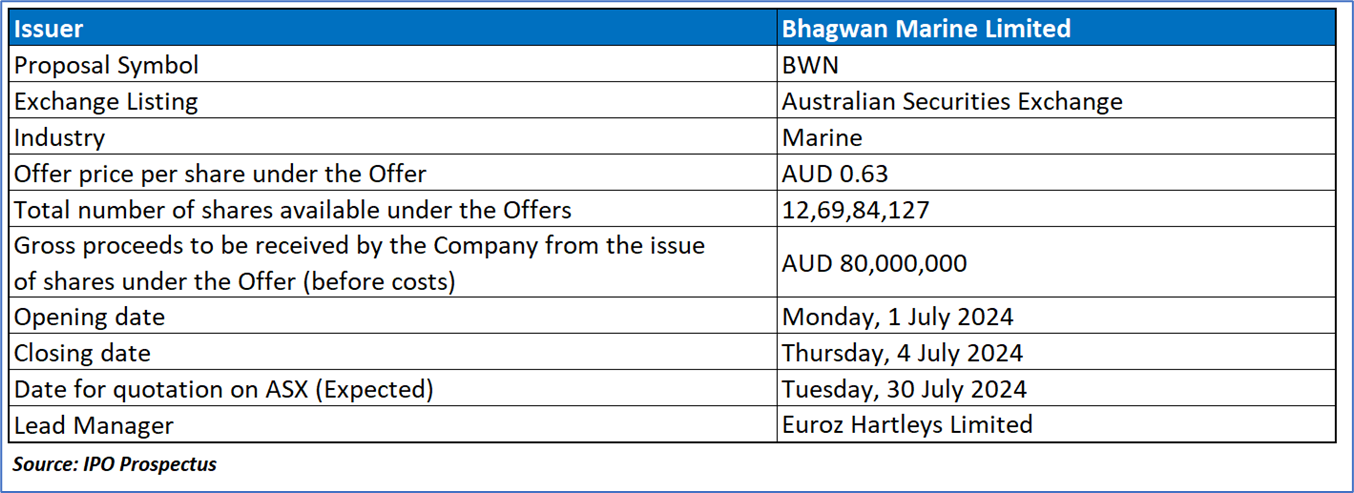

The Offer

Company Overview

Bhagwan Marine Limited is a national Australian marine services company that offers a diverse range of marine solutions in ports, nearshore, offshore, and subsea locations. The company provides extensive marine services across various industries, including oil and gas, subsea, port, civil construction, renewables, and defense. Bhagwan's operations are primarily based out of its major facilities in Dampier, Brisbane, Darwin, and Melbourne, strategically located near the assets and operations of its key clients throughout Australia.

Key Highlights

Primary Offering:

The Public Offer entails the offering of 12,69,84,127 Shares at a price of AUD0.63 per Share, with the objective of generating AUD80,000,000 in funds (pre-expenses).

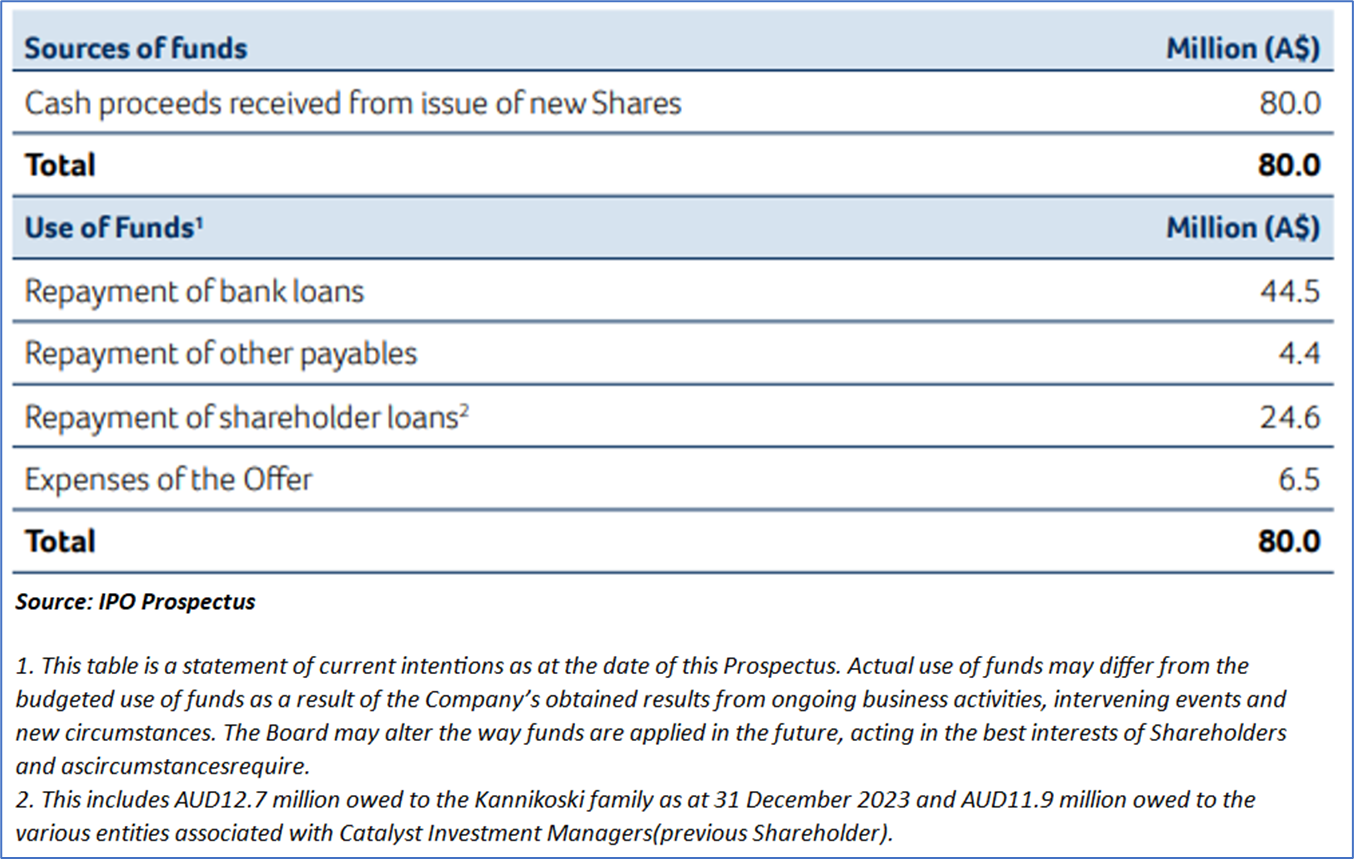

Use of proceeds:

Industry Overview:

Overview of the Key Markets for Bhagwan’s Marine Services

Dividend policy:

The Board has the discretion to determine the payment of dividends by the Company, which will depend on various factors, many of which may be beyond the control of the Company and its Directors and Management and are not reliably predictable. These factors include the general business environment, the Company's operating results, cash flows, and financial condition, future funding requirements, capital management initiatives, taxation considerations, contractual, legal, or regulatory restrictions on dividend payments, and any other factors deemed relevant by the Directors.

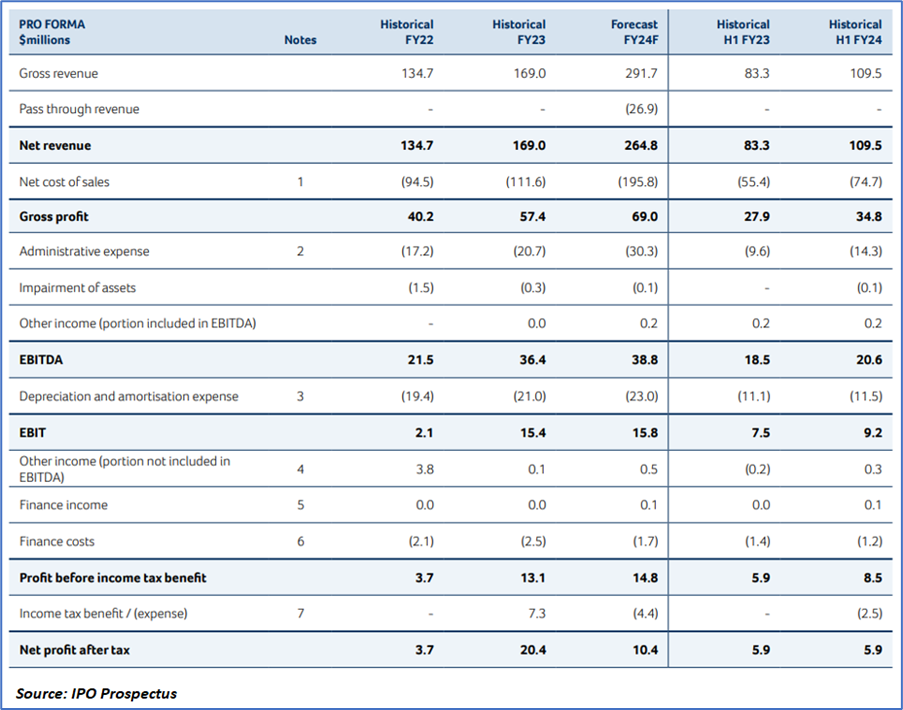

Financial Highlights (Pro Forma Income Statement) (Expressed in AUD):

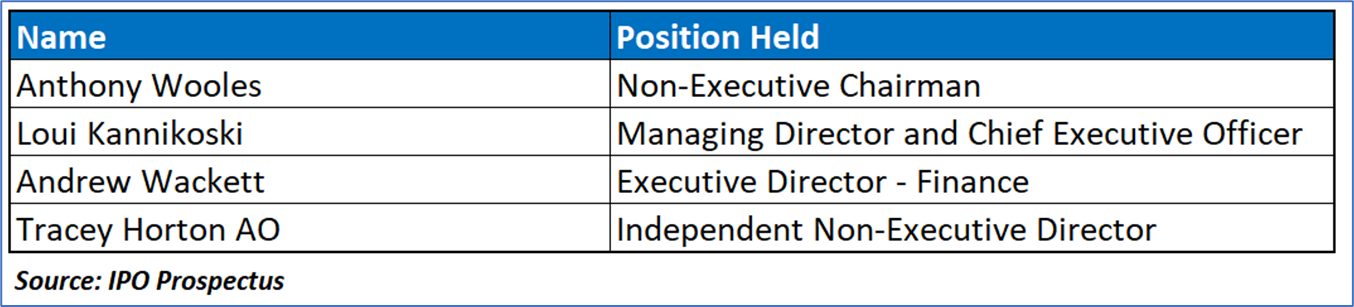

Key Management Highlights

Risk Associated (High)

Reliance on Resources and Oil and Gas Exploration, Development, Production, and Decommissioning Activity: Bhagwan's performance and future growth heavily depend on the activity levels in the resources and oil and gas industries. The demand for Bhagwan’s services, including port services, civil construction, and offshore services, is directly influenced by the level of resource and oil and gas exploration, development, production, and decommissioning activities. A decline in these activities can significantly impact Bhagwan’s revenue, particularly in areas where it operates. Various factors such as economic growth, commodity prices, and energy demand affect these industries, and any prolonged period of low activity could materially and adversely affect Bhagwan’s business, financial position, and growth prospects.

Reliance on Key Clients: Bhagwan derives a significant portion of its revenue from a small number of key clients, with approximately 40% of its FY23 revenue coming from three key clients. These clients provide revenue through various services such as civil construction, subsea, offshore, and port services. Although these clients are contracted under Master Service Agreements (MSAs), services are often provided on a project, on-demand, or ad hoc basis, with no minimum revenue requirements. The termination of these contracts, reduction in client activity, or failure to meet client expectations can adversely impact Bhagwan’s revenue and financial performance.

Failure to Renew Existing Contracts or Win New Contracts: Bhagwan's ability to maintain and grow its business relies on renewing existing contracts and winning new ones. Contracts vary in length and are subject to competitive tender processes. Factors such as service quality, pricing, location of key personnel, and competition affect Bhagwan’s ability to secure contracts. A significant portion of Bhagwan’s projected revenue growth depends on large contracts, such as a major decommissioning contract contributing to 22.9% of FY24F revenue. Failure to consistently secure similar contracts, retain existing clients, or expand service offerings could negatively impact Bhagwan’s financial performance and growth prospects in various industry segments, including the offshore wind and defense sectors.

Conclusion

Bhagwan Marine Limited is a leading Australian marine services company, offering a wide range of solutions across ports, nearshore, offshore, and subsea locations, with strategic facilities in Dampier, Brisbane, Darwin, and Melbourne. The IPO aims to raise AUD 80,000,000 by offering 12,69,84,127 shares at AUD 0.63 per share, which will support further expansion. Bhagwan Marine plays a critical role in the thriving Australian offshore oil and gas sector, which has seen investments exceeding AUD 260 billion since 2007. The company is well-positioned to capitalize on ongoing and future investments in Australia's maritime trade and port operations, supported by substantial government funding. Additionally, Bhagwan Marine's capabilities in subsea services for both offshore oil and gas and emerging offshore wind energy markets present significant growth opportunities. Despite the inherent risks associated with reliance on the oil and gas sector and key clients, Bhagwan Marine's strategic positioning and diversified service offerings make it a decent company in the marine services industry.

Hence, given the financial performance of the company, incurred net losses, company’s product, and associated risks “Bhagwan Marine Limited” IPO seems “Attractive" at the IPO price.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.