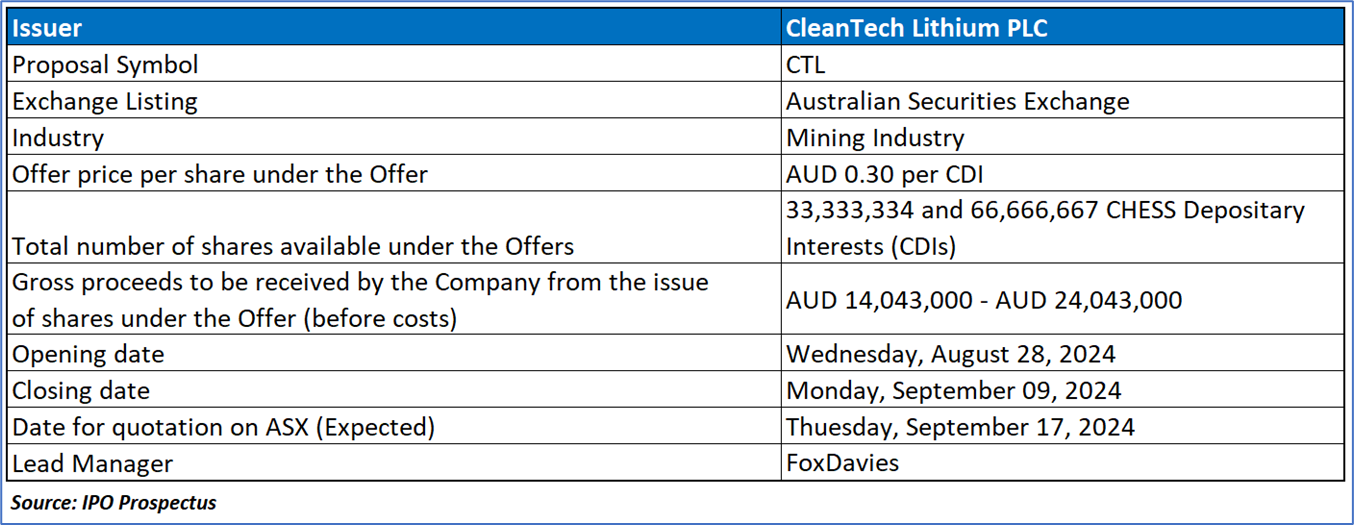

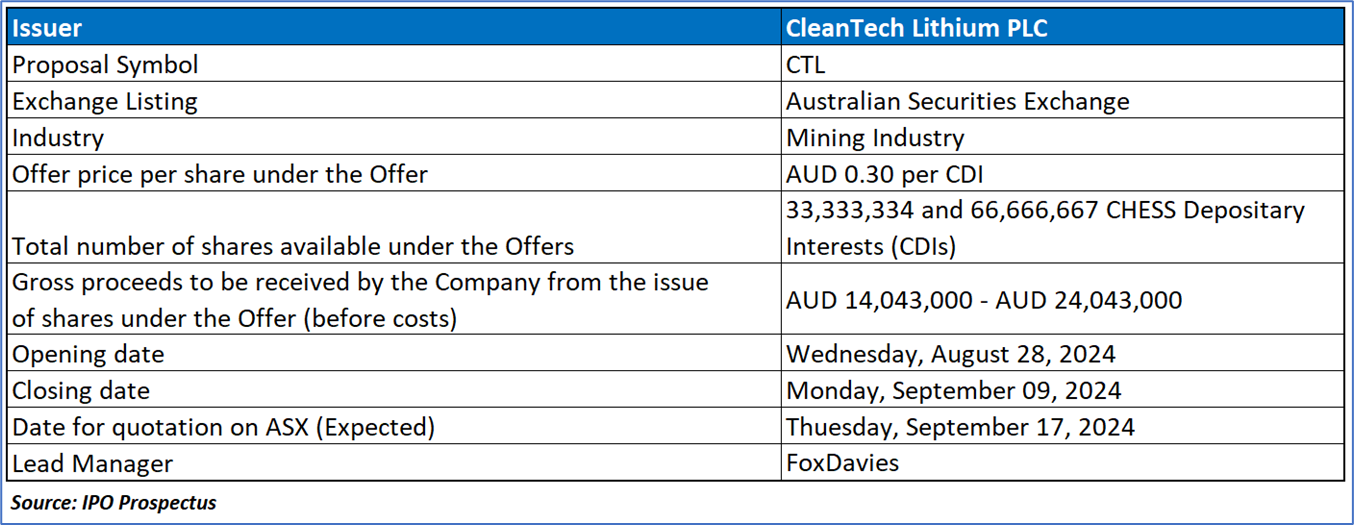

The Offer

Company Overview

CleanTech Lithium PLC, an AIM-listed company, is a leader in the exploration and development of Direct Lithium Extraction (DLE)-based lithium brine projects in Chile, where the government promotes DLE to increase lithium production. Incorporated in Jersey in December 2021 and listed on AIM in March 2022, the company focuses on environmentally sustainable lithium extraction for the electric vehicle and energy storage markets. Its two core projects, Laguna Verde and Viento Andino, are strategically positioned with access to Chile’s renewable energy grid. CleanTech’s innovative DLE approach minimizes water depletion and environmental impact, providing a faster and more efficient lithium extraction process compared to traditional methods. The company’s pilot plant has shown promising results, and its goal is to commercially produce battery-grade lithium carbonate using renewable energy to meet the growing global demand for lithium in the clean energy transition. With a strong management team, CleanTech aims to become a leading supplier in the decarbonization and net-zero efforts.

Key Highlights

Primary Offering:

CleanTech Lithium PLC, in accordance with the Prospectus, is offering between 33,333,334 and 66,666,667 CHESS Depositary Interests (CDIs) at AUD 0.30 per CDI. Each CDI will come with one attaching option, exercisable at AUD 0.375. This public offer aims to raise between AUD 10 million and AUD 20 million before costs. Additionally, there is a secondary offer of up to 4,333,333 Fox-Davies Options to Fox-Davies or its nominees. Each CDI represents one share in the company.

Use of proceeds:

- Total Funds Available: The total funds available to CleanTech Lithium PLC, under both the minimum and maximum subscription scenarios, are as follows: AUD 14,043,000 for the minimum subscription and AUD 24,043,000 for the maximum subscription. These proceeds are intended to support a wide range of activities critical to the company’s operations and growth strategies.

- Allocation of Funds: The funds will be allocated across key operational areas.

