Company Overview: Marathon Petroleum Corporation is engaged in refining, marketing, retail and transportation businesses in the United States and the largest east of the Mississippi. The Company operates through three segments: Refining & Marketing; Speedway; and Midstream. The Refining & Marketing segment refines crude oil and other feedstocks at the Company's seven refineries in the Gulf Coast and Midwest regions of the United States. Its Speedway segment sells transportation fuels and convenience products in the retail market in the Midwest, East Coast and Southeast regions of the United States. The Company's Midstream is engaged in the operations of MPLX LP and certain other related operations. It gathers, processes and transports natural gas, natural gas liquids (NGLs), crude oil and refined products. MPLX is a limited partnership which owns, operates, develops and acquires midstream energy infrastructure assets.

.png)

MPC Details

Largest Independent Player in Petroleum Industry: Marathon Petroleum Corporation (NYSE: MPC) is a leading, integrated, downstream energy company headquartered in Findlay, Ohio. The company acquired Andeavor as on 01 October 2018 and became the largest independent petroleum product refining, marketing, retail, and midstream business in the US. MPC operates the business with more than 3 million barrels per day of crude oil capacity across 16 refineries. The marketing system of the company comprises branded locations and operation of retail convenience stores across the United States. The midstream operations of MPC are steered through MPLX LP (MPLX) and Andeavor Logistics LP (ANDX) wherein MPC owns 63.6% stake in common shares of each.

The company has three business segments, i.e., (a) Refining & Marketing – this business segment refines crude oil and other feedstocks at 16 refineries in the West Coast, Gulf Coast and Mid-Continent regions of the US. The refined products are sold to wholesale marketing customers, buyers on the spot market, Retail businesses running Marathon® branded outlets, (b) Retail – the segment is responsible for selling transportation fuels and convenience products in the retail market across the US through Speedway brand and ARCO brand, (c) Midstream – is responsible for transporting, store, distribute and market crude oil and refined products, mainly for the Refining & Marketing segment.

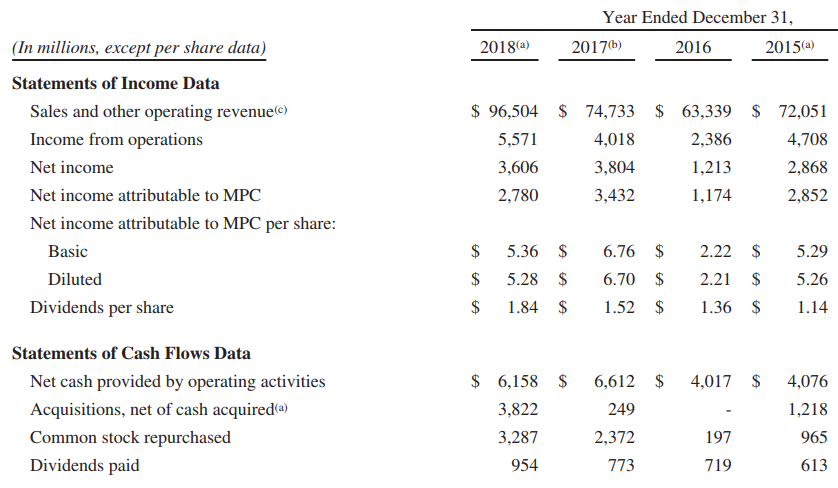

From the analysis standpoints, total sales and other operating revenue posted a CAGR growth of 10.2% over the period of FY15 to FY18. Net income attributable to MPC remains volatile with a CAGR growth of -0.8% and 53.9% over the period of FY15-FY18 and FY16-FY18, respectively. The total size of the balance sheet increased with total asset rising from $43,115 million in FY15 to $92,940 million in FY18. Long-term debt, including capitalized leases, also saw an increase from $ 11,925 million in FY14 to $27,524 million in FY18. Going forward, with the ongoing restructuring of the business, recent acquisition, strong and diversified fuel branding platform, unique competitive advantage in retail segment, expected run-rate synergies for retail segment, strong balance sheet for strategy foundation, disciplined capital allocation policy, etc., the company has commenced a growth path, bundled with wide opportunities and thus, shareholders’ value enhancement.

