What is unsecured loan?

An unsecured loan does not need any form of security. Instead of depending on a borrower's assets as security, lenders prefer to grant unsecured loans based on their creditworthiness.

When a loan isn't backed by collateral, the lender may demand a higher interest rate and needs exceptional or decent credit.

Highlights

- An unsecured loan is backed by the borrower's creditworthiness instead of security, such as real estate or other assets.

- Because unsecured loans are riskier for lenders than secured loans, they require higher credit scores to be approved.

- If a borrower fails on an unsecured loan, the lender may hire a collection agency or take the borrower to court to pay a debt.

Frequently Asked Questions (FAQs)

What is the process of getting an unsecured loan?

Source: © Peshkov | Megapixl.com

Lenders look at a borrower's borrowing record whenever they request for an unsecured loan to see if they have successfully paid off loans acquired for various reasons in the past. Then, a computer generates a credit score based on the information in credit reports, which is a shortcut for determining creditworthiness.

A person can acquire an unsecured loan with decent credit. It is feasible to rebuild credit over time if they had done minimal borrowing in the past or had adverse credit due to past financial difficulties. Before applying for an unsecured loan, consider improving your credit score.

Lenders would also want to know if borrowers will be able to repay any new loans. Lenders will seek proof of income when borrowers apply for a loan, either unsecured or secured. Then they'll calculate a debt-to-income ratio to see how much of a hardship the new loan payment will be concerning the borrower's monthly income.

What are the various types of unsecured loans?

Loans for students

Student loans are unsecured loans obtained from private lenders or the federal government and are used to pay for eligible educational expenditures.

Only your promise to repay a loan on time secures these unsecured loans and lines of credit. The lender can send your account to a collection agency, report your late payments to credit bureaus, and take you to court to have your wages garnished if you don't pay. As a result of these efforts, credit ratings are likely to fall.

Personal loan

A personal loan is a one-time borrowing from a financial institution that you repay with interest in fixed monthly instalments.

Unsecured personal loans can be utilised for various purposes, including vacation funding, debt reduction, marriage, and home improvement projects.

Revolving loan

A revolving loan has a credit limit, and a bank will accept a borrower for a specific amount that can be spent, repaid, and re-used. Revolving unsecured loans include personal lines of credit and credit cards. However, this loan has a disadvantage: the interest rate may be variable, meaning it may alter over time.

Source: Copyright © 2021 Kalkine Media

Who can obtain an unsecured loan?

An unsecured loan can be a viable choice for someone in desperate need of money but isn't comfortable providing security to secure a loan.

A typical loan is better for those who know how much money they'll need and when they'll need it, such as consolidating debt, whereas a line of credit is better for individuals who don't know how much money they'll need and when they'll need it.

It's important to remember that taking on unnecessary debt might strain one's budget, thus applying for a loan should only be done if one needs money. In addition, because the lender takes on additional risk with an unsecured personal loan, a person typically needs good credit to qualify.

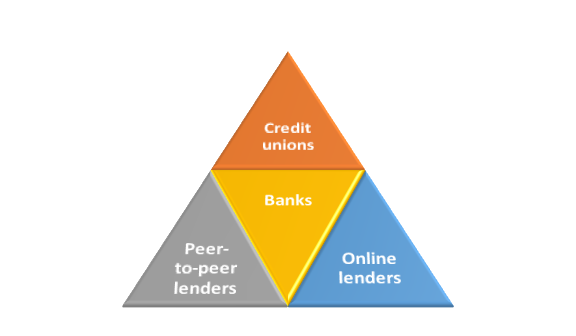

What are the various types of lenders that provide unsecured loans?

Credit unions

If a person is already a credit union member, they should inquire about their unsecured loan possibilities. Credit unions often provide cheaper interest rates and more flexible payback options on unsecured personal loans and unsecured credit cards. Therefore, the loan amounts at certain financial firms may be lesser.

Banks

If you value in-person assistance, this kind of brick-and-mortar lender may be a good fit for you. If you're a bank account, you could be eligible for a client relationship discount. While many of the big banks' unsecured personal loan offerings are limited, a few still do. Though, most institutions also provide unsecured credit cards.

Online lenders

Numerous online lenders provide unsecured personal loans, and a person could request one. They may provide same-day financing and more significant loan amounts, and some are prepared to work with people with bad credit, but they may charge higher interest rates than financial institutions.

Peer-to-peer lenders

Peer-to-peer lenders, like online lenders, operate online, and when you apply for an unsecured personal loan, an individual investor, rather than a bank, funds it. Less qualifying restrictions and lower interest rates may be available from this sort of lender.

Source: Copyright © 2021 Kalkine Media

What are the distinctions between unsecured and secured loans?

The requirement for collateral is the primary distinction between secured and unsecured loans. When applying for a secured loan, you must put up an asset, such as your car, property, cash, or investments. The collateral might be utilised to pay the lender if you default on the loan. Auto loans and mortgages are classic examples of secured loans.

The house becomes the collateral when you take out a mortgage. If you fall behind on your payments, your lender might seize your home and sell it, a process known as foreclosure. Likewise, if you don't make your auto loan instalments, your lender will seize possession of the vehicle.

Unsecured loans work in the opposite direction of secured loans. Personal loans, credit cards, and student loans are examples of these types of loans. Because there is no asset to reclaim in the event of failure, lenders incur a more significant risk when issuing this loan, which is why interest rates are higher.

Source: © Stuartkey | Megapixl.com

Furthermore, if you are turned down for unsecured credit, secured loans may be available. However, you must have something valuable to utilise as collateral.

What are the benefits and drawbacks of unsecured loans?

The key advantage of an unsecured loan from the borrower's standpoint is risk reduction. If you could obtain an unsecured loan and failed to make payments, you do not risk losing your possessions; instead, your credit score is jeopardised.

Because unsecured loans do not require collateral, the lender bears greater risk, which generally leads to higher interest rates and less favourable terms. While unsecured loans may be less dangerous for the borrower, it's crucial to consider how much extra you'll pay for the loan. You might find that putting down an asset as collateral is more advantageous than paying the extra money in interest.

Please wait processing your request...

Please wait processing your request...