What is unconventional cash flow?

Unconventional cash flow can be described as a bunch of cash flows activities of a company characterised by numerous changes in the direction of cash flow over time. In unconventional cash flow, the directional changes are represented by (+) or (-) signs.

The (+) sign denotes inflow or inward cash flow, while the (-) sign denotes outflow or outward cash flow.

Unlike unconventional cash flow, conventional cash flow denotes the flow of cash in one direction. That implies that there will either be cash inflow or outflow happening in a company. The concept of unconventional cash flow is widely used in calculating discounted cash flow (DCF). However, it is relatively easy to calculate DCF with conventional cash flow than unconventional cash flow. It might result in multiple Internal Rate of Return (IRR), which depends on the number of times the direction changes in an unconventional cash flow.

Summary

- Unconventional cash flow has identified the flow of cash taking place in a company in random directions. It is usually denoted by mathematical signs such as (+) and (-).

- Internal Rate of Return helps investors get a general overview of a company and helps predict its future regarding profitability.

- One of the major drawbacks of unconventional cash flow is that it produces multiple values of IRR and thus makes it difficult for an investor to analyse the organisation's profitability.

Frequently Asked Question (FAQ)

What is the Internal Rate of Return (IRR) with respect to unconventional cash flow?

The Internal Rate of Return (IRR) can be defined as a method used for analysing cash flow. Ideally, the Internal Rate of Return is applied while calculating acquisitions and other business investments. Thus, IRR can efficiently help investors have a general overview of the company's financial status and help predict the company's future in terms of finance.

Image source: © Designer491 | Megapixl.com

A company with an unconventional cash flow will represent multiple IRR. This happens because IRR depends upon the number of times the direction of cash flow changes in a company. Whereas conventional cash flow, on the other hand, will only have one IRR.

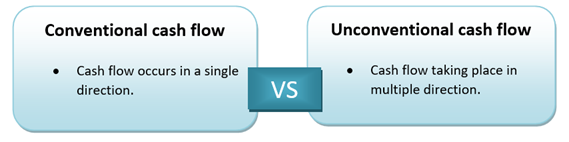

How is conventional cash flow different from unconventional cash flow?

The major contrasting feature of conventional cash flow and unconventional cash flow are stated below:

- Conventional cash flow

Conventional cash flow only denotes cash flow in a single direction of an organisation or a company. Generally, it is observed that cash outflow takes place only once in most companies (usually during the commencement of a project), after which there is only cash inflow taking place in the company. The outflow happens obviously due to the capital needed for the project. It can happen for buying raw materials or buying new machinery needed for the project. It is followed by the cash inflow, which happens as the company earns revenue from the project. Exceptions might take place, as there could be a cash inflow in the beginning if the company receives funding from investors or a loan from the bank.

Let us study an example to understand conventional cash flow in a better way. Let us assume that company A is willing to open a new branch in a big city. Now company A needs a lot of capital, in the beginning, to open the office in the new city. Therefore, the company applies for a loan from a bank. Upon approval of the loan, company A receives cash in its account, which denotes cash inflow at the project's beginning.

When company A has already gathered the capital needed for its new project, there will only be cash outflow taking place for a significant period. The cash outflow will continue to take place until the company start making a profit. Only then the company will start experiencing cash inflow again.

Source: Copyright © 2021 Kalkine Media

- Unconventional cash flow

On the other hand, unconventional cash flow is identified by cash flow happening in random directions in a company or an organisation. For example, such a type of cash flow is commonly observed in companies that require regular maintenance of equipment and machinery.

Let us understand the concept of unconventional cash flow with the help of an example. Let us assume that a person who owns a hotel needs to maintain the room and its accessories regularly.

What are the challenges involved with unconventional cash flow?

In the case of a conventional cash flow, a company begins a project with negative cash flow. This happens because the company prepares itself for the project by spending money to buy raw materials or new machinery needed for the project. However, this phase does not last for a long time as the company starts production. Therefore, the company soon starts to experience a successive period of positive cash flow as it starts earning revenue. Thus, calculating IRR for these companies is more accessible as only one value of IRR can be obtained.

Image source: © Rummess | Megapixl.com

On the other hand, a company that experiences unconventional cash flow has various IRR values. This is because the company is constantly experiencing cash flow in random directions, and IRR depends on the number of direction changes in cash flow. Therefore, as IRR helps determine the financial status of a company and predict the future of the company, it becomes difficult for investors to analyse with multiple values of IRR.

What is an ideal example of unconventional cash flow?

We can find numerous real-life examples of unconventional cash flow. It can be commonly spotted in organisations that need to upgrade or maintain their business equipment frequently. Suppose a huge thermal power plant whose cash flow is being expressed over the last 25 years. Out of the 25 years, the company will experience cash outflow for the initial five years. From the sixth year to the 16th year, the company will experience a continuous period of cash inflow. In the 17th year, the company will undergo its scheduled maintenance, whereas, from the 18th year, the company again experiences cash inflow.

Please wait processing your request...

Please wait processing your request...