Company Overview: Apple Inc. designs, manufactures and markets mobile communication and media devices, personal computers and portable digital music players. The Company sells a range of related software, services, accessories, networking solutions, and third-party digital content and applications. The Company's segments include the Americas, Europe, Greater China, Japan and Rest of Asia Pacific. The Americas segment includes both North and South America. The Europe segment includes European countries, India, the Middle East and Africa. The Greater China segment includes China, Hong Kong and Taiwan. The Rest of Asia Pacific segment includes Australia and the Asian countries not included in the Company's other operating segments. Its products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of consumer and professional software applications, iPhone OS (iOS), OS X and watchOS operating systems, iCloud, Apple Pay and a range of accessory, service and support offerings.

AAPL Details

Apple Inc. (NASDAQ: AAPL) has been witnessing a challenging environment lately given the iPhone related concerns, and US-China trade scenario. As per the company, sluggish sales might still be witnessed in the short to medium term given weak demand for the iPhone. Nonetheless, Apple is devising its strategy to foster on growth stemming from its profitable Apple Services segment given the performance for iCloud network, music platform, etc. It is still having the capability to bag the title of leading valuable publicly traded company. The group is trying to regain performance over fundamental parameters (as depicted below) and many key parameters are still above the industry medians despite the recent turbulence that Apple has witnessed. While there is sluggishness in growth in terms of margins, the group is trying to rebase its growth levers and has the capability to witness improved performance.

.png)

Financial Performance (Source: Company Reports and Thomson Reuters)

Key Organizational Changes: Apple has announced that its retail chief Angela Ahrendts will leave the company in April 2019 post serving the company for about five years. During these five years, the company had redesigned its retail stores so that the customers will get the feel that Apple is a luxury brand; and therefore as per this strategy, it had opened stores at locations in high-class districts like Chicago’s Michigan Avenue. She had undertaken some difficult and controversial steps, like the removal of the formal Apple “Genius Bar” for technical service from the stores and in place had set up more casual service centers. Another important step that Angela took was that she had cut the number of other companies to sell their accessories such as phone cases in AAPL’s stores, which helped in increasing the company’s business and had created Apple’s own, space. However, due to the fall in the demand of the iPhones’ latest models, the company had to relax its strict pricing approach in order to boost sales. Angela had tried other strategies but it failed to show in numbers. Moreover, in recent years, some customers had complained about long wait times to purchase AAPL’s products and to get appointments with the company’s technicians. Further, as part of the low-cost battery replacement program for iPhones, the customers who all wanted to exchange the batteries had to wait several days for their demand to be fulfilled in stores. The Retail chief Angela Ahrendts is being replaced with Deirdre O’Brien, who is the current head of its human resources department, to run AAPL’s retail. O’Brien’s main focus is to increase the demand in China, the world’s biggest smartphone market.

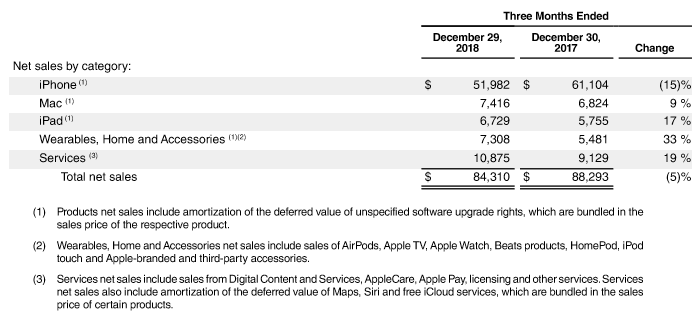

US China trade tensions on the ease: AAPL gets directly affected due to the trade dispute between the U.S. and China, which had also affected the financial market. AAPL is an American technology company, however a Taiwanese company produces AAPL’s products in Chinese factories. Meanwhile, at the start of December, President Donald Trump and Chinese leader Xi Jinping had declared a 90-day cease-fire. As per some of the analysts, there is a high probability that the tensions that arose due to trade tariffs might ease out now. AAPL, believes that this will be a big relief for the group. During the first quarter 2019, AAPL’s iPhone revenue had fallen by 15 percent year-over-year to $51.9 billion. As per the group, China’s economic weakness had impacted iPhone sales performance. The company for the first time had disclosed that iPhones accounted for 900 million of its active devices. Over last 12 months, the group has achieved its installed base of active devices expand by over 100 million units.

