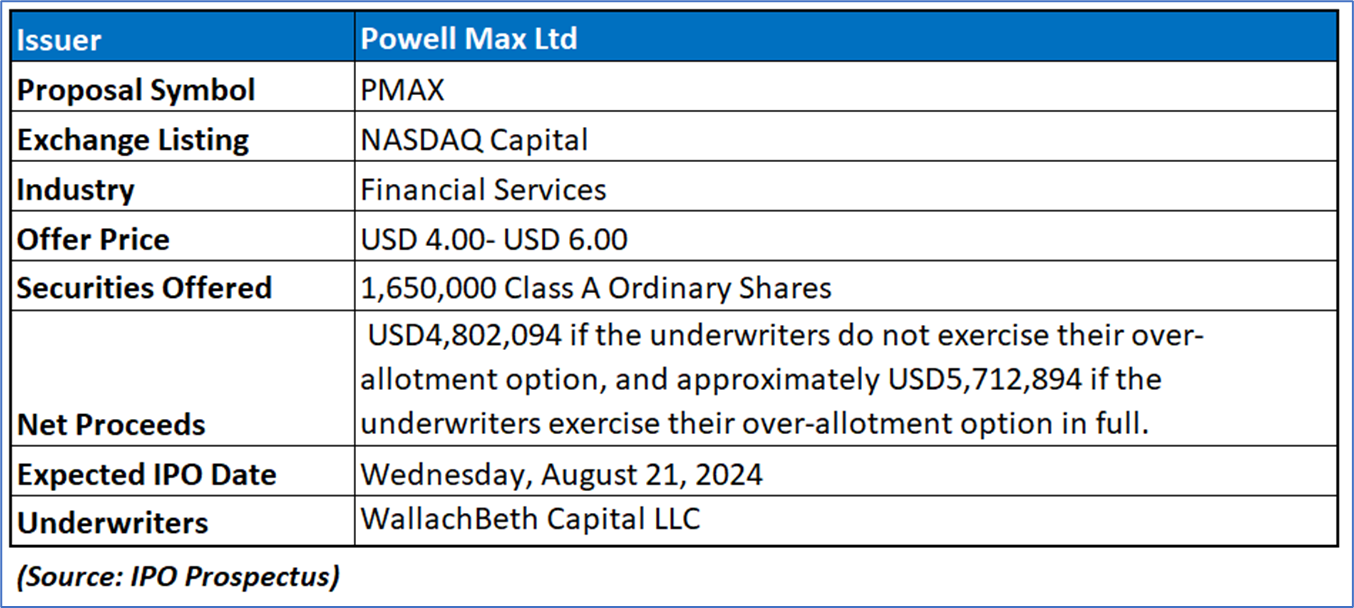

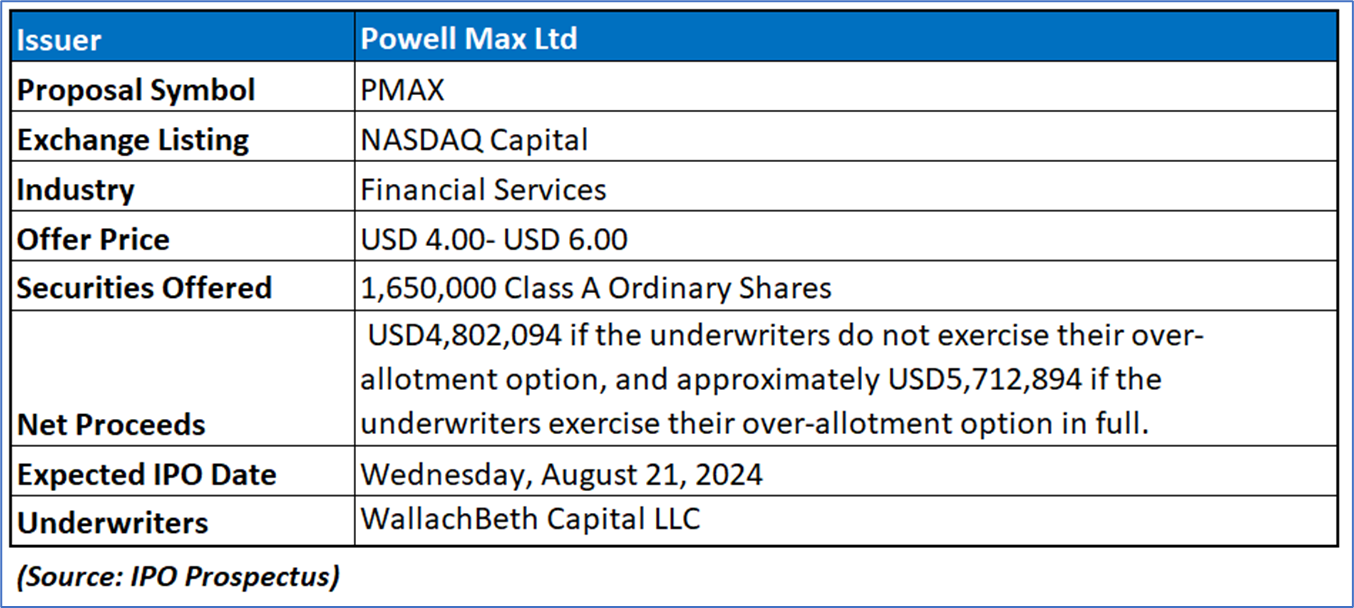

The Offer

Company Overview

Powell Max Limited, incorporated in the British Virgin Islands with operations in Hong Kong through its subsidiary JAN Financial, provides financial communication services for corporate clients, including financial printing, reporting, and transaction management. Its clients are primarily companies listed on the Hong Kong Stock Exchange, requiring compliance with the HK Listing Rules and Hong Kong’s Securities and Futures Ordinance.

Key Highlights

Primary Offering:

PMAX anticipates issuing 1,650,000 Class A Ordinary Shares (underwriters a 45-day option to purchase from us up to an additional 15% of the Class A Ordinary Shares).

Use of proceeds:

The primary objective of the PMAX offering is to establish a public market for its Class A Ordinary Shares and reduce debt through loan repayment. Based on an IPO price of USD 4.00 per share, PMAX expects to raise approximately USD 4.8 million in net proceeds, or USD 5.7 million if the underwriters exercise their over-allotment option in full. The funds will be allocated as follows: approximately 57% for operating cash flow and general corporate use, 13% for loan repayment, 15% for registering and operating overseas business entities in the U.S., and 15% for potential future mergers and acquisitions, primarily targeting e-delivery companies, financial printers, electronic filing service providers, and media and communications firms.

Dividend policy:

PMAX does not anticipate paying dividends in the foreseeable future, opting to retain all available funds and future earnings for business operations and expansion. Any future dividend decisions will be at the discretion of the board of directors, based on factors such as financial condition, capital needs, contractual obligations, and economic conditions. As of the end of 2022 and 2023, neither PMAX nor its subsidiary JAN Financial has distributed any dividends. As a holding company incorporated in the British Virgin Islands (BVI), PMAX relies on dividends from its subsidiaries to meet cash requirements, and any dividend payments will be subject to compliance with BVI solvency laws and Hong Kong distribution regulations. Any dividends paid on Class A Ordinary Shares will be in U.S. dollars.