- For drilling and hydrogeology, the company will allocate 14% (AUD 1,933,000) under the minimum subscription and 23% (AUD 5,483,000) under the maximum subscription. Engineering and feasibility studies will receive 10% (AUD 1,463,000) and 14% (AUD 3,361,000) under the minimum and maximum scenarios, respectively. Additionally, EIA and community engagement costs will be covered by 6% (AUD 867,000) under the minimum subscription and 7% (AUD 1,797,000) under the maximum subscription.

- Direct Lithium Extraction and Licence Purchase: The allocation for Direct Lithium Extraction (DLE) technology is set at 4% (AUD 559,000) for the minimum subscription and 6% (AUD 1,330,000) for the maximum subscription. The Laguna Verde licence option purchase remains constant, receiving 14% (AUD 1,900,000) of the funds, regardless of the subscription size.

- Capital and Operational Expenditure: For capital expenditure (capex) and operational expenditure (opex), the company will allocate 48% (AUD 6,722,000) of the funds under the minimum subscription and 58% (AUD 13,871,000) under the maximum subscription. These funds will be crucial in supporting ongoing and future projects that require significant investment in equipment and resources.

- Additional Costs and Loan Note Redemption:

- The general and administrative costs will account for 10% (AUD 1,441,000) of the minimum subscription and 15% (AUD 3,628,000) of the maximum subscription. Public offer costs will consume 9% (AUD 1,285,000) of the minimum and 8% (AUD 1,950,000) of the maximum subscription. Working capital and other expenses will receive 19% (AUD 2,726,000) under the minimum and 23% (AUD 5,578,000) under the maximum subscription.

- Regarding loan note redemption, the redemption premium is set at 4% (AUD 599,000) for the minimum and 2% (AUD 599,000) for the maximum. The redemption par value will account for 28% (AUD 3,995,000) under the minimum and 17% (AUD 3,995,000) under the maximum, resulting in a total loan note redemption of 33% (AUD 4,594,000) for both scenarios.

Dividend policy:

The Company does not anticipate paying dividends in the near future, as it plans to prioritize the use of cash reserves for exploration activities related to its projects. Any decision regarding future dividend payments will be at the discretion of the Directors and will depend on factors such as distributable earnings, the Company's financial performance, capital needs, and general business conditions. No guarantees are provided regarding the payment of dividends, nor is there any assurance that dividends will carry franking credits.

