Section 1: Company Overview and Fundamentals

1.1 Company Overview:

Xcel Energy Inc. (NASDAQ: XEL) is an electric and natural gas delivery company. The Company provides a comprehensive portfolio of energy-related products and services to approximately 3.8 million electric customers and 2.2 million natural gas customers through four utility subsidiaries, NSP-Minnesota, NSP-Wisconsin, PSCo and SPS. The Company operates in two segments.

Kalkine’s Dividend Income Report covers the Company Overview, Key positives & negatives, Investment summary, Key investment metrics, Top 10 shareholding, Business updates and insights into company recent financial results, Key Risks & Outlook, Price performance and technical summary, Target Price, and Recommendation on the stock.

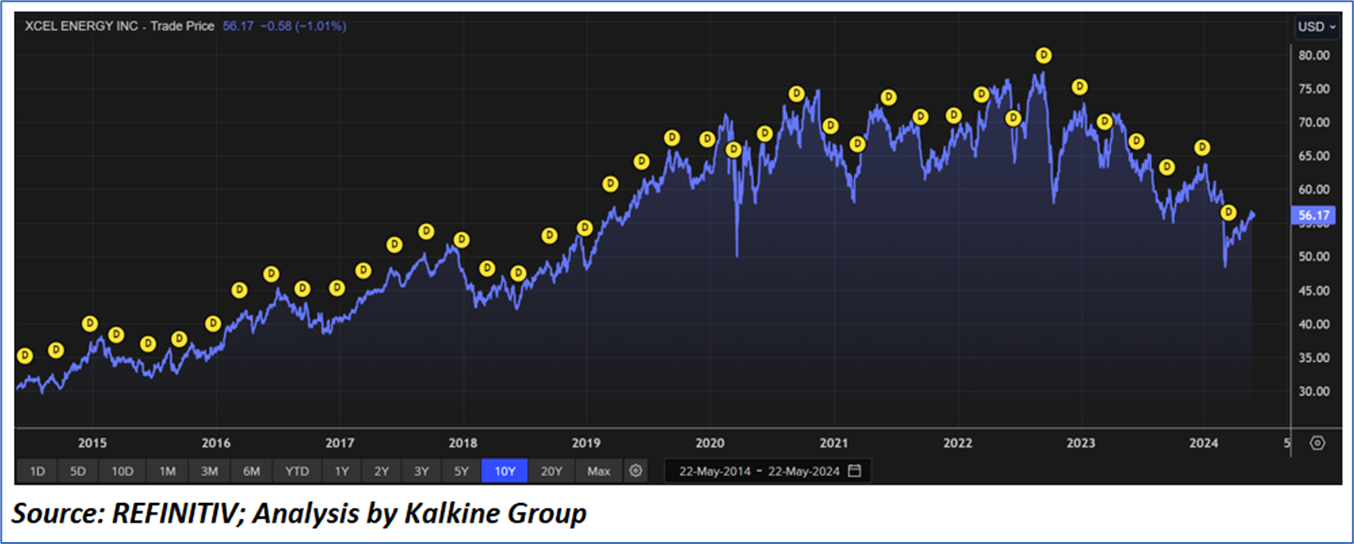

Price Performance:

