ADF Group Inc. (TSX: DRX) is a Canadian company specializing in the design and engineering of connections, as well as the fabrication and installation of complicated steel structures, heavy steel-built ups, and architectural metalwork.

Key highlights

- Favorable market trends: The US government eventually approved its USD 1.2 trillion infrastructure spending plan in early November 2021. Sums are planned, among other things, for new infrastructure, such as highways (USD 110 billion), transportation/airports (USD 42 billion), and energy structures (USD 70 billion), all of which ADF serves. For the next five years, these expenditures are likely to result in a rise in new projects. Other indicators, even before this news, showed that the building industry is in strong form. These factors enable management to look ahead to the future quarters and fiscal years with renewed optimism, allowing the company to maintain its strong order backlog increase.

- Secured new contracts under the belt: Recently, new contracts of CAD 100 million were granted to the firm. The Corporation has been chosen to take part in new construction projects in the commercial building sector in the Southeast and Western United States, as well as the industrial sector in Eastern Canada. These new contracts are set to begin and will last until mid-2023.

- Robust order backlog: On October 31, 2021, the company's order backlog totaled CAD 310.3 million, up from CAD 282.5 million on the same date in previous year. Fabrication hours accounted for 40% of the order backlog on October 31, 2021, compared to 34% on January 31, 2021. Fabrication hours are the Corporation's primary business and most value-added activity. Most of the contracts on hand as on October 31, 2021, will be progressively executed between now and the end of the fiscal year ending January 31, 2023.

- Curtailing long term debt: The company is able to reduce its debt burden sequentially as a result of strong business and excellent cash flows, which is a critical plus. Debt reduction improves the firm's financial flexibility. The firm is improving its debt/equity ratio by reducing long-term debt, which was CAD 15.7 million on October 31, 2021, compared to CAD 18.3 million on January 31, 2021. Additionally, the company's debt to equity ratio in Q3 2022 was 0.22x, which was the lowest in the prior three quarters.

Source: REFINITIV, Analysis by Kalkine Group

- Strong liquidity: Despite the pandemic's impact, the Company maintains a strong financial position and is well-positioned to meet its financial obligations. It does not anticipate any liquidity risk in the near future, based on its cash and cash equivalents position, credit facilities, and anticipated capital investment. Cash and cash equivalents totaled CAD 14.7 million as of October 31, 2021. Furthermore, Management expects that the funds available will be adequate to enable the execution of the order backlog in hand on October 31, 2021, as well as cover the company's financial obligations for the fiscal year 2022.

- Improving cash cycle days: The company's cash cycle (days) is improving sequentially, which is a significant positive, meaning that it is taking less days to convert inventory to cash. Its current Cash Cycle is of 82.5 days, which is the lowest in the last three quarters, is appriciable.

Source: REFINITIV, Analysis by Kalkine Group

- Strong inventory management: The company's inventory turnover ratio is improving sequentially, which is a significant positive. The company's inventory turnover ratio was 12.8x in Q3 2021, compared to an industry norm of 1.0x. Higher inventory turnover implies that a company's services are in high demand. It also has a lower average inventory days of 7.1, compared to an industry median of 88.6 days, suggesting that the company's cash is tied up in inventory for a shorter amount of time, indicating that it is churning its cash effectively.

Source: REFINITIV, Analysis by Kalkine Group

Risks associated with investment

Several risk and uncertainty factors affect ADF's markets, which might have an influence on its business, financial situation, and operating results. These risks and uncertainties include, but are not limited to, variables such as global economic concerns. Economic conditions may put downward pressure on profit margins on new projects to be negotiated with clients, as well as the order backlog and new contract awards. Another significant risk is competition in the Corporation's business area. Furthermore, an increase in steel prices might be a concern, however this would be minimized by sale price adjustment provisions agreed to with clients and incorporated in contracts.

Financial overview of Q3 FY2021

Source: Company Filing

- Robust revenues: In Q3 2021, the company posted higher revenues up by CAD 63.0 million to CAD 110.1 million, against CAD 47.1 million in the previous corresponding period. An increase in revenues stems for the most part from the execution of projects in the backlog, during the analyzed periods.

- Rise in cost of sales: in the reported period the company’s cost of sales increased to CAD 103.9 million compared to CAD 39.6 million in pcp. The cost of sales as a % of revenue in Q3 2021 stood at 94% compared to 84% in pcp.

- Decline in gross profit: In Q3 2021, the company’s gross profit witnessed a decline to CAD 6.2 million compared to CAD 7.5 million in Q3 2020. Primarily due to rise in cost of sales.

- Higher net income: On the back of higher revenues in Q3 2021, the company managed to post higher net income at CAD 2.7 million, compared to CAD 2.5 million in pcp, partially supported by lower income tax expense.

Top-5 Shareholders

The top 5 shareholders have been highlighted in the table, which forms around 15.59% of the total shareholding. Canadian Erectors, Ltd. and Norrep Capital Management Ltd. hold the company's maximum interests at 10.24% and 2.61%, respectively. The company's institutional ownership stood at 2.61%, while strategic entities ownership stands at 13.35%.

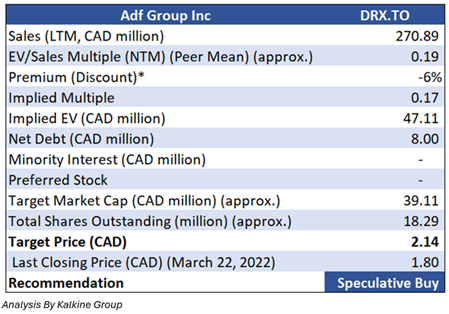

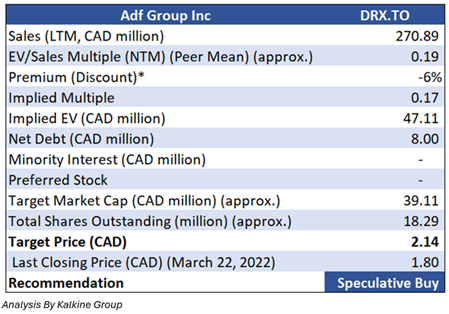

Valuation Methodology (Illustrative): EV to Sales based Valuation Metrics

Analysis by Kalkine Group

Stock recommendation

The firm posted revenues of CAD 110.2 million for the third quarter ended October 31, 2021, compared to CAD 47.2 million in the previous corresponding period. While sales for the first nine months of the fiscal year reached CAD 233.7 million, up by CAD 98.3 million compared to the previous corresponding period, in line with the recent expansion of the order backlog. Whereas, on October 31, 2021, the company's order backlog stood at CAD 310.3 million, up from CAD 282.5 million in the pcp.

The US government eventually approved its USD 1.2 trillion infrastructure investment plan in early November 2021, allowing management to look ahead to the future quarters and fiscal years with fresh hope, which is a big boost. Furthermore, the company just won additional contracts for CAD 100 million. The firm is also effectively managing its inventories and reducing its long-term debt, which is a huge benefit.

Therefore, based on the above rationales and valuation, we recommend a “Speculative Buy” rating at the last closing price of CAD 1.80 as on March 22, 2022. Additionally, the markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

One-Year Technical Price Chart (as on March 22, 2022). Source: REFINITIV, Analysis by Kalkine Group

Technical Analysis Summary

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.