Section 1: Company Overview and Fundamentals

1.1 Company Overview:

General Mills, Inc. (NYSE: GIS) is a manufacturer and marketer of branded consumer foods. The Company operates through four segments: North America Retail, International, Pet, and North America Foodservice.

Kalkine’s Dividend Income Report covers the Company Overview, Key positives & negatives, Investment summary, Key investment metrics, Top 10 shareholding, Business updates and insights into company recent financial results, Key Risks & Outlook, Price performance and technical summary, Target Price, and Recommendation on the stock.

Stock Performance:

1.2 The Key Positives, Negatives, and Investment summary

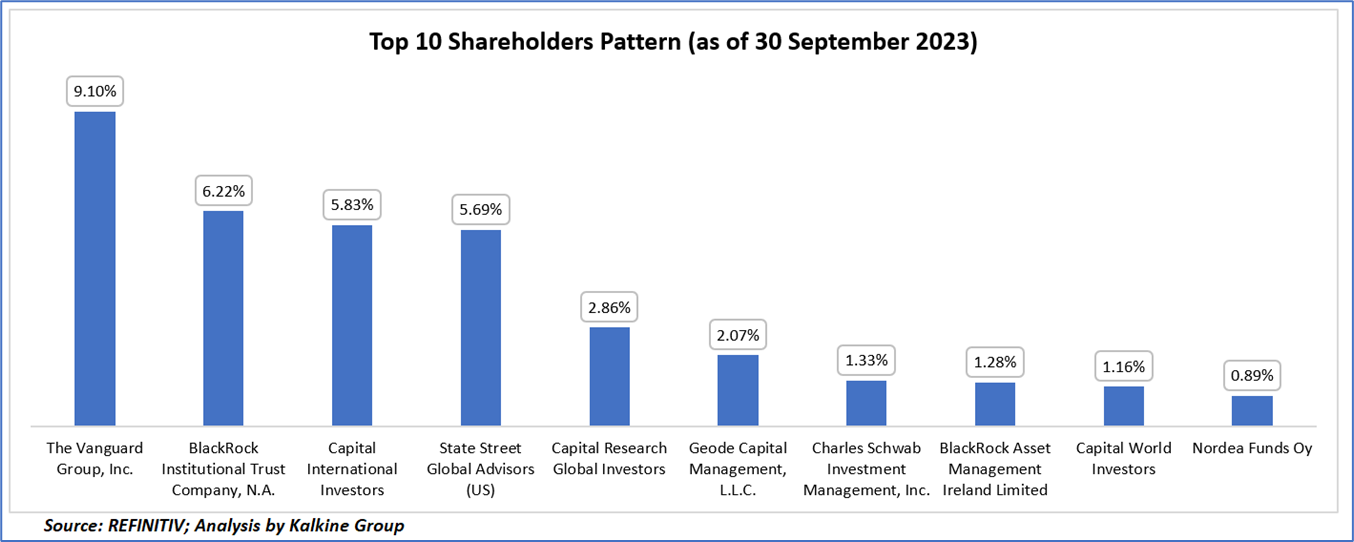

1.3 Top 10 shareholders:

The top 10 shareholders together form ~36.42% of the total shareholding, signifying diverse shareholding. The Vanguard Group, Inc., and BlackRock Institutional Trust Company, N.A. are the biggest shareholders, holding the maximum stake in the company at ~9.10% and ~6.22%, respectively.