Industry Analysis:

- Global Equity Market Size: As per the World Federation of Exchanges, global equity market capitalization reached USD 111 trillion in 2023, reflecting a 10.25% year-on-year (y-o-y) growth compared to USD 101 trillion in 2022. The following figure presents global equity market capitalization from 2018 to 2023, detailing both US dollars and year-on-year percentage changes.

- Global Listed Companies: The number of listed companies worldwide decreased from 58,927 in 2022 to 54,590 in 2023, representing a 6.7% year-on-year decline. This reduction is primarily attributed to the anticipated global economic slowdown. The figure below illustrates the total number of listed companies worldwide, based on data from the World Federation of Exchanges.

- Hong Kong Equity Market Size: In 2023, the market capitalization of the Hong Kong equity market stood at USD 3.9 trillion, accounting for approximately 3.51% of the total global equity market capitalization. For comparison, the Nasdaq and the New York Stock Exchange posted market capitalizations of USD 23.4 trillion and USD 25.6 trillion, respectively, in the same year. The accompanying figure highlights the market capitalization of selected global exchanges.

Financial Highlights (Results of Operations) (Expressed in USD)

- Revenue Breakdown: For the years ending December 31, 2022, and 2023, revenue from corporate financial communications services accounted for 90.9% and 79.7% of PMAX's total revenue, respectively. Revenue from IPO financial printing services represented 9.1% and 20.3% of the total revenue in these periods. For the year ending December 31, 2023, PMAX achieved total revenue of HKD49,121,839 (USD 6,288,884), up from HKD37,772,821 in 2022, reflecting a 30.0% increase. This growth is attributed to the rise in revenue from both corporate financial communications and IPO financial printing services.

