool of the junior tranche. Senior tranches are bought by pension and insurance funds or institutional investors. Another way of classification is through rating such as AAA tranche, BB trance etc. This is based on the credit rating.

Another way to classify it based on cash flows and risk profiles. This is usually done in the case of collateralised mortgage securities. The tranches are alphabetically named, i.e., A tranche, B tranche, and so on up to Z tranche. Here the tranche having the lowest ranking is called a Z tranche. It is that part of a financing agreement to which cash is paid off after all other tranches. It is the riskiest part used to attract investors to tranches ranked above it.

Classification helps understand the risk and credit rating associated with each tranche. They yield differently depending on their maturity and credit rating. It can also act as a risk measurement parameter.

What are the benefits and limitations of Tranching?

Larger the number of securities in the underlying asset pool, a larger number of tranches can be issued with differing credit ratings. This can sometimes also make the transaction complex and risk-prone. Thus, tranching has the following pros and cons-

Benefits-

- Several securities can be pooled and used together.

- Reduces the risk associated with the entire pool.

- It is a preferred choiceof investment bankers

- Provides big funding to borrowers.

- It is a synthetic product, a new financial instrument

- It gives lenders and investors a choice

- Cash flowscan be streamlined and adjusted as per need

Limitations-

- Tranching is complicated and is for sophisticated investors.

- It requires a lot of documentation.

- Risk profiling and loss estimation is a major part of it.

- A tranche may allot a higher rating to a risky security.

- The real performance of a security cannot be gauged from Tranches.

Please wait processing your request...

Please wait processing your request...