The Offer

Company Overview

Kindly MD, Inc. (KDLY) is a Utah-based company established in 2019, specializing in healthcare data and dedicated to addressing holistic pain management and combating the opioid epidemic. Kindly MD provides integrated healthcare services to patients, combining prescription medicine and behavioral health interventions to mitigate opioid use among those suffering from chronic pain, aiming to prevent and alleviate addiction and dependence on opiates.

The company’s outpatient clinical services, available on a fee-for-service basis, encompass evaluation and management for chronic pain, functional medicine, cognitive behavioral therapy, trauma and addiction therapy, recovery support services, overdose education, peer support, limited urgent care, preventative medicine, medically managed weight loss, and hormone therapy. Utilizing an embedded model of prescriber and therapist teams, Kindly MD tailors patient-specific care programs with the objective of reducing opioid usage while effectively managing patients through non-opioid alternatives and behavioral therapy. Moreover, beyond patient treatment, Kindly MD collects comprehensive data on the motivations and mechanisms driving patients towards alternative treatments, aiding in individualized patient care and providing valuable insights for the Company and its investors. Kindly MD aspires to emerge as a leading resource for evidence-based guidelines, data, treatment paradigms, and educational initiatives in the battle against the opioid crisis in the United States.

Key Highlights

Primary Offering:

RBRK anticipates issuing 23,000,000 shares (or 26,450,000 shares, assuming the underwriters’ option to purchase additional shares of Class A common stock is exercised in full), with expected net proceeds totaling approximately USD632.6 million (or approximately USD729.3 million if the underwriters’ option to purchase additional shares is exercised in full), assuming an initial public offering price of USD29.50 per share, representing the midpoint of the estimated price range.

Use of proceeds:

KDLY anticipates receiving net proceeds from the offering of approximately USD6,154,999, after accounting for underwriting discounts, commissions, and estimated offering expenses, based on a per unit price of USD5.50. If the underwriters’ representative exercises the over-allotment option in full, the net proceeds would increase to approximately USD7,099,098. These funds are earmarked for various purposes, including capital expenditures, labor, real estate acquisition, marketing, sales, and technology development. Specifically, capital expenditures amounting to USD2,140,000 will facilitate the expansion of new clinic locations and potential acquisitions. Real estate acquisition, though not yet specified, is allotted USD500,000. Technology development, allocated USD1,000,000, aims to enhance data collection systems, refine data analysis, and bolster artificial intelligence capabilities. Additionally, a portion of the proceeds, USD584,999, will be used to repay amounts due under certain promissory notes. KDLY believes that these funds, combined with existing cash reserves and potential proceeds from warrant exercises, will sufficiently support operational expenses and capital requirements for at least the next 12 months. However, the final allocation of proceeds may be subject to management's discretion and dependent on various factors influencing business conditions. Any surplus proceeds not immediately utilized will be invested in short-term, interest-bearing instruments.

Dividend policy:

KDLY has abstained from distributing dividends throughout the three preceding fiscal years and currently holds no intentions to initiate dividend payments on its Common Stock. The company's current strategy entails retaining all earnings, if any, for reinvestment into its business operations.

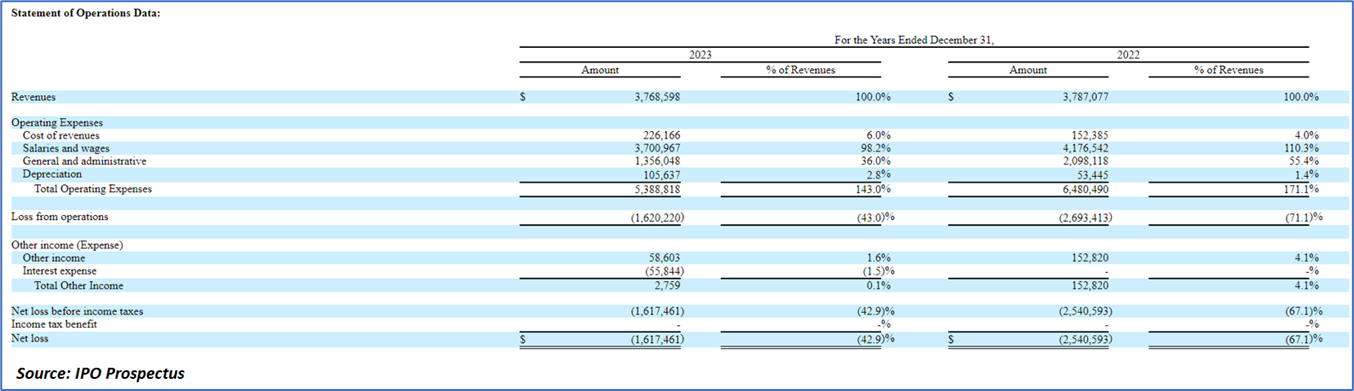

Financial Highlights (Results of Operations) (Expressed in USD)