Financial Highlights (Results of Operations) (Expressed in USD)

- Income and Operating Losses: For the financial years ending 31 December 2021, 2022, and 2023, the Company reported no income. Administrative costs increased from EUR 1,201,000 in 2021 to EUR 3,149,000 in 2022 and EUR 4,647,000 in 2023. In addition, a provision for Chilean VAT recoverable was introduced in 2022, amounting to EUR 645,000 and further rising to EUR 1,239,000 in 2023. Consequently, the Company's operating loss expanded from EUR 1,201,000 in 2021 to EUR 5,886,000 by 2023. The loss before tax remained consistent with the operating loss, as no income tax was reported during these periods.

- Comprehensive Losses and Foreign Exchange Impacts: The total loss for the year after tax increased significantly over the three-year period, from EUR 1,205,000 in 2021 to EUR 5,886,000 in 2023. Other comprehensive income reflected foreign exchange differences arising from the translation of functional currencies. In 2021, a minor foreign exchange gain of EUR 2,000 was recorded, followed by a gain of EUR 338,000 in 2022. However, this reversed into a foreign exchange loss of EUR 1,021,000 in 2023, contributing to the overall comprehensive loss for the year.

- Cash Flow from Operations and Investments: The Company's net cash used in operating activities increased from EUR 717,000 in 2021 to EUR 5,409,000 in 2023, largely driven by higher administrative costs and provisions. Net cash used in investing activities, primarily related to exploration and evaluation assets, rose significantly from EUR 696,000 in 2021 to EUR 8,852,000 in 2023. This reflects the Company's continued focus on its exploration projects.

- Financing Activities and Cash Position: The Company raised substantial funds through the issuance of ordinary shares, generating net proceeds of EUR 4,614,000 in 2021, EUR 17,014,000 in 2022, and EUR 8,192,000 in 2023. Despite the increase in expenditure, the Company maintained a positive cash flow from financing activities. However, the net cash inflow of EUR 3,149,000 in 2021 turned into an outflow of EUR 6,068,000 by 2023. Cash and cash equivalents at the start of the year increased from EUR 96,000 in 2021 to EUR 12,368,000 in 2023.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “CTL” is exposed to a variety of risks such as:

- Fixed and Contingent Payment Obligations Under LV Purchase Agreement: The Company faces significant financial obligations under the Laguna Verde (LV) Purchase Agreement. These include a series of fixed payments totaling USD 4.25 million by 2027 and larger contingent payments based on production milestones. If the Company fails to raise the required capital or meet these payment obligations, it risks forfeiting up to 49% interest in LV Concessions, posing a serious risk to its ownership and operations.

- Exploration and Development Risks: The Company's projects are at an early exploration stage, which involves high uncertainty and risk. The development of mineral resources is a lengthy process requiring substantial investment. Many factors, such as geological complexity, technical feasibility, and economic conditions, could impede progress. Success in these ventures is not guaranteed, and the Company may face challenges in obtaining the necessary funds to move projects forward.

- Unproven Processing and Extraction Techniques: The Company plans to use Direct Lithium Extraction (DLE) technology, which, though promising, is still relatively new and untested on a large scale for lower-grade brines. There are uncertainties regarding the long-term performance of the technology, particularly in commercial settings. If the DLE process fails to scale up or encounters technical issues, it could significantly impact on the economic viability of the Company’s projects.

Conclusion

CleanTech, focused on environmentally sustainable lithium extraction using Direct Lithium Extraction (DLE) in Chile, aims to capitalize on the increasing demand for lithium, driven by the electric vehicle and energy storage markets. CleanTech Lithium PLC's innovative DLE approach offers a faster and more efficient lithium extraction process compared to traditional methods, significantly reducing environmental impact, particularly in water-depleted regions. The funds raised from the IPO will be allocated to various operational areas, including drilling, engineering studies, and the further development of DLE technology. This IPO provides investors an opportunity to participate in a company strategically positioned to supply the growing global demand for lithium, particularly as the world transitions towards cleaner energy solutions. However, there should be awareness of the risks, including exploration uncertainties and the unproven large-scale application of DLE technology.

Hence, given the financial performance of the company, use of proceeds, and associated risks “CleanTech Lithium PLC (CTL)” IPO seems “Neutral" at the IPO price.