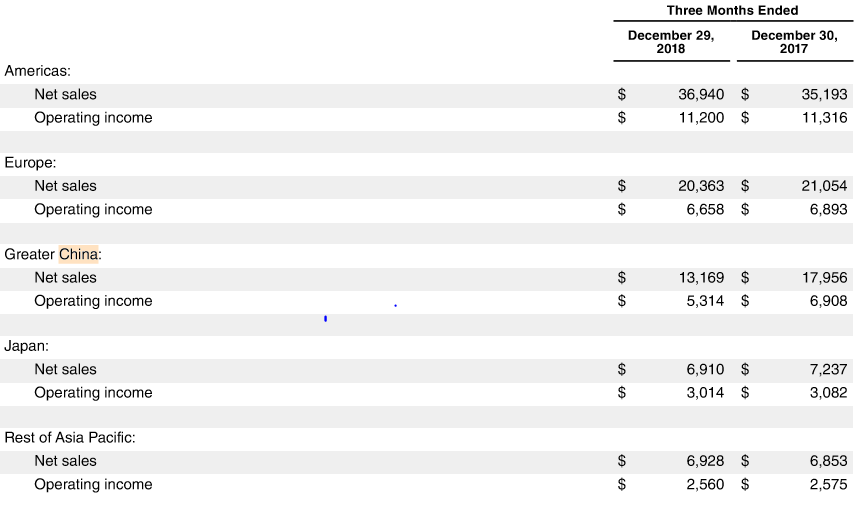

iPhone sales impacted overall result: AAPL stock fell after the company had posted decline in revenue and profit for its first holiday-quarter (December Quarter) in more than ten years. The company had also warned its investors about the slowdown in its core iPhone revenues which is due to the weakness in China that had affected the company this year. As a result, Apple had already slashed the guidance for the first quarter of FY 19 earlier this month January. AAPL for the first quarter of FY 19 has reported 4.5 percent decline in the adjusted revenue to $84.31 billion. Its iPhone sales fell 15% in the quarter to $51.98 billion from $61.1 billion a year earlier as the customers do not want to pay up for iPhones, which has witnessed rise in starting price by more than 50% in recent years to nearly $1,000. The lower priced option by the company, iPhone XR, released in October, also witnessed drop in demand against what the company expected. This has forced the company to reduce its production. The iPhone demand had fallen particularly in Greater China, where the company’s total sales declined by 27% to $13.17 billion. Meanwhile, the local smartphone competitors like Huawei Technologies Co. and Xiaomi Corp. had released smartphones at competitive (lower) prices.

Geographic Performance (Source: Company Reports)

Strong Performance in other categories: However, for the first quarter of FY 19, the company has delivered 19% rise in the total revenue from all other products and services. The company has posted 19 percent growth in the Services revenue, which had reached to an all-time high at $10.9 billion, up over the prior year. AAPL also reported growth of 9 percent and 33 percent, respectively in the revenue from Mac, and Wearables, Home and Accessories, which had also attained all-time highs. The revenue from iPad has grown by 17 percent during the first quarter. Geography-wise, AAPL achieved revenue records in many developed geographies - the United States, Italy, Canada, Germany, Spain, Korea and the Netherlands. Challenges in emerging markets did prevail, however, still few countries could witness record performance and these included Mexico, Malaysia, Poland, and Vietnam. AAPL’s total active devices increased 8% last year to 1.4 billion during the first quarter, which is all time high and the company has posted strong earnings per share of $4.18 (up 7.5%). This is also all time high for earnings per share. Moreover, during the first quarter of 2019, the company has posted the product gross margin of 34.3% and the services gross margin of 62.8%. The product gross margin was up 60 basis points on a sequential basis as holiday quarter helped the group while higher cost structures with roll-out of new products and fluctuations from foreign exchange impacted the scenario a bit. There was an expansion of 170 basis points in services’ gross margin on a sequential basis at the back of favorable mix and leverage while impact from foreign exchange played some role. Despite the expansion in gross margins for products and services, on a sequential basis, the total gross margin for the company declined by 30 basis points and this was owing to varied mix between products and services. Additionally, AAPL reported for $102.8 billion in term debt and $12 billion in commercial paper outstanding; while the net cash position was reported to be $130 billion. In view of various challenges and plans to mitigate the scenario, AAPL targets to be having a net cash neutral position over time.

First Quarter 2019 Products and Services Performance (Source: Company Reports)

Capital Management: AAPL has declared a cash dividend per share of $0.73 of the company’s common share and this will be paid on February 14, 2019 to shareholders that are in record as at February 11, 2019. While the group has witnessed key challenges over a period of time, the net cash position of $130 billion has been up from $123 billion as noted in the previous quarter. The group has also returned over $13 billion to shareholders in the first quarter of 2019, and this was achieved through share repurchases and dividends. The group also reported a healthy operating cash flow ($26.7 billion) during the December quarter.

Future Outlook: For the March 2019 quarter, AAPL expects the revenue to be in the range of $55 billion to $59 billion against the average consensus estimate of around $59 -$60 billion. This may be owing to an expected fall in the number of iPhones sold in the March quarter. For the second quarter of FY 19, AAPL expects the gross margin to be between 37 percent and 38 percent, operating expenses to be between $8.5 billion and $8.6 billion, and other income to be of $300 million while tax rate is expected to be of approximately 17 percent. The other product and services’ segments are expected to perform well as seen in the past.

Stock Recommendation: AAPL stock is trading at a price of $174.24, and has support at $142 level and resistance around $185. During the first quarter of 2019, the company had attained all-time records across multiple categories of services, which include the app store, Apple Play, Cloud Services, and the app store search ad business. The group also attained highest quarterly music revenue given the support from demand of Apple Music, which has over 50 million paid subscribers. In view of the Forward 24 months EPS consensus projection of above current levels, a single digit stock price growth (%) is expected. Given the current low levels of the stock and services’ segment setting as a new growth driver, we give a “Buy” on AAPL at the current price of $ 174.24.

.png)

AAPL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.