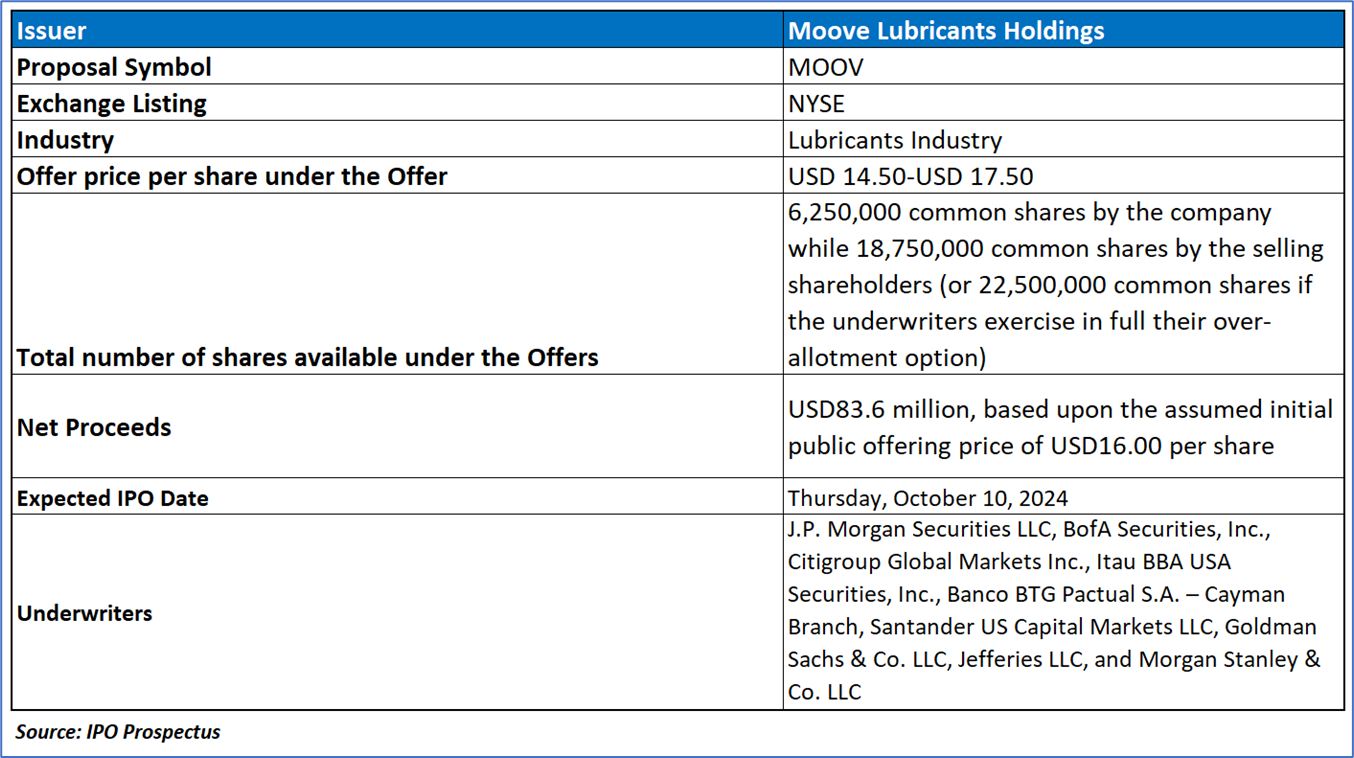

The Offer

Company Overview

Moove Lubricants Holdings (MOOV) is a leading global provider of lubricant solutions, specializing in the formulation, manufacturing, distribution, and marketing of lubricant products across various end markets. The company has established a strong strategic alliance with ExxonMobil, leveraging its brand, research capabilities, and proprietary technologies to enhance its supply chain and marketing strategies. With a focus on optimizing costs and tailoring products to meet evolving customer needs, Moove distinguishes itself through its expertise in sourcing and deep supply chain knowledge, allowing it to deliver high-performance products at competitive prices. This customer-centric approach, combined with a culture of high performance, has driven margin expansion and strong cash returns on capital investments, positioning Moove as a preferred partner in the lubricant industry.