Historical Financial Snapshot (Source: Company Reports)

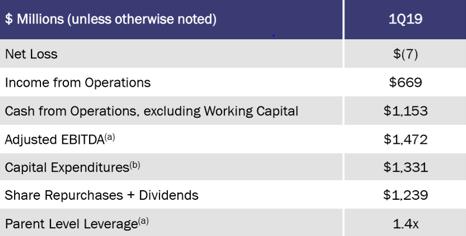

Results for the first quarter 2019: The company had posted lower than expected results for 1Q19 on the back of lower refining margins and rise in gasoline inventories. MPC, in the period, reported the adjusted loss per share of 9 cents with adjusted revenue growth of 50.7% to $28.6 billion. Revenue growth was driven by throughput volumes growth.

First Quarter 2019 Highlights (Source: Company Reports)

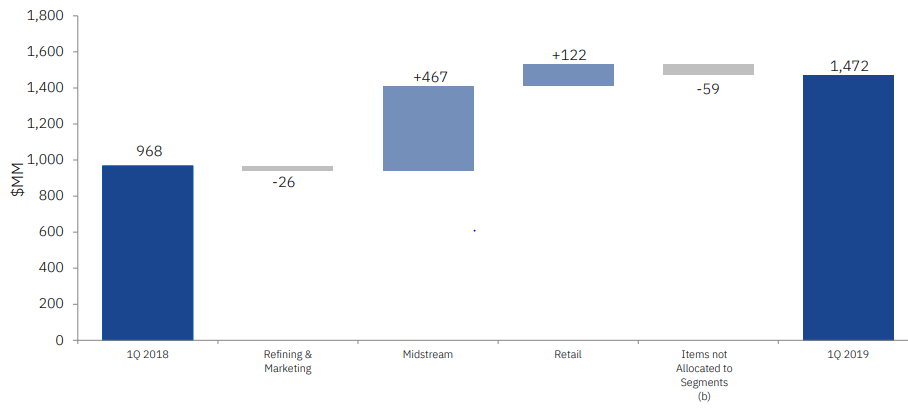

During the quarter, MPC posted an increase in the total income from operations to $669 million and adjusted EBITDA of $1.47 billion, compared to total income from operations of $440 million and adjusted EBITDA of $0.968 billion in the corresponding period last year.

Adjusted EBITDA- 1Q 2019 vs. 1Q 2018 Variance Analysis (Source: Company Reports)

At the end of March 2019, the company had cash and cash equivalents of $755 million. This excludes the cash and cash equivalents of MPLX and ANDX of $93 million and $29 million, respectively. Debt, at the end of the quarter, stood at approximately $5 billion available under a revolving credit agreement.

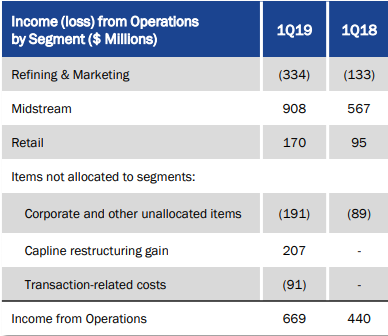

Segment Wise Performance in 1QFY19: During the first quarter of 2019, refining and marketing segment’s operating losses rose around 3 times to $334 million. Refining margin per barrel came in at $11.17. EBITDA for the segment declined during the quarter to $93 million as compared to $119 million posted in the corresponding quarter last year.

During the quarter, total income from the operations of Midstream segment rose to $908 million as compared to $567 million posted for the first quarter of 2018. The increase was on account of the contribution of $220 million, received from Andeavor Logistics. Further increase in the income of operations of $121 million was due to the growth in the MPLX's businesses.

Income from operations from the Retail segment, during the quarter, grew to $170 million from $95 million posted in the first quarter of 2018. The rise in income was due to the addition of the legacy Andeavor retail operations along with $24 million growth in the earnings of MPC's legacy Speedway segment.

Income (loss) from Operations by Segment (Source: Company Reports)

A Quick Look on Acquisition of Andeavor Logistics LP: MPC has planned to merge its midstream units for the combined value of $9 billion. This will be done through the merger of two master limited partnerships (MLPs), MPLX and Andeavor Logistics LP, which operate in the company’s midstream segment. MPC is acquiring Andeavor Logistics LP for unit to unit transaction with the combined exchange ratio of 1.07x, reflecting the premium of 1% to the market. The merger is for the total consideration of an enterprise value of approximately $14 billion. The transaction value comprises of ~$5 billion debt of ANDX and $600 million of ANDX’s preferred units. As per the merger agreement, ANDX shareholders will get 1.135x of MPLX common shares for each ANDX common shares held by them, reflecting a premium of 7.3%. Meanwhile, MPC shareholders will get 1.0328x MPLX common shares for each ANDX common share held by them, reflecting the discount of 2.4%. With this deal, both the companies expect to expand their geographic reach, enhance export capabilities, leverage the existing assets of MPLX for third-party business and grab opportunities for the longer-term. Through the development, both the parties will be able to generate sustainable fee-based cash flow from the business.

