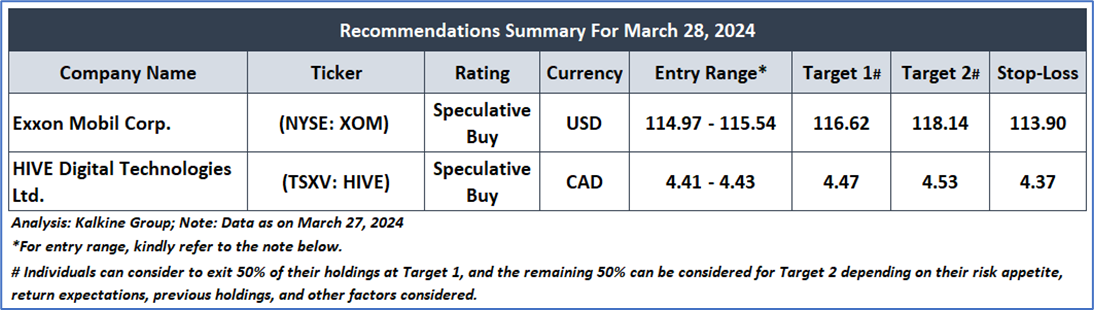

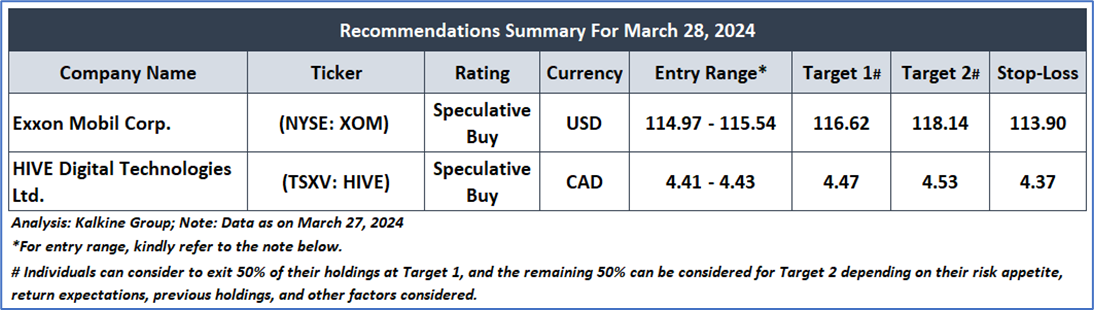

Company Overview: Exxon Mobil Corp. (NYSE: XOM) engages in the exploration, development, and distribution of oil, gas, and petroleum products. HIVE Digital Technologies Ltd. (TSXV: HIVE) engages in building a bridge from the block chain sector to traditional capital markets. It provides digital asset mining, hosting, and managed infrastructure operation services. This Report covers the Price Action, Technical Indicators Analysis along with the Target Levels, Stop Loss Level, and Recommendations on these two stocks.

XOM’s Technical Observation

The XOM stock has experienced an upward trend, fueled by significant trading volume and crucial levels, potentially signaling continued growth. This positive trajectory could be further bolstered by the increasing 14-day Relative Strength Index (RSI), suggesting a favorable market dynamic. Moreover, XOM's current position above its 21-day and 50-day Simple Moving Averages (SMAs) might function as a temporary support zone in the approaching time frame.

HIVE’s Technical Observation

HIVE stock has demonstrated resilience along its upward-sloping trendline, hinting at potential further upward movement. The formation of a hammer candle on the daily chart at the same trendline, combined with heightened trading activity, may indicate an impending uptrend. This positive trend could be further reinforced by the 14-day Relative Strength Index (RSI) reversing from lower levels, signifying positive market momentum. However, HIVE's position below its 50-day Simple Moving Average (SMA) might function as a temporary resistance zone in the forthcoming period.

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risks: This report may be looked at from a high-risk perspective and recommendations are provided only for day trading purposes. Recommendations provided in this report are solely based on technical parameters, and the fundamental performan`ce of the stocks has not been considered in the decision-making process. Other factors which could impact stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Entry Range: For the given recommendation(s), the Entry Range is based on considering a certain range (0.5% - 2%) above (in speculative buy case) or below (in sell case) of the previous day close price. A recommendation will be considered void if the prices do not test the given range levels for the particular day.

Note 2: This report's recommendation(s) is purely for day trading purposes and position(s) will be considered closed automatically at the close price of the day in case no target or stop loss level is hit. It is advisable to follow the targets and stop-loss levels strictly and exit the position accordingly, as it may lead to limitless loss if the position is not taken care of with due diligence.

How to Read the Charts?

The Green colour line reflects the 21-period moving average, while the red line indicates the 50- period moving average. SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving averages, then it shows prices are currently trading in a bullish trend.

The Black colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period), which indicates the strength of the price trend. A reading above 50 indicates a positive momentum, while below 50 indicates a negative momentum. A reading of 70 or above suggests overbought status, while a reading of 30 or below suggests an oversold status.

The Blue colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volumes, and higher liquidity in stocks helps in easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and are used for trend identification purposes. The trend lines also act as a line of support and resistance.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is March 27, 2024.The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individuals. The technical analysis reports generally chart out metrics that individuals may assess before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

CA

Please wait processing your request...

Please wait processing your request...