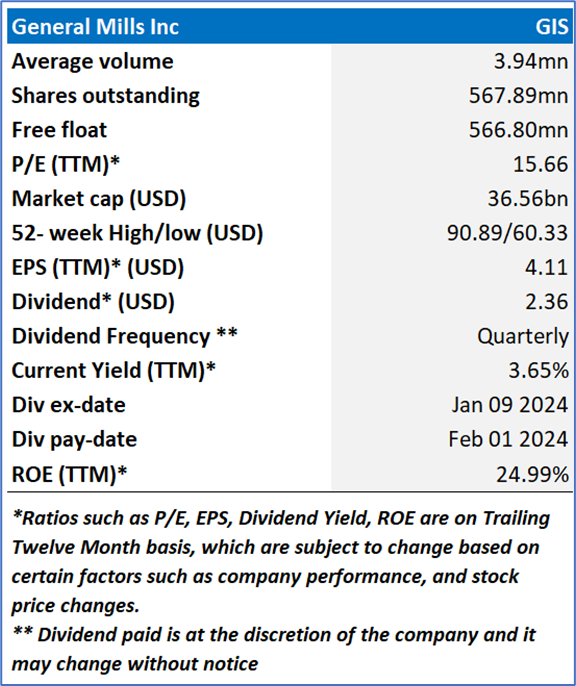

1.4 Consistent dividend payments with impressive dividend yield:

General Mills Inc. has a noteworthy dividend history, making it one of the market's enduring dividend aristocrats with an impressive 124 years of uninterrupted dividend payments. The company has consistently exhibited steady growth in its dividends, achieving an annual increase typically ranging from 4-7% in recent years, resulting in a compound annual growth rate (CAGR) of around 4.76% over the past five years. As of January 10, 2024, the annual dividend stands at USD2.36, providing an annual yield of approximately 3.65% based on the prevailing stock price. General Mills maintains a commitment to a sustainable dividend policy, aiming to strike a balance between dividend growth and reinvestment in future growth opportunities. Although recent dividend increases have been slightly below historical averages, attributed to inflationary pressures and strategic initiatives, the company's steadfast dedication to dividends and its financial stability position it as an appealing choice for income-focused investors seeking reliable returns. Despite the current yield not being the highest, General Mills' robust track record of dividend growth instills confidence in its ongoing dividend sustainability.