MPLX already enjoys stronghold in Marcellus, and this merger will further help to strengthen their presence in the Permian. Moreover, the merger will increase the returns on project backlog. Further, MPLX, itself will fund for the equity portion of the capital investments and will increase the distribution coverage throughout 2019 and 2020. Additionally, the deal received the green flag after the approval from both MPLX’s & ANDX’s Conflicts Committees and by both their Boards of Directors. ANDX's General Partner and an MPC subsidiary, both form about 64% of ANDX's common units. Both of them are supporting this merger and have agreed to give the written consents for the approval of this transaction.

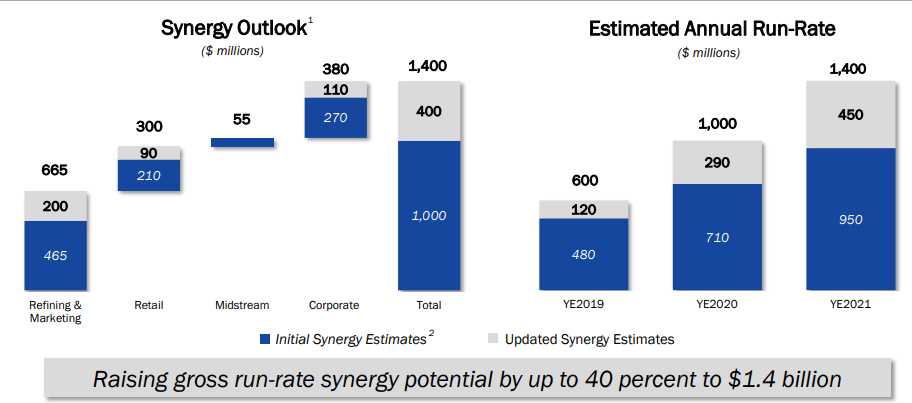

Overall, this deal is anticipated to be closed in the second half of 2019, after fulfilling the conditions required by this agreement. The deal is anticipated to unlock MPC’s value of approximately $2 billion, which was in discount due to future growth concerns. Additionally, during the first quarter of 2019, MPC has realized the total synergy of $133 million related to the Andeavor combination. The company projects that it will be able to realize the annual gross run-rate synergies of up to $600 million by the end of 2019, and $1.4 billion by the end of 2021.

Increasing Synergy Potential (Source: Company Reports)

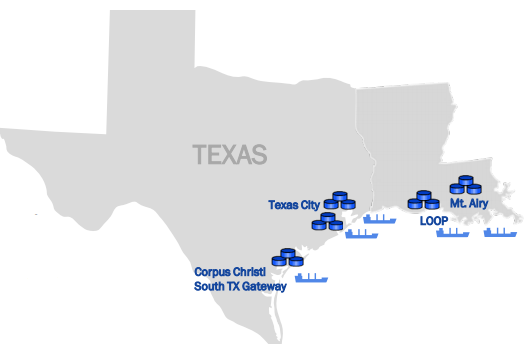

Expansion of Capabilities for Export: The company is expanding its capabilities for export, which is projected to create third party revenue and will able to meet the global demand for crude, refined products, and Natural Gas Liquids (NGLs). For this, the company has already acquired Mt. Airy, LA in the third quarter of 2018 and is expanding LOOP through the reversal of planned Capline & Swordfish Pipeline. Moreover, the planned projects for the expansion of export are South Texas Gateway, which will be operational after the construction of Gray Oak Pipeline (anticipated to be in service from the fourth quarter of 2019) and the development of Texas City, which is the hub for planned W2W and BANGL pipelines.

Expanding Export Capabilities (Source: Company Reports)

Capital Management: The company has a target for the consolidated capital return to be more than 50% of the discretionary (consolidated operating cash flow less maintenance and regulatory capex) free cash flow. The company has set a target for an annual dividend to post more than 10% long term growth rate. Moreover, the company had repurchased $885 million of shares during the first quarter of 2019. The company has existing authorization of $4.9 million, which is anticipated to be completed by 2020-year-end.