Key Highlights

Primary Offering:

The total number of shares available under the offers includes 6,250,000 common shares issued by the company and 18,750,000 common shares offered by the selling shareholders. If the underwriters fully exercise their over-allotment option, the total number of common shares available would increase to 22,500,000.

Use of proceeds:

Moove estimates that the net proceeds from the sale of common shares in its upcoming offering will be approximately USD 83.6 million, based on an assumed initial public offering price of USD 16.00 per share (the midpoint of the estimated price range), after accounting for underwriting discounts, commissions, and offering expenses. A USD 1.00 increase or decrease in the assumed IPO price would alter the net proceeds by approximately USD 5.9 million, while a change of 1.0 million shares offered would impact net proceeds by about USD 15.1 million. The company plans to allocate USD 55.8 million (or INR310.0 million) of these proceeds for the acquisition of DIPI Holdings S.A. and its subsidiaries, with the remainder directed toward general corporate purposes, including working capital and potential future investments. While Moove intends to use the net proceeds as outlined, it retains the flexibility to reallocate funds as necessary, dependent on various factors and unforeseen events. Until the proceeds are utilized, the company will invest them in capital preservation instruments, although there are no guarantees regarding income generation or preservation of value from such investments. It is important to note that Moove will not receive any proceeds from the sale of shares by selling shareholders.

Industry Overview

Dividend policy:

On June 12, 2024, MOOV declared a dividend of INR900 million, which was subsequently paid to its shareholders on June 21, 2024. Additionally, the company distributed dividends amounting to INR246.1 million for the fiscal year ending December 31, 2023, and INR248.9 million for the fiscal year ending December 31, 2022. MOOV has not established a formal dividend policy regarding future distributions. The company intends to continue distributing a portion of its future earnings to shareholders at the discretion of its board of directors, subject to applicable laws. Such determinations will be influenced by various factors, including financial condition, operational results, capital requirements, contractual restrictions, prevailing business conditions, and any other relevant considerations deemed pertinent by the board of directors.

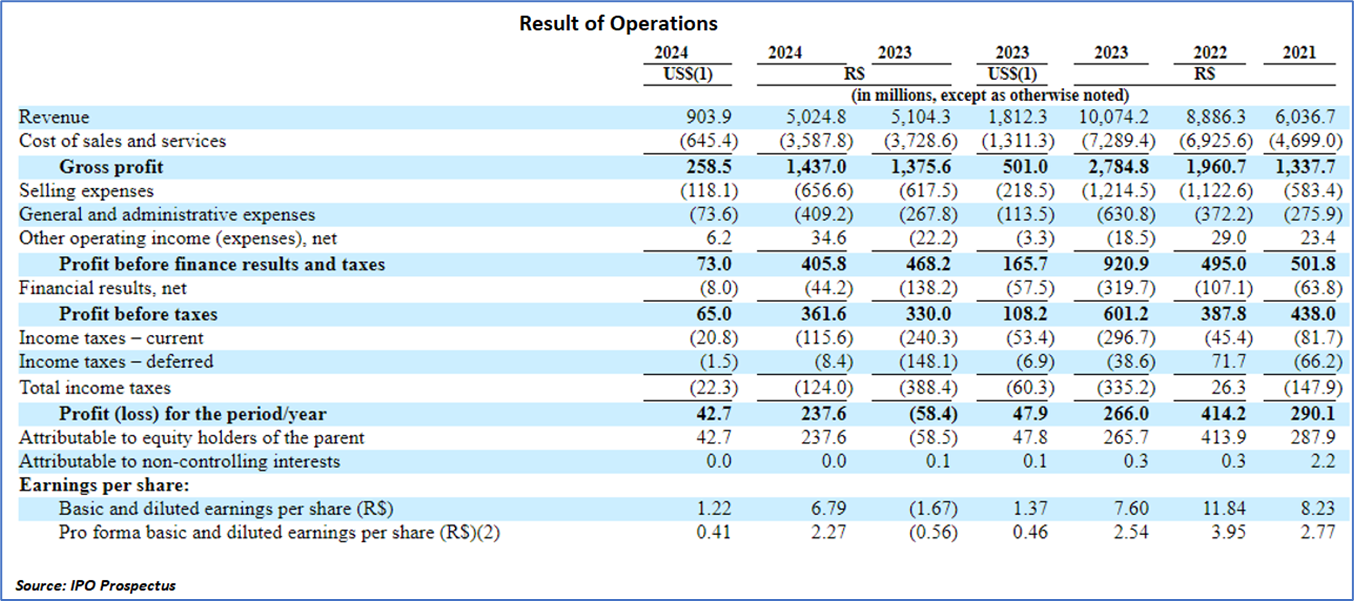

Financial Highlights (Results of Operations) (Expressed in USD)

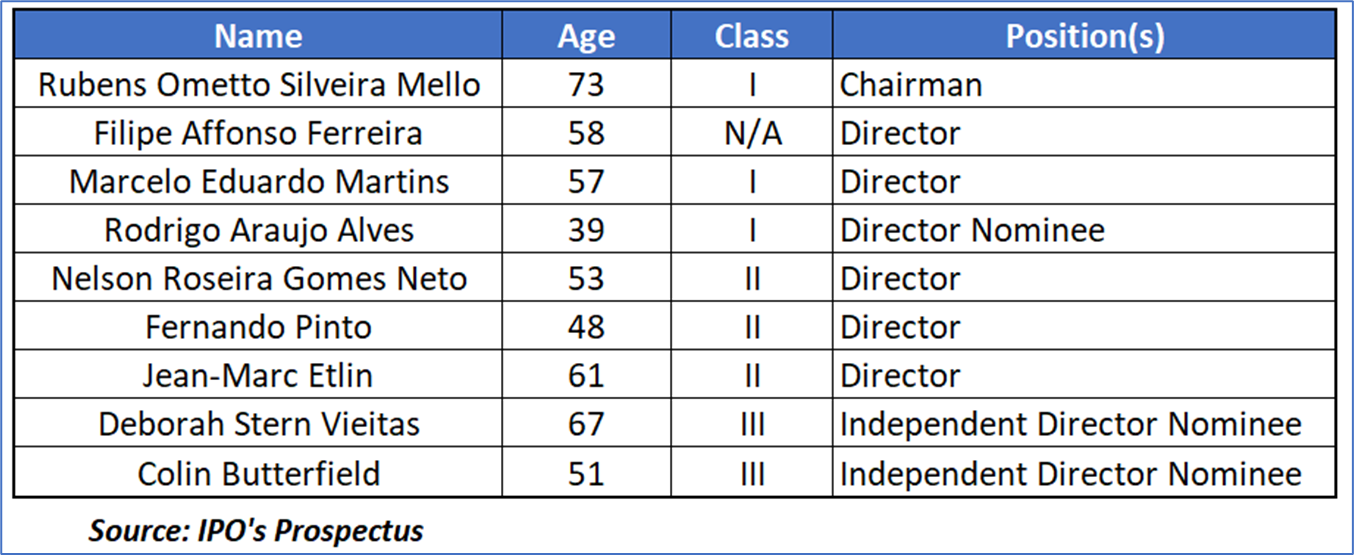

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “MOOV” is exposed to a variety of risks such as:

Conclusion

Moove Lubricants Holdings is offering an IPO comprising 6.25 million shares from the company and 18.75 million from selling shareholders, potentially increasing to 22.5 million if the over-allotment option is exercised. The estimated net proceeds from the IPO, projected at approximately USD 83.6 million, will primarily fund the acquisition of DIPI Holdings S.A., with the remainder earmarked for general corporate purposes. Moove, a key player in the lubricant industry with a strategic partnership with ExxonMobil, leverages its deep supply chain expertise to deliver high-performance products. Despite reporting a decline in revenue for the first half of 2024 compared to the previous year, the company showed improved profitability metrics. However, investment risks include dependency on ExxonMobil agreements, potential manufacturing disruptions, and vulnerabilities to cybersecurity threats.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Moove Lubricants Holdings (MOOV)” IPO seems “Neutral" at the IPO price.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.