1.5 Key Metrics

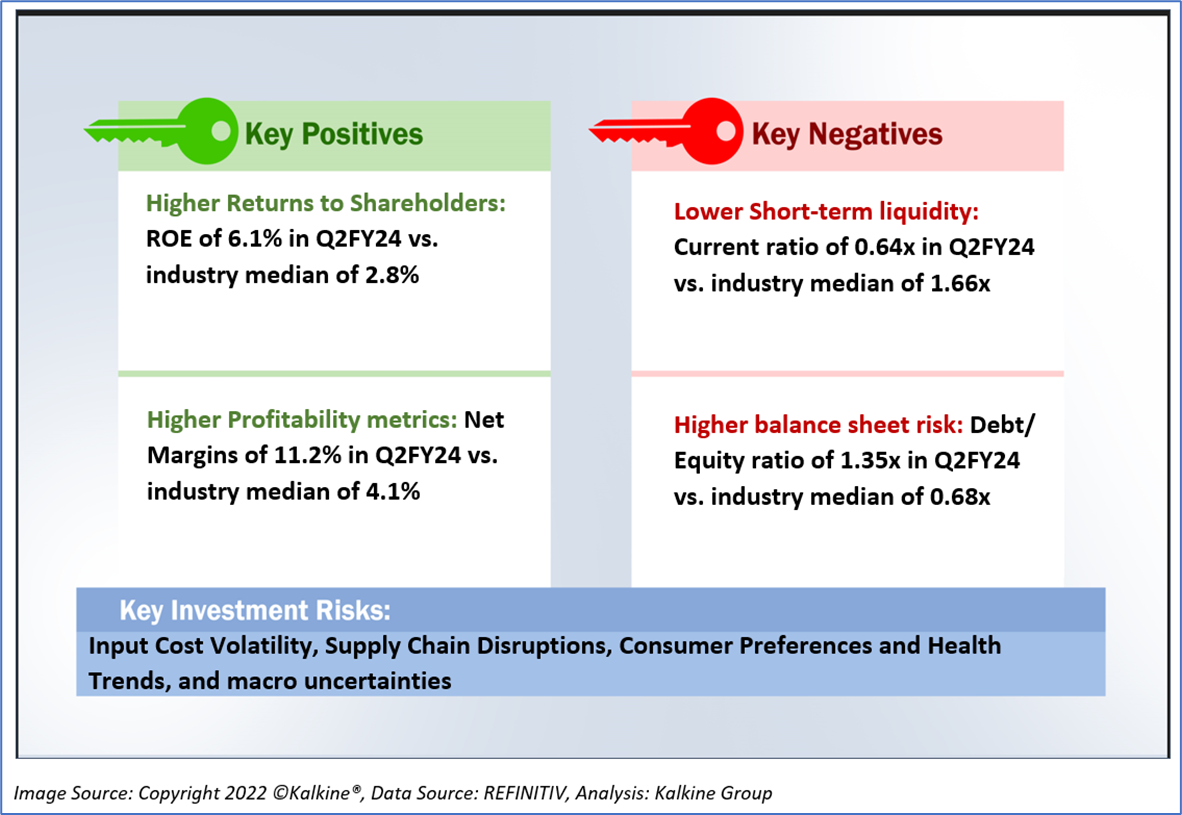

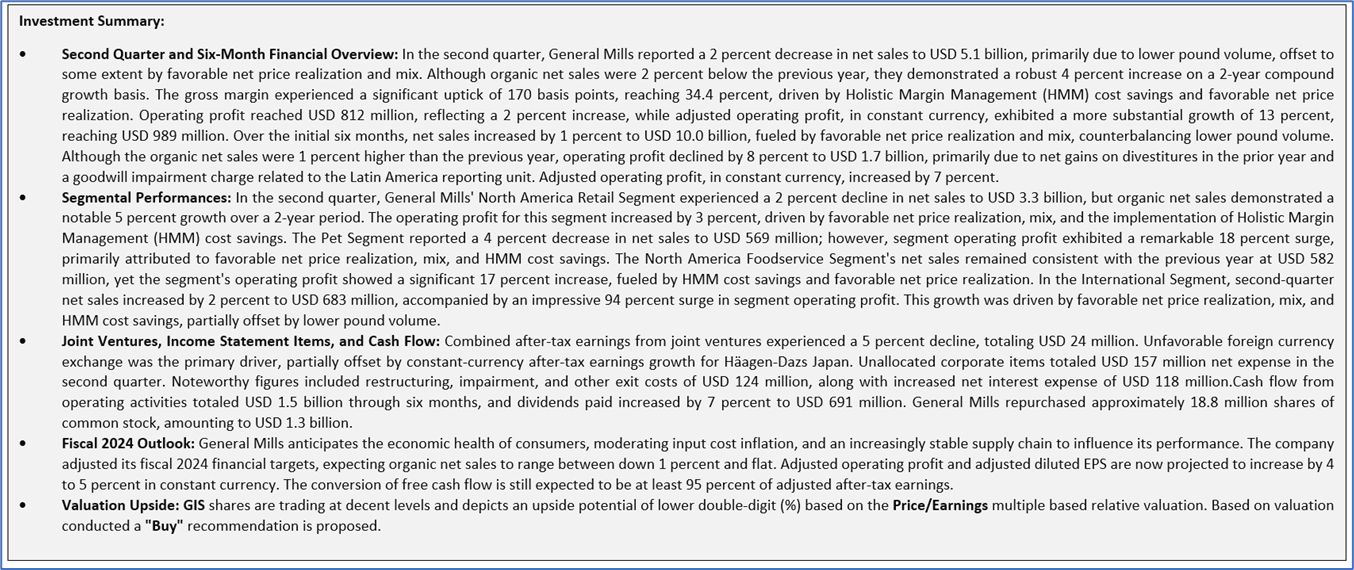

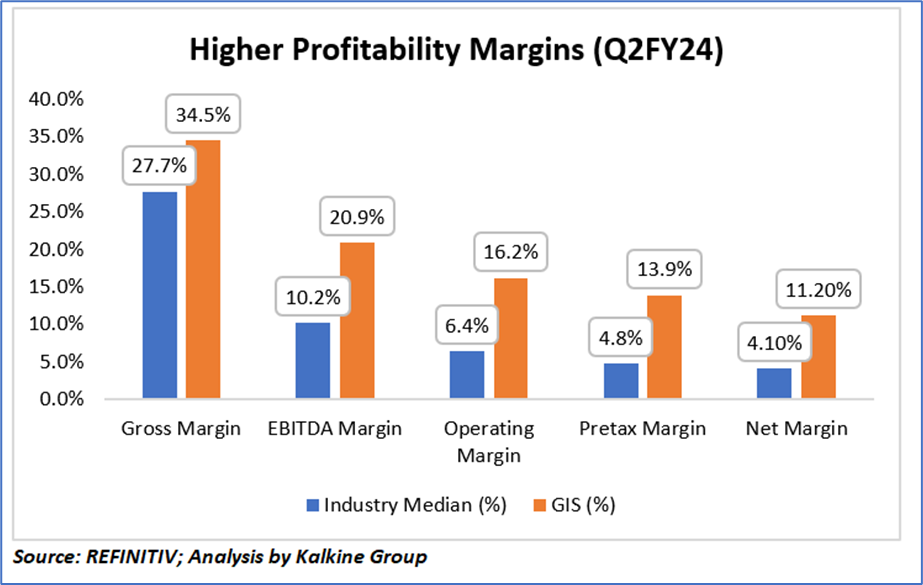

In the second quarter of fiscal year 2024, General Mills (GIS) demonstrated favorable financial performance metrics compared to the industry median. Specifically, GIS exhibited a higher gross margin of 34.5%, surpassing the industry median of 27.7%. The EBITDA margin for GIS stood notably higher at 20.9%, outperforming the industry median of 10.2%, signifying a more robust operational performance. The operating margin for General Mills was also impressive at 16.2%, in contrast to the industry median of 6.4%. The pretax margin for GIS reached 13.9%, exceeding the industry median of 4.8%, indicating a more favorable pre-tax profitability. Finally, the net margin for General Mills was 11.20%, surpassing the industry median of 4.10%, underscoring GIS's superior net profitability relative to industry benchmarks. These financial metrics collectively underscore General Mills' strong financial performance during the second quarter of fiscal year 2024.