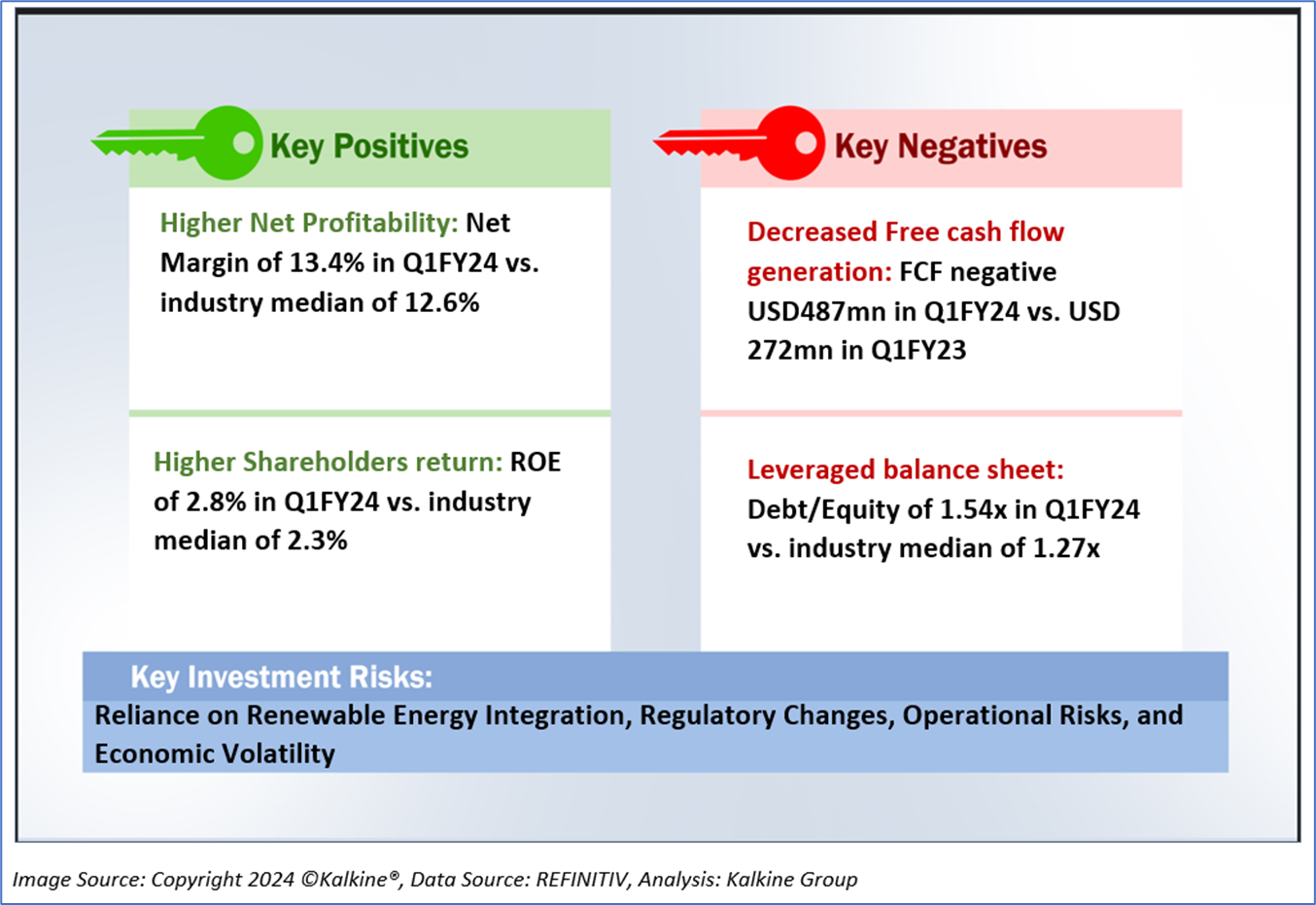

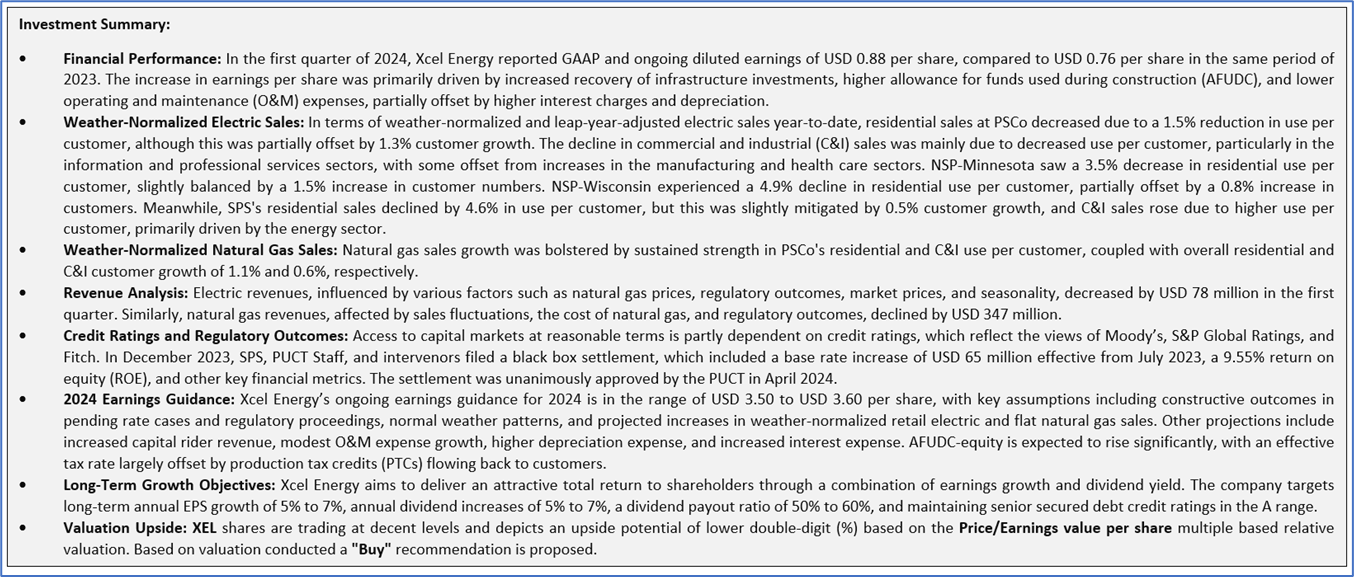

1.2 The Key Positives, Negatives, and Investment summary

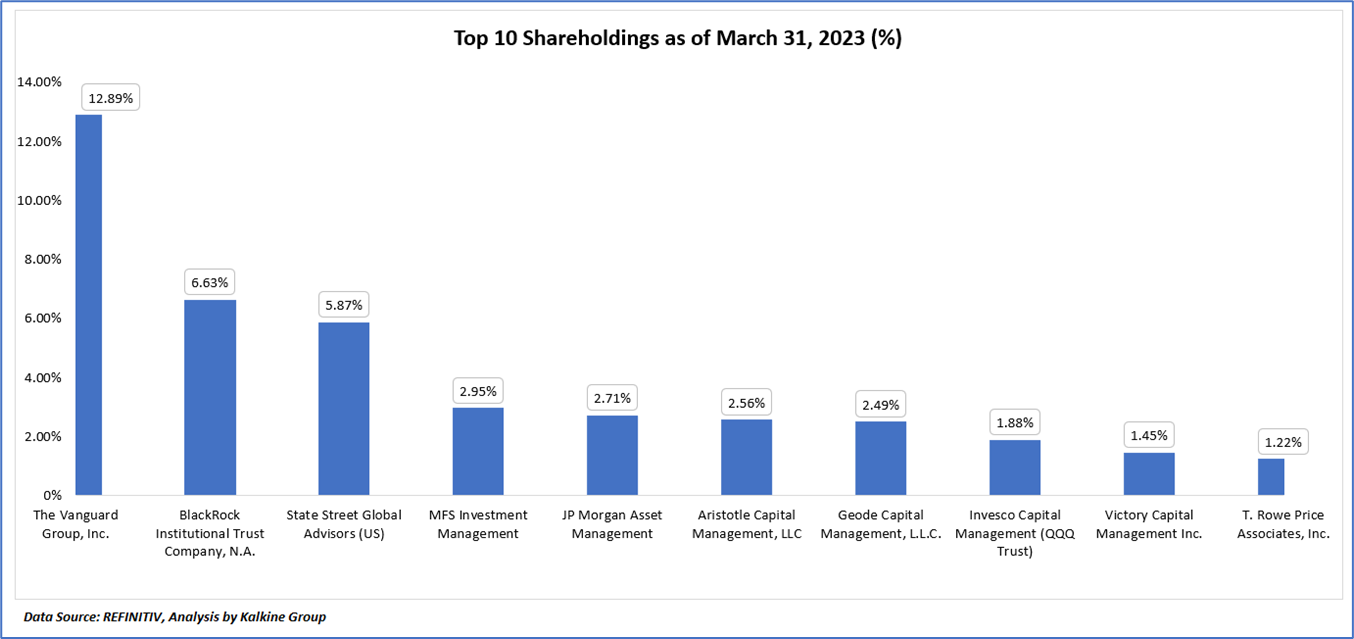

1.3 Top 10 shareholders:

The top 10 shareholders together form ~40.65% of the total shareholding, signifying diverse shareholding. The Vanguard Group, Inc., and BlackRock Institutional Trust Company, N.A., are the biggest shareholders, holding the maximum stake in the company at ~12.89% and ~6.63%, respectively.

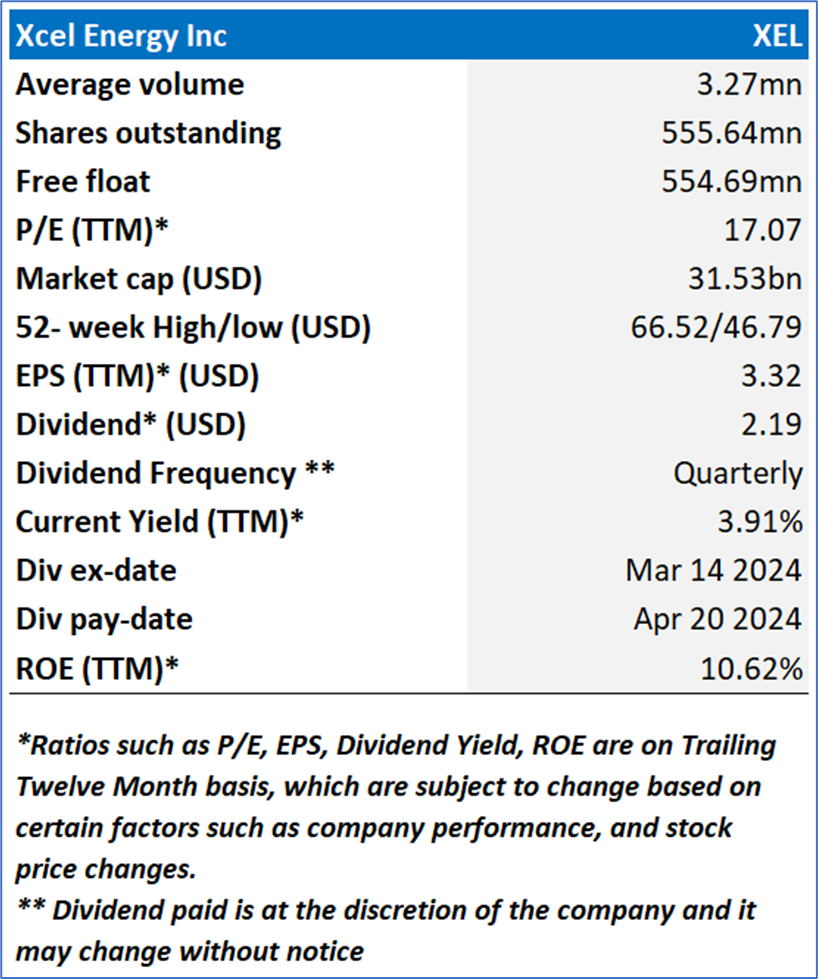

1.4 Dividend payments with impressive dividend yield:

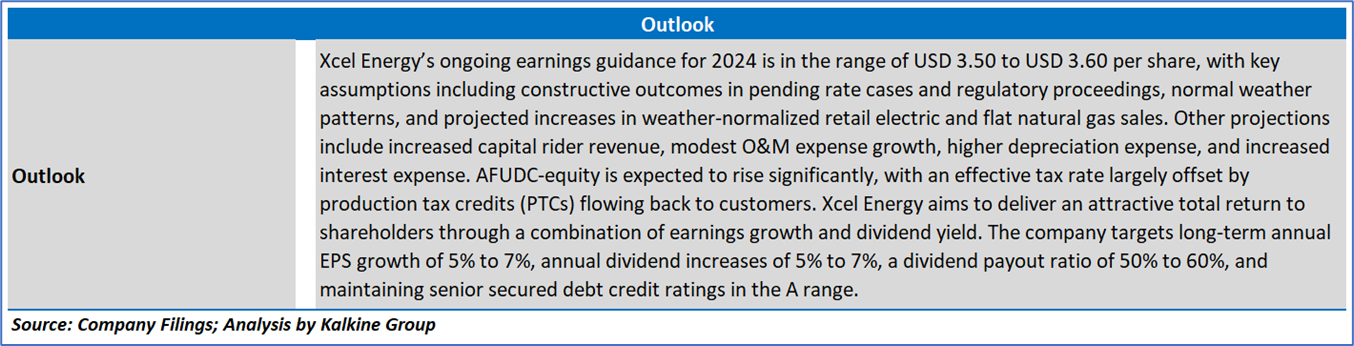

Xcel Energy aims to deliver an attractive total return to shareholders by combining earnings growth and dividend yield. The company targets annual earnings per share (EPS) growth of 5% to 7%, based on a 2023 ongoing earnings base of USD 3.35 per share. Additionally, Xcel Energy plans to increase annual dividends by 5% to 7% and targets a dividend payout ratio of 50% to 60%. The company also aims to maintain senior secured debt credit ratings in the A range.

The Board of Directors of Xcel Energy Inc. (NASDAQ: XEL) has approved an increase in the quarterly dividend on the company’s common stock from USD 0.52 per share to USD 0.5475 per share, equivalent to an annual rate of USD 2.19 per share. These dividends are payable on April 20, 2024, to shareholders of record on March 15, 2024. This marks the twenty-first consecutive year of dividend increases, reflecting the company's strong performance and commitment to shareholder value.

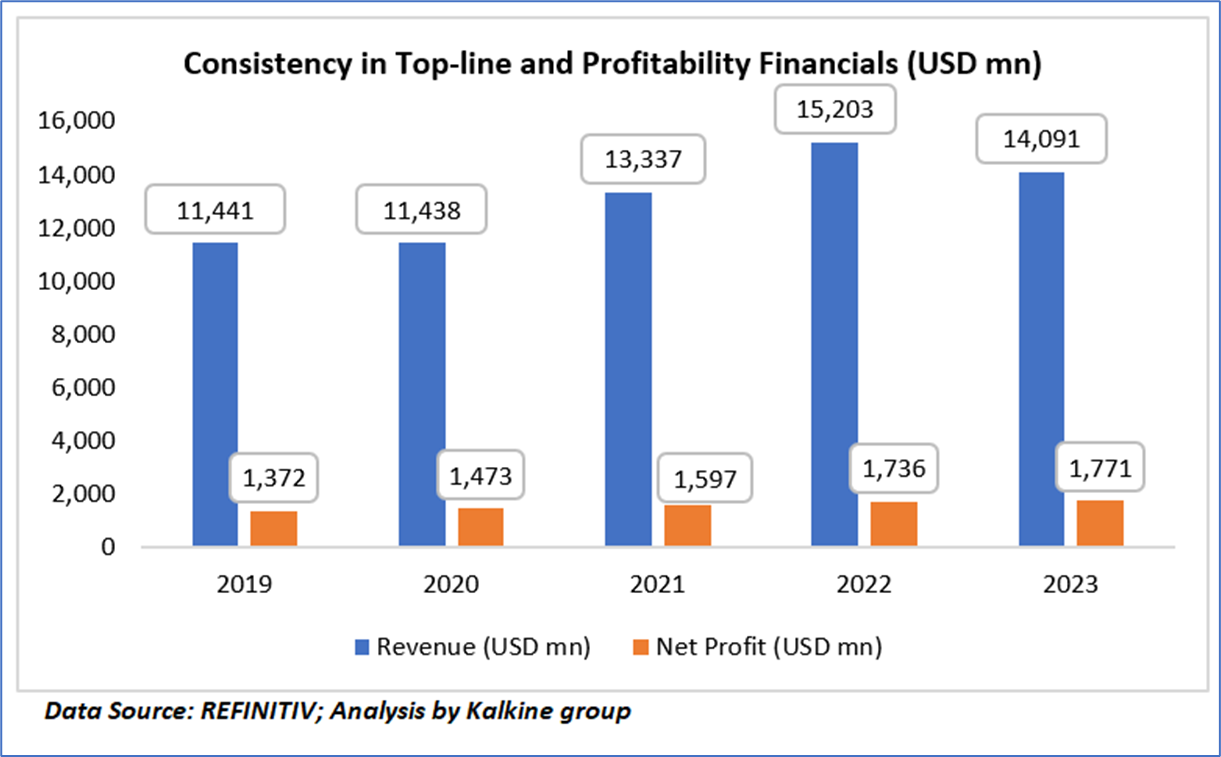

1.5 Key Metrics

Over the five-year period from 2019 to 2023, the revenue of the company experienced significant fluctuations. In 2019, the revenue stood at USD 11,441 million, slightly decreasing to USD 11,438 million in 2020. However, the revenue increased notably to USD 13,337 million in 2021 and further to USD 15,203 million in 2022. In 2023, the revenue declined to USD 14,091 million.

Net profit showed a consistent upward trend over the same period. In 2019, the net profit was USD 1,372 million, increasing to USD 1,473 million in 2020. The upward trend continued with net profits of USD 1,597 million in 2021, USD 1,736 million in 2022, and USD 1,771 million in 2023.

The net margin, which represents the percentage of revenue that translates into profit, exhibited some variability. In 2019, the net margin was 11.99%, rising to 12.88% in 2020. It then slightly decreased to 11.97% in 2021 and further to 11.42% in 2022. However, in 2023, the net margin improved to 12.57%.

Overall, while revenue experienced some volatility, the company's net profit consistently increased, reflecting a robust financial performance. The net margin's fluctuation indicates changes in cost management and efficiency over the years, with an overall improvement in profitability by 2023.

Section 2: Business Updates and Financial Highlights

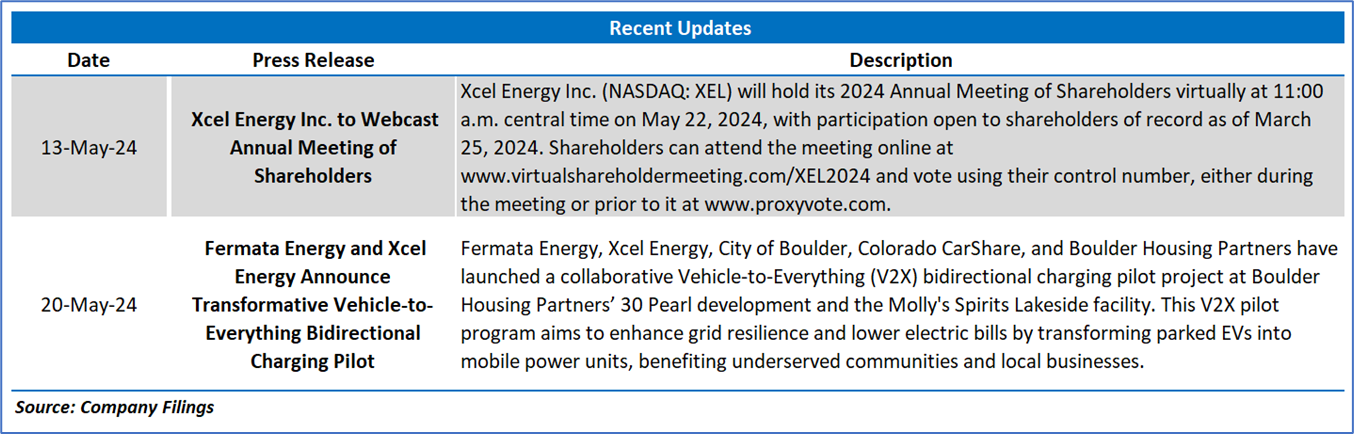

2.1 Recent Updates:

The below picture gives an overview of the recent updates:

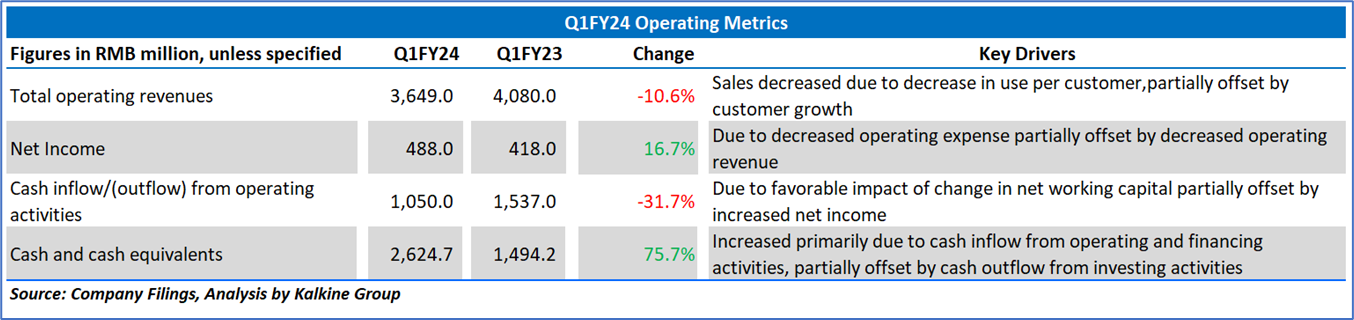

2.2 Insights of Q1FY24:

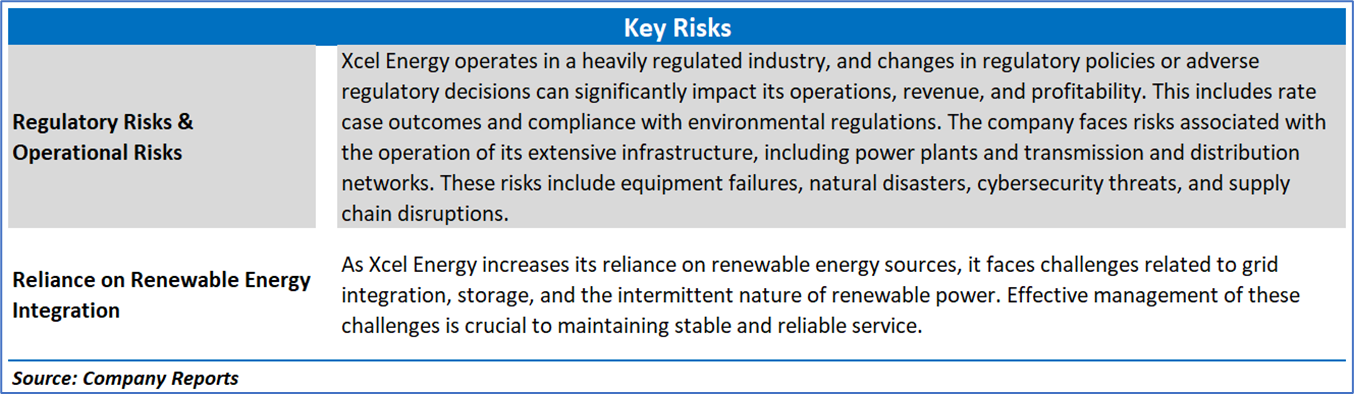

Section 3: Key Risks and Outlook:

Section 4: Stock Recommendation Summary:

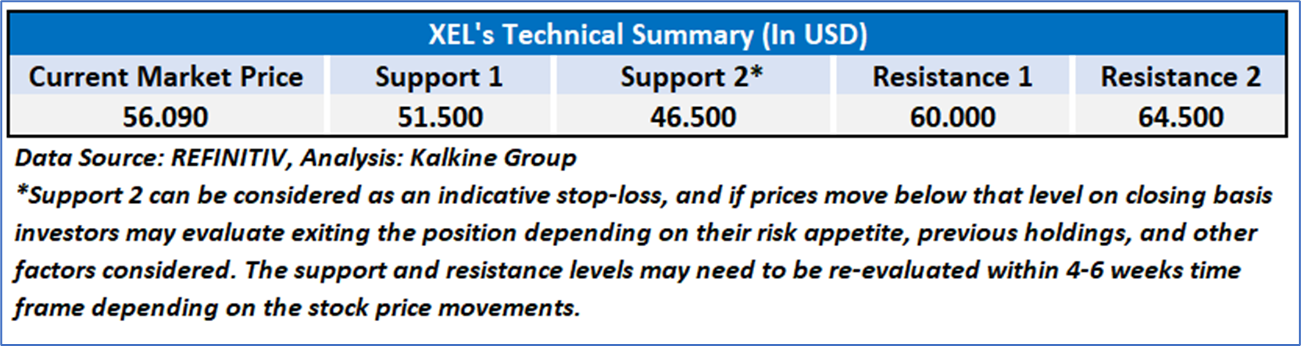

4.1 Technical Summary:

Price Performance:

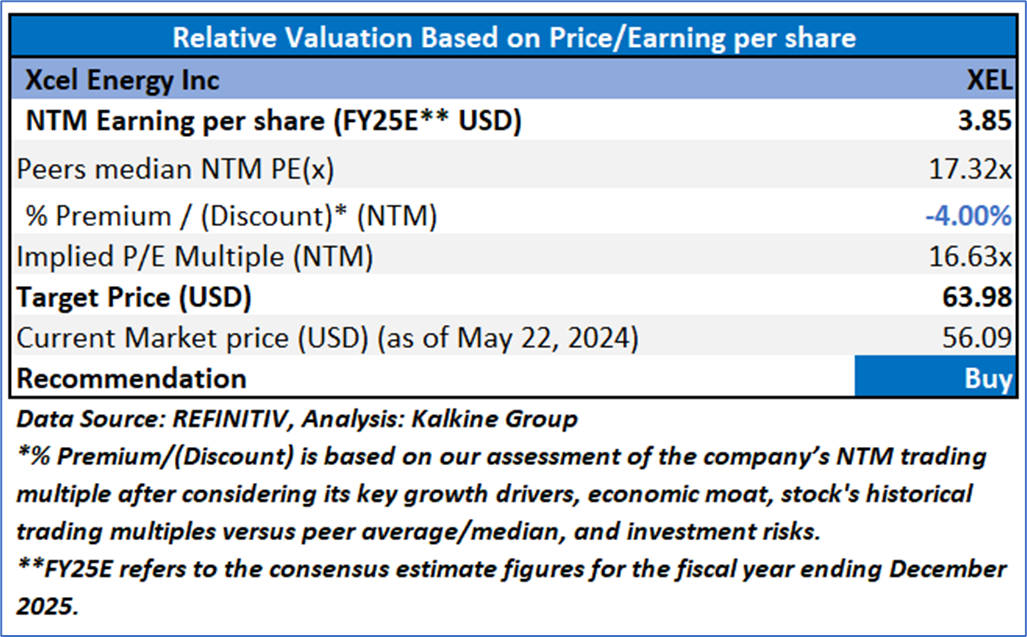

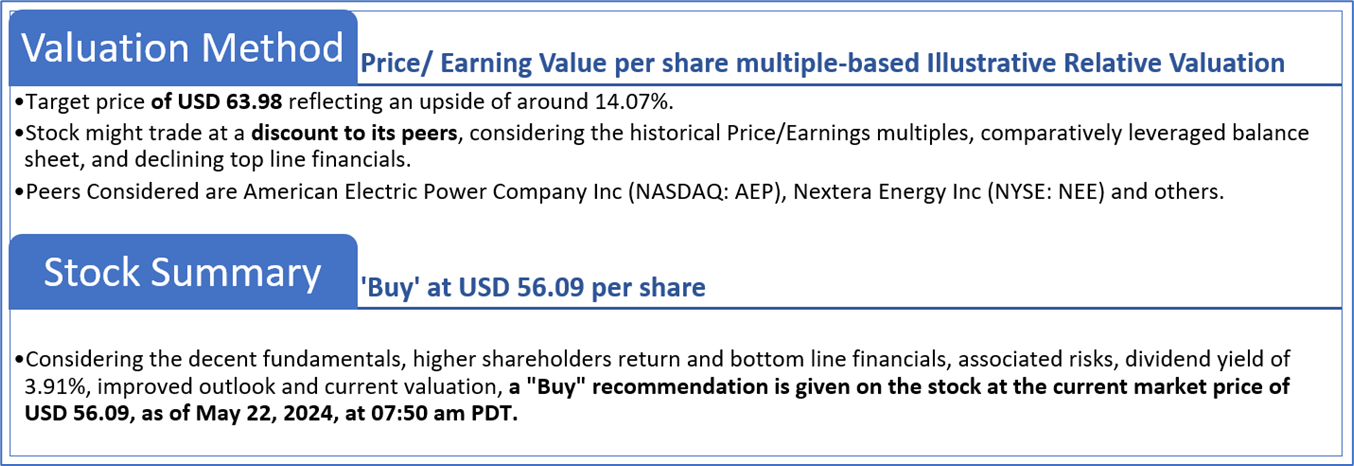

4.2 Fundamental Valuation

Valuation Methodology: Price/Earnings Per Share Multiple Based Relative Valuation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is May 22, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.