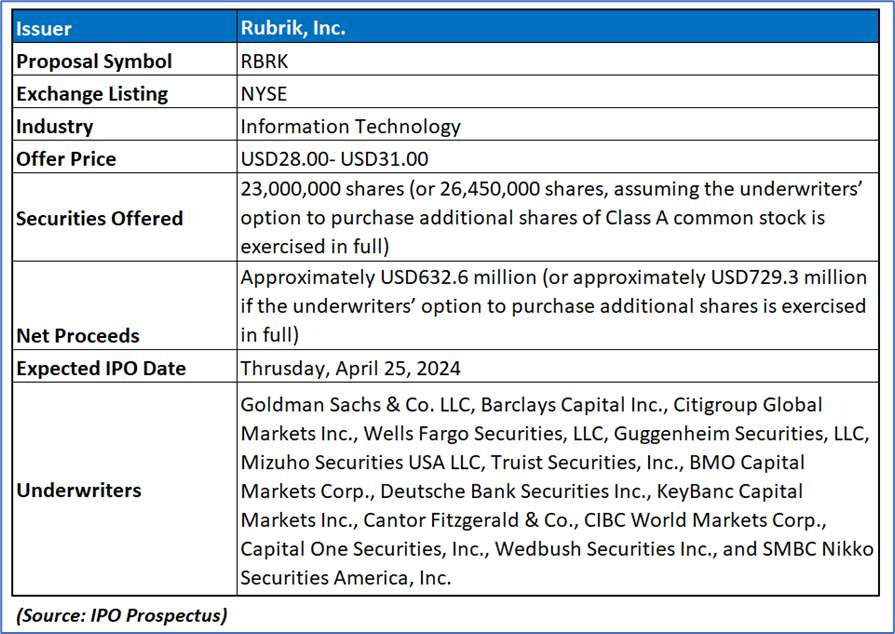

The Offer

Company Overview

Rubrik Inc aims to protect global data with its Zero Trust Data Security approach, recognizing the inevitability of cyberattacks targeting data. The Rubrik Security Cloud (RSC) is developed with Zero Trust principles to secure data across enterprise, cloud, and SaaS applications, facilitating the detection, analysis, and remediation of data security risks and unauthorized user activities. The company's transition from Converged Data Management to Cloud Data Management (CDM) and finally to RSC reflects its dedication to innovation and customer-focused solutions. By shifting to subscription-based offerings, Rubrik prioritizes recurring revenue streams, with RSC becoming the primary revenue contributor. Revenue recognition is aligned with subscription terms, with the majority of sales structured as three-year terms with upfront payment. Rubrik continues to innovate its security product portfolio, introducing solutions like Threat Hunting, Threat Containment, and Cyber Recovery, to address evolving cybersecurity challenges and meet customer needs.

Key Highlights

Primary Offering:

RBRK anticipates issuing 23,000,000 shares (or 26,450,000 shares, assuming the underwriters’ option to purchase additional shares of Class A common stock is exercised in full), with expected net proceeds totaling approximately USD632.6 million (or approximately USD729.3 million if the underwriters’ option to purchase additional shares is exercised in full), assuming an initial public offering price of USD29.50 per share, representing the midpoint of the estimated price range.

Use of proceeds:

The anticipated proceeds from the offering by the company, estimated at around USD632.6 million (or approximately USD729.3 million if the underwriters’ option to purchase additional shares is fully exercised), are predicated on an assumed initial public offering price of USD29.50 per share, the midpoint of the price range specified in the prospectus. These proceeds, after deducting underwriting discounts, commissions, and estimated offering expenses, will primarily serve to bolster the company's capitalization, enhance financial flexibility, and establish a public market for its Class A common stock. USD 379.8 million of these proceeds is earmarked for the full repayment of the Bridge Notes, including accrued interest and estimated debt issuance costs, with the remaining funds intended to satisfy anticipated tax withholding and remittance obligations related to the RSU Net Settlement.

Following the termination of the Bridge Notes upon full repayment, the company will have broad discretion over the utilization of the remaining net proceeds, which are intended for general corporate purposes, including working capital, operating expenses, and capital expenditures. While specific allocations for these funds have yet to be determined, potential avenues include acquisitions or strategic investments in complementary businesses, products, services, or technologies. Notably, the company retains the flexibility to invest the unallocated funds in investment-grade, interest-bearing instruments until they are utilized for the purposes. The precise utilization of these net proceeds remains subject to the company's discretion, with no definitive agreements or commitments in place for specific uses currently.