- Gross Profit: PMAX's gross profit increased from approximately HKD15,555,141 in 2022 to HKD23,883,018 (USD 3,057,653) in 2023, marking a 53.5% rise. The gross profit margin improved from 41.2% in 2022 to 48.6% in 2023. This improvement is due to higher revenue from a successful IPO project and effective cost control measures within the production team.

- Finance Costs: Finance costs, which include interest expenses on lease liabilities and bank borrowings, decreased from HKD690,476 in 2022 to HKD550,714 (USD 70,506) in 2023, reflecting a 20.2% reduction. This decrease is primarily due to lower imputed interest from lease liabilities as they approached maturity.

- Operating Activities: In 2022, PMAX generated net cash from operating activities amounting to HKD5,473,251, which included adjustments for non-cash items such as depreciation, allowances for expected credit losses, and interest expenses. For 2023, net cash generated from operating activities increased to HKD7,112,687 (USD 910,610), driven by a net profit of HKD7,079,243 (USD 906,329) and adjustments for depreciation, allowances, and interest expenses. This was partially offset by increases in trade receivable and payables and a decrease in contract liabilities.

- Investing Activities: For the year ended December 31, 2022, PMAX used net cash of HKD465,347 in investing activities, primarily for purchasing property, plant, and equipment, with interest income partially offsetting this amount. In 2023, net cash used in investing activities decreased to HKD239,074 (USD 30,608), with expenditures on property and equipment totaling HKD287,307 (USD 36,783), partially offset by increased interest income.

- Financing Activities: In 2022, PMAX's net cash used in financing activities totaled HKD4,213,393, covering repayments of bank borrowings and lease liabilities. For 2023, net cash used in financing activities increased to HKD4,609,403 (USD 590,124), which included repayments of bank borrowings and lease liabilities, partially offset by advances from an ultimate beneficial shareholder and interest payments.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “PMAX” is exposed to a variety of risks such as:

- Economic and Market Conditions: A significant portion of PMAX's revenue relies on financial and business transactions within the equity markets. Economic trends affecting these transactions could negatively impact demand for PMAX’s services. The company's performance is closely tied to the Hong Kong equity market and broader economic conditions, including IPOs, secondary offerings, and mergers and acquisitions. Economic downturns or volatility may result in reduced transaction volumes, impacting client financial health and potentially increasing credit risks. Such factors could adversely affect PMAX’s results of operations, financial position, and cash flow.

- Quality of Customer Support and Client Retention: The quality of PMAX’s customer support is crucial for maintaining and growing its client base. If the company fails to meet or exceed client expectations, it may experience a decline in clients and market share, increased service costs, and resource diversion. High client retention rates are essential, especially during periods of decreased transactional volume. Factors such as service value, pricing, competition, and economic conditions could influence client retention. A decline in retention rates may result in decreased net sales and profitability, adversely affecting PMAX’s financial performance.

- Technological Changes and Competitive Pressure: The evolving technological landscape poses a risk to PMAX as clients increasingly seek self-service solutions for regulatory documentation. Failure to adapt and develop competitive technologies could lead to a decline in business as clients opt for alternative solutions. Additionally, the highly competitive and fragmented market may exert pressure on pricing and profitability. PMAX's ability to attract clients depends on continuously enhancing its services and adapting to technological advancements. Inability to innovate effectively or respond to market demands could negatively impact the company's reputation, sales, and financial results.

Conclusion

PMAX, through its subsidiary JAN Financial, specializes in providing financial communication services including financial printing, reporting, and transaction management, primarily for clients listed on the Hong Kong Stock Exchange. The company is poised to raise approximately USD 4.8 million from its IPO, with proceeds aimed at establishing a public market for its shares and reducing debt. PMAX has demonstrated strong financial performance, with a 30.0% increase in total revenue from 2022 to 2023 and a 53.5% rise in gross profit. The reduction in finance costs and effective management of operating cash flow further highlight its financial stability. With a strategic focus on expanding its operations and exploring potential mergers and acquisitions, PMAX is positioned for growth in a sector closely tied to the equity markets, which could benefit from future market opportunities.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Powell Max Limited (PMAX)” IPO seems “Attractive" at the IPO price.