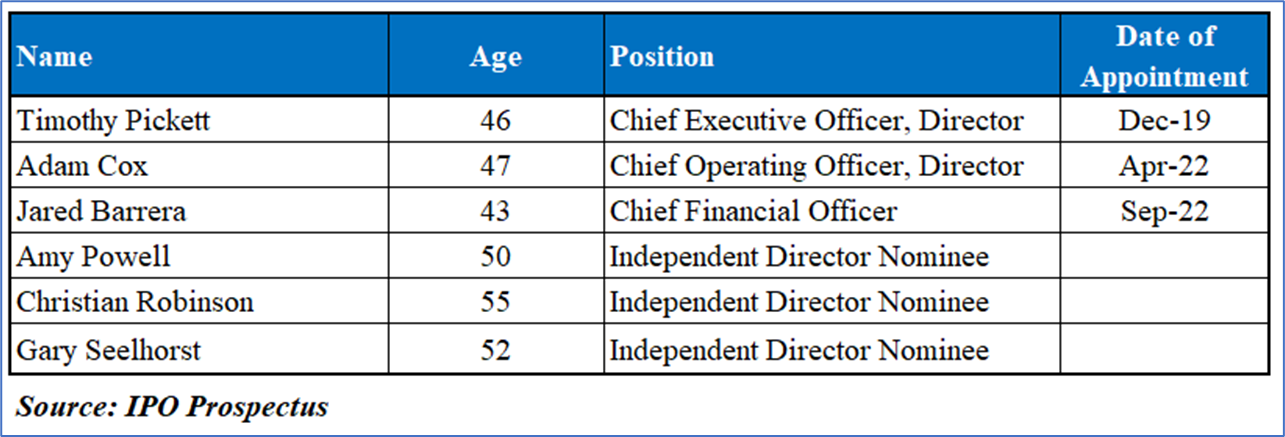

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “KDLY” is exposed to a variety of risks such as:

Volatility in Revenue and Profitability: KDLY's business strategy may subject it to substantial fluctuations in revenues, losses, and earnings. As KDLY focuses on a limited number of business initiatives at a time, its success hinges on the market acceptance of these initiatives, potentially leading to variable profitability. Economic conditions and market dynamics may further impact KDLY's revenues and profitability, posing additional risks to its financial performance. Moreover, KDLY's ability to generate positive cash flow and sustain profitability may be influenced by changes in the market for its products and services, as well as general economic risks that could affect its operational results and financial stability.

Risk of Insufficient Capital and Going Concern Uncertainty: There is a risk that KDLY may not secure adequate capital to sustain its operations and pursue business development activities. While KDLY plans to raise additional capital through the sale of Common Stock, there is no guarantee of success in these endeavors. The anticipated nature of KDLY's services makes it challenging to accurately forecast revenues and operating results, which may fluctuate due to various factors such as capital availability, sourcing strong opportunities, managing liquidity requirements, and competition. Additionally, KDLY's ability to attract and retain qualified personnel is crucial for its success, and any limitations in this regard could adversely affect its operations. The lack of available and cost-effective directors and officer's insurance coverage further compounds these risks, potentially impeding KDLY's ability to attract and retain talented executives and hinder its business development efforts.

Conclusion

KDLY, a Utah-based company established in 2019, specializes in healthcare data, focusing on holistic pain management and combating the opioid epidemic through integrated healthcare services. The company plans to issue 23,000,000 shares in its IPO, expecting net proceeds of approximately USD 632.6 million for various purposes, including capital expenditures and technology development. Despite a slight decrease in revenue in fiscal year 2023, attributed to discounts on patient care services, KDLY saw a significant improvement in net loss per share, indicating operational efficiencies. Additionally, KDLY's commitment to addressing the opioid crisis and its comprehensive data collection efforts underscore its long-term dedication to innovation and patient care. The company's strategic allocation of funds for technology development reflects its forward-thinking approach to improving healthcare outcomes and staying ahead in a rapidly evolving industry. However, investing in KDLY's IPO entails risks, including the impact of revenue volatility, insufficient capital, and talent retention challenges due to the lack of insurance coverage.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Kindly MD, Inc. (KDLY)” IPO seems “Neutral" at the IPO price.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.