.png)

Dividend History (Source: Company Reports)

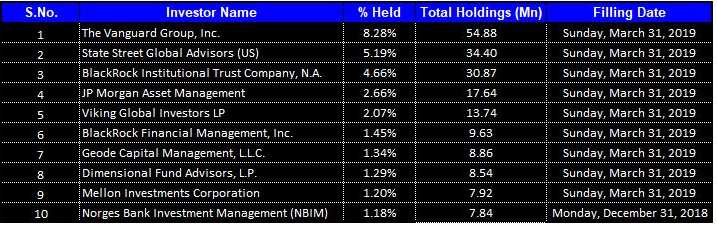

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table, which together form around 29.33% of the total shareholding. The Vanguard Group, Inc., and State Street Global Advisors (US) hold the maximum interest in the company at 8.29% and 5.19%, respectively.

Top 10 Shareholders (Source: Thomson Reuters)

Key Personnel Changes: MPC has appointed Donald C. Templin as the Executive Vice President and Chief Financial Officer (CFO), joined the office in the new role from July 1, 2019. He was previously, the president of Refining, Marketing and Supply of the company. Templin had replaced Timothy T. Griffith, who was the previous CFO of the company. MPC had taken this decision after it appointed Griffith as the President of MPC’s subsidiary Speedway LLC.

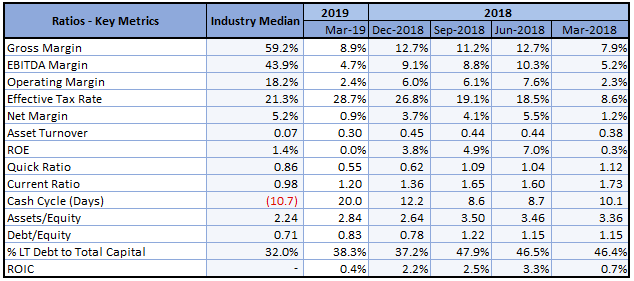

Key Metrics: The company posted a bit disappointing margins in the first quarter of 2019. EBITDA and operating margins for the first quarter stood at 4.7% and 2.4%, as compared to 5.2% and 2.3%, respectively in 1QFY18. Net margin at 0.9% in the quarter was lower as compared to 1.2% in the corresponding quarter last year.

Key Ratio Metrics (Source: Thomson Reuters)

Outlook for Second Quarter 2019: For the second quarter of 2019, the company expects the total throughput of 2,925 thousand barrels per day for the R&M segment. Total direct operating costs for the segment in the second quarter are projected to be at $8.70 per barrel. The company projects the corporate and other unallocated items to be at $200 million.

.png)

Second-Quarter 2019 Outlook (Source: Company Reports)

.png)

Key Valuation Metrics (Source: Thomson Reuters)

Valuation Methodology:

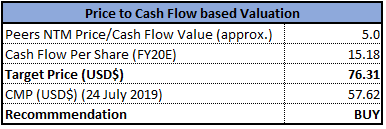

Method 1: Price/Cash Flow Based Valuation (NTM):

Price/Cash Flow Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

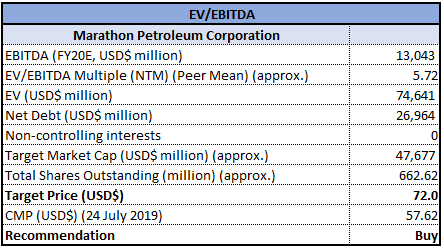

Method 2: EV/EBITDA Based Valuation (NTM):

EV/EBITDA Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

Note: All forecasted figures and peers have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: The stock is trading at a price of $57.62, has support at $46.48 level and resistance at $66.24 level. MPC is in the process of strengthening its midstream operations and retail segments, which comprise of Speedway gas stations, convenience stores, and Andeavor's retail & direct dealer business. The company, in the first quarter, posted the weak set of numbers and refining margins. The company is scheduled to post its second quarter results on 01 August 2019. Going forward, with the strengthening segments and acquisition, we expect the company to post good results in the future. Based on the foregoing, we have valued the stock using two relative valuation methods, Price to Cash Flow multiple and EV/EBITDA multiple, and have arrived at the target price upside in the ambit of low double-digit growth (in %). Hence, we recommend a “Buy” rating on the stock at the current market price of $57.62 per share, up 3.43% on 24 July 2019.

.png)

MPC Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.