Section 2: Business Updates and Financial Highlights

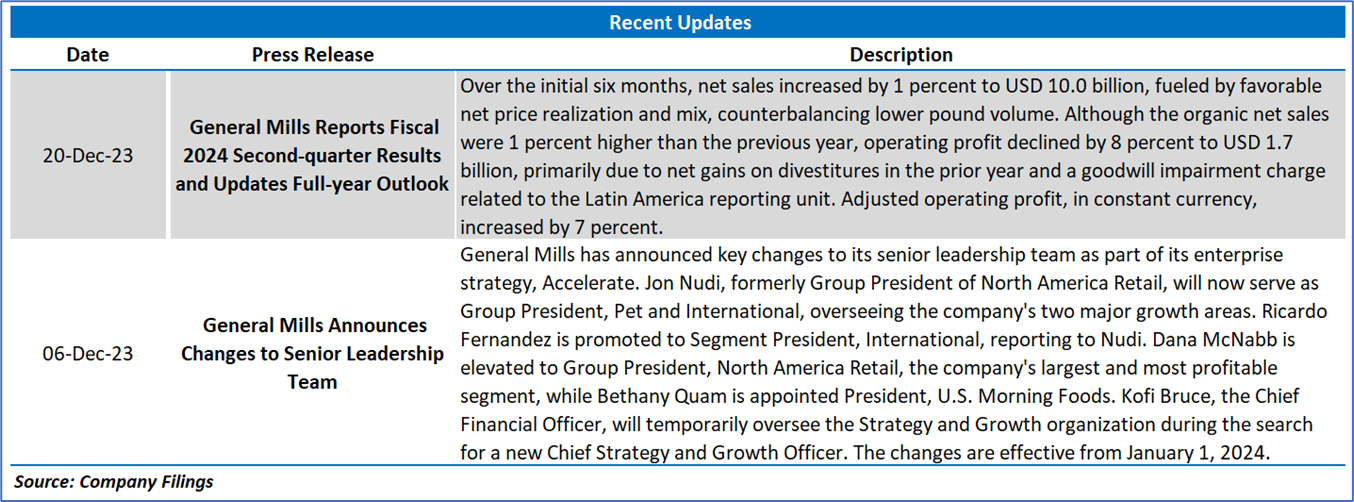

2.1 Recent Updates:

The below picture gives an overview of the recent updates:

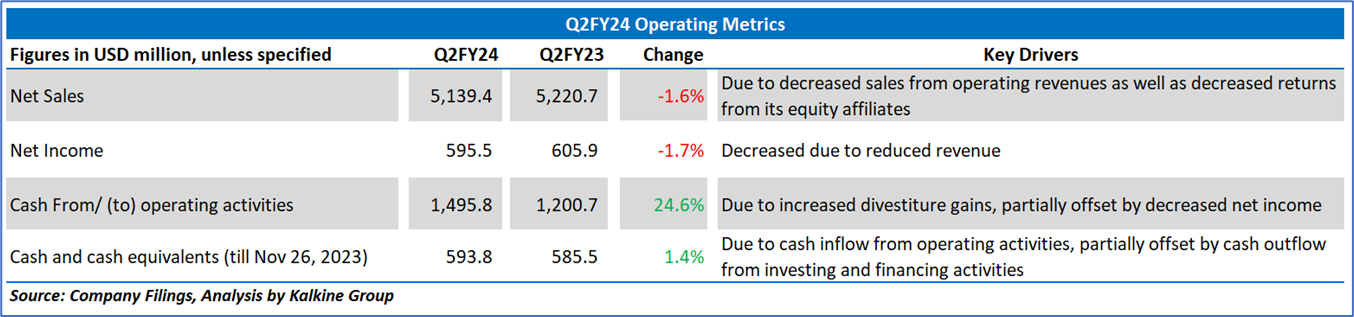

2.2 Insights of Q2FY24:

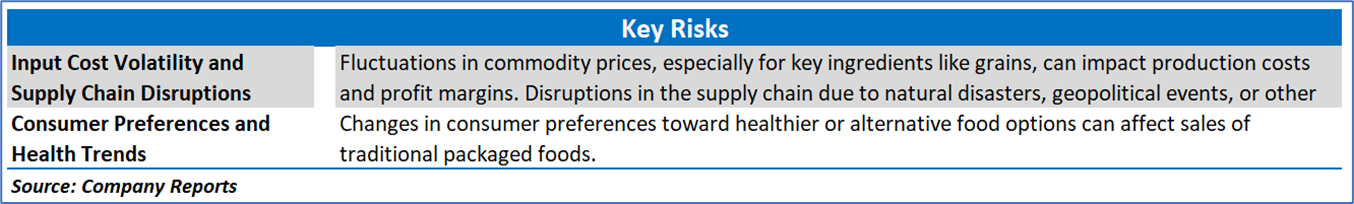

Section 3: Key Risks and Outlook:

Section 4: Stock Recommendation Summary:

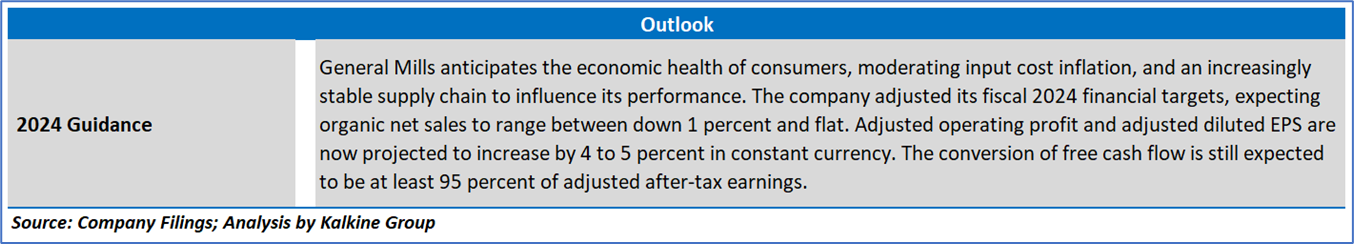

4.1 Price Performance and Technical Summary:

Stock Performance:

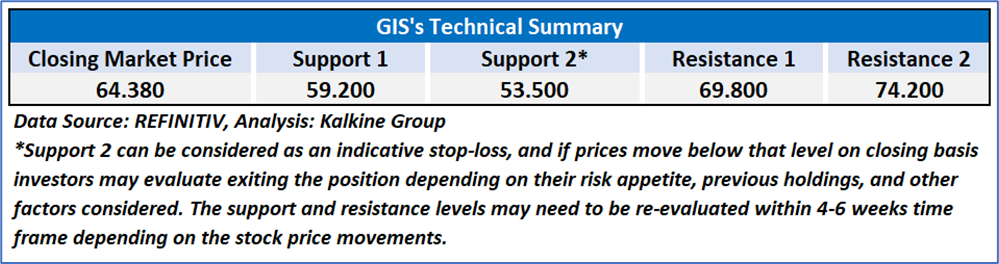

4.2 Fundamental Valuation

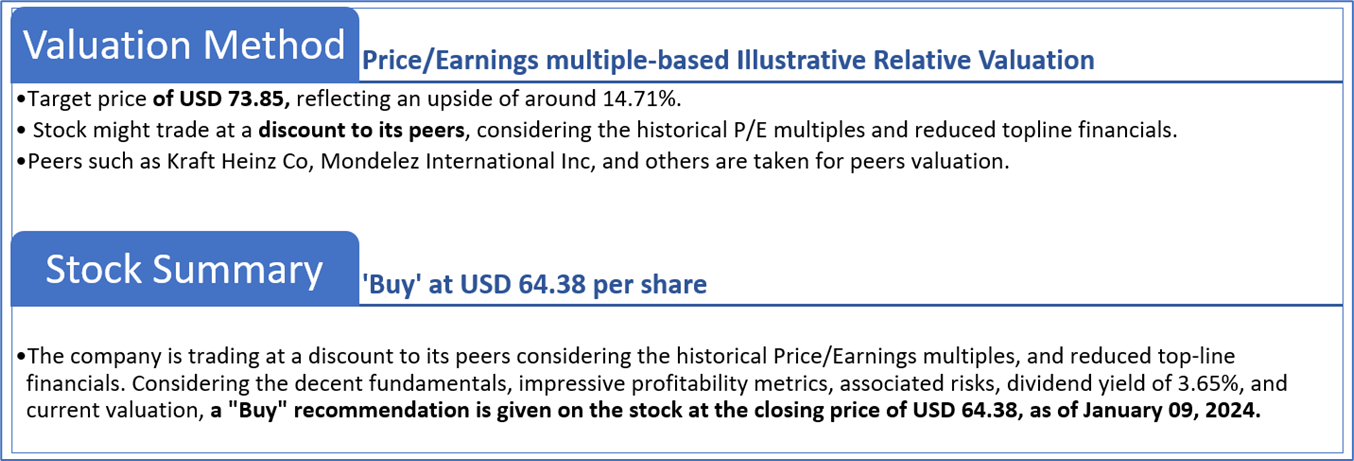

Valuation Methodology: Price/Earnings Multiple Based Relative Valuation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is January 09, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.