Define Upstream

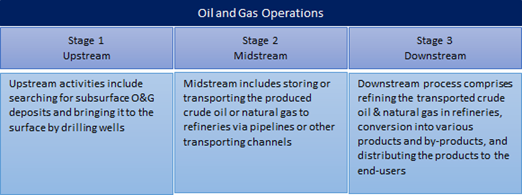

In the oil & gas sector, all the activities which are related to exploration and production of oil and natural gas are termed as Upstream activities. The operations of Oil & Gas Industry include searching for subsurface O&G deposits to drill wells for production and then transporting the produced material to refineries to convert it to a usable form and finally make it available for end-users.

The whole Oil & Gas process can be classified into three main categories which are known as Upstream, Midstream and Downstream.

Image Source © Kalkine Group

Upstream Process

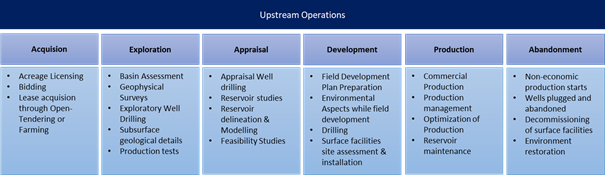

Upstream is referred to as “E&P” which means Exploration & Production. Exploration involves all the activities that are involved in search of specific subsurface areas where a petroleum reservoir is located. Whereas production involves all the processes involved in bringing the found subsurface deposit of oil & natural gas to the surface using drilling techniques. The upstream operations consist of Acquisition, Exploration, Appraisal, Development, Production and Abandonment

Image Source © Kalkine Group

Acquisition

The acquisition consists of various activities starting from the purchase of license blocks and searching for O&G deposits using multiple sophisticated techniques. Acquisition on acreage can be made by open tendering either by direct negotiation or by the farm-in process into an existing block.

Exploration

After the acquisition of the O&G block, various extensive surveys like gravity, magnetic, seismic are conducted to delineate the subsurface deposits of hydrocarbon. The primary step in the exploration phase is Basin Assessment which is carried out to study the area of interest. An exploratory well is drilled to assess the geological details of that area.

The companies use advance modelling techniques to prepare realistic basin models and to study the basin evolution. Based on available geological and geophysical survey data and results of the analysis made on that data, a decision is made either to move further with the lease or not. The fundamental objective of this phase is to evaluate the risk and to evaluate the volume of hydrocarbons present in the reservoir.

Appraisal

The main objective of appraisal stage is to assess the potential and extent of reservoir better. After completion of the exploratory phase, the reservoir engineers and geologists start planning appraisal activities. More wells are drilled to reduce the uncertainty of the evaluated volume of hydrocarbon. Expected Reservoir performance is evaluated and the production forecast for the field is prepared.

Development

After the completion of the Appraisal phase, the economic presence of hydrocarbon is confirmed or denied. If the field contains commercial deposits of hydrocarbon, a Field Development Plan (FDP) is prepared for the phased development of the field. The objective is to deplete the reservoir in most technically significant, safest end economical manner to get optimum Return on Investment (ROI). Appropriate locations for drilling various wells are drawn based on economics & survey results to start the production in a full-fledged manner. A proper assessment for LNG site is also conducted, which requires the construction of large scale export-import, storage and transportation facilities.

Production

After the completion of FDP, the field is developed, multiple wells are drilled, and production starts. The field starts producing from wells in a full-fledged manner. It is the first stage in the life-cycle of a field when the extracted hydrocarbon gives the first revenue from selling the O&G. When the revenue exceeds the investment that the company made during the initial phases, the company starts getting profit. This stage can last up to 45 years, depending on the potential of field and easiness to explore the reserves. After due course of time, the rate of production starts deteriorating due to the decline in reservoir pressure. Special EOR (Enhanced Oil Recovery) techniques like steam injection, water flooding is used to regain again the declined pressure of the reservoir which is commonly known as "Maintenance" phase to enhance the production rate. Finally, after producing the commercial hydrocarbons, the well is shut and abandoned.

Abandonment

The gradual decrease in production rates due to the decline in reservoir pressure leads to non-economic recovery of reserves from the reservoir. When the field reaches its economic limit, the company decides to stop production from that field and abandon the operations from there. The producing wells are plugged & abandoned (P&A). The objective is to protect the future commercial zones and near freshwater zones from contamination.

Decommissioning of previously installed production facilities is done as they are no longer economical. The land under the facility is reconditioned, and environmental restoration is carried out.

Please wait processing your request...

Please wait processing your request...