Dividend policy:

Rubrik Inc has never issued cash dividends on its capital stock and currently plans to retain all available funds and future earnings for the development and expansion of its business. Consequently, the company does not foresee paying any cash dividends in the foreseeable future. Any decisions regarding the declaration and payment of dividends will be made by its board of directors based on various factors, including financial condition, operational results, contractual obligations, capital needs, and business outlook. Furthermore, the company's ability to distribute dividends may be constrained by restrictions on its Amended Credit Facility and any future agreements it may enter into.

Industry Opportunity & Fortification of Data Resilience in the Digital Frontier:

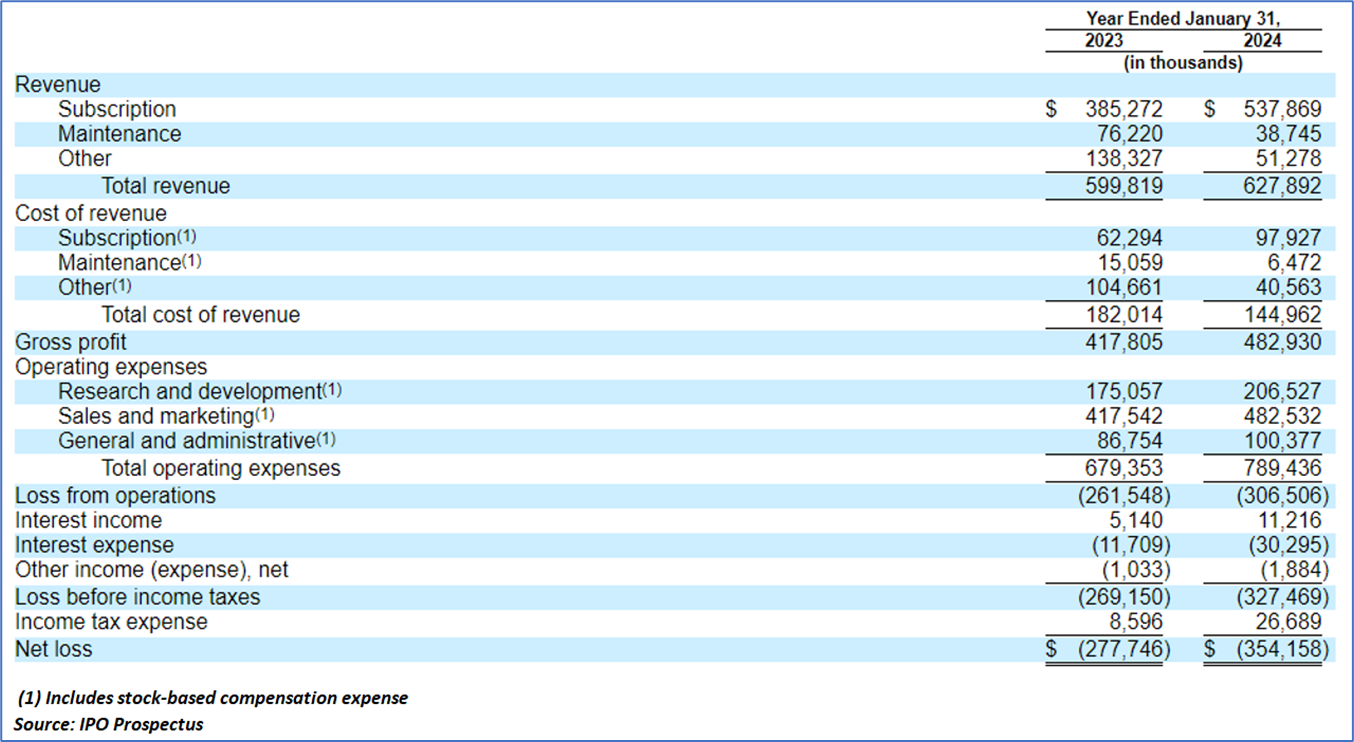

Financial Highlights (Results of Operations) (Expressed in USD):

