The Offer

Company Overview

BlinkLab, established on August 17, 2021, aims to expedite the development and commercialization of intellectual property (Licenced IP) from Princeton University. The company holds an exclusive global license for the Licenced IP, focusing on smartphone-neurobehavioral testing. BlinkLab has created a medical device, the BlinkLab Device, in the form of a smartphone application with an e-platform. This device conducts neurometric tests aiding in the diagnosis of conditions like autism spectrum disorder (ASD), attention deficit hyperactivity disorder (ADHD), schizophrenia, and other neurodevelopmental disorders. The BlinkLab Tests, including eyeblink conditioning, prepulse inhibition of acoustic startle, and habituation of eye blink response, serve as biomarkers for neurological and psychiatric disorders. Results from these tests are recorded on smartphones and analyzed using machine learning on BlinkLab's confidential and secure online platform. BlinkLab's immediate focus is to complete regulatory clinical studies and secure FDA approval in the US and CE Mark in Europe. The ultimate goal is to introduce the BlinkLab Device to the market initially as a diagnostic tool for ASD.

Key Highlights

Primary Offering:

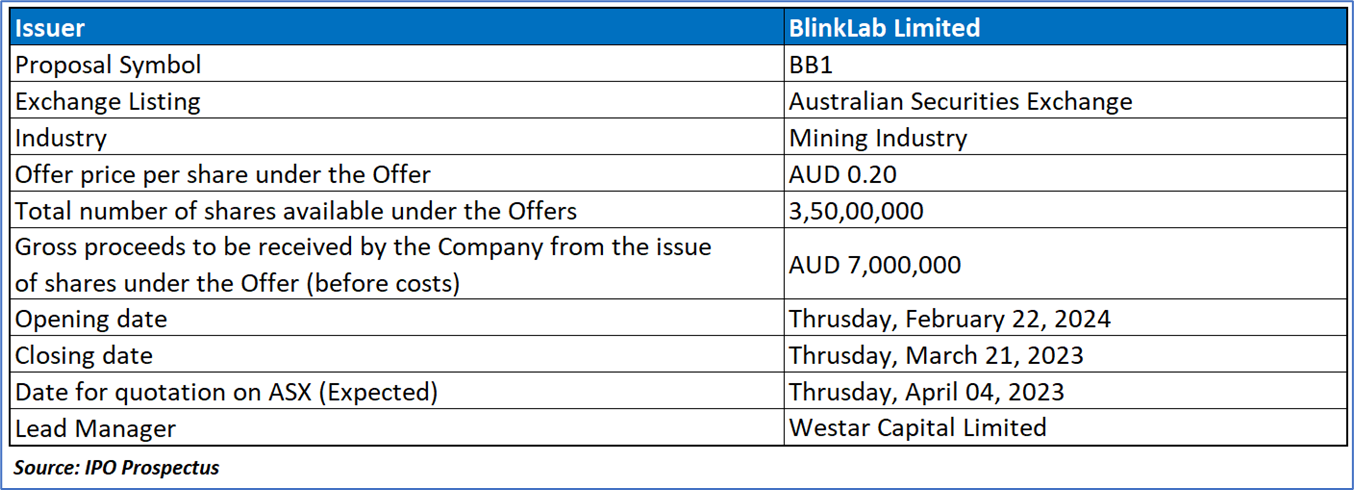

The Public Offer entails the offering of 35,000,000 Shares at a price of AUD0.20 per Share, with the objective of generating AUD7,000,000 in funds (pre-expenses).

Use of proceeds:

Industry Overview:

Dividend policy:

The Company foresees substantial expenditures for the assessment and advancement of its business, with a predominant focus expected over the next two years from the date of this Prospectus. Consequently, the Company does not anticipate declaring any dividends during this period. The decision to pay dividends in the future rests with the discretion of the Directors and will hinge on factors such as the availability of distributable earnings, operating results, the financial condition of the Company, future capital requirements, and other relevant business considerations. The Company cannot provide assurance regarding the payment of dividends or the availability of franking credits, as these decisions will depend on various factors as evaluated by the Directors.

Financial Highlights (Expressed in AUD):

Key Management Highlights

Risk Associated (High)

Conclusion

BlinkLab Limited, an emerging player in smartphone-neurobehavioral testing, has proposed an initial public offering (IPO) to generate AUD7,000,000. Established in August 2021, the company holds exclusive global rights to intellectual property from Princeton University, focusing on neurobehavioral testing for conditions like ASD, ADHD, and schizophrenia. The BlinkLab Device, a smartphone application, conducts neurometric tests aiding diagnosis, with regulatory studies underway for FDA approval. The industry overview emphasizes the growing market for neurodevelopmental disorder diagnostics and BlinkLab's innovative contributions. However, financial highlights reveal a pre-revenue status, and potential investors should consider the high associated risks, including dependence on the Princeton Licence Agreement, government interest and rights, jurisdictional patent requirements, and trade secret vulnerabilities. The company anticipates significant expenses, postponing dividends for the next two years, with future decisions subject to various business factors.

Hence, given the financial performance of the company, incurred net losses, company’s product, and associated risks “BlinkLab (BB1)” IPO seems “Neutral" at the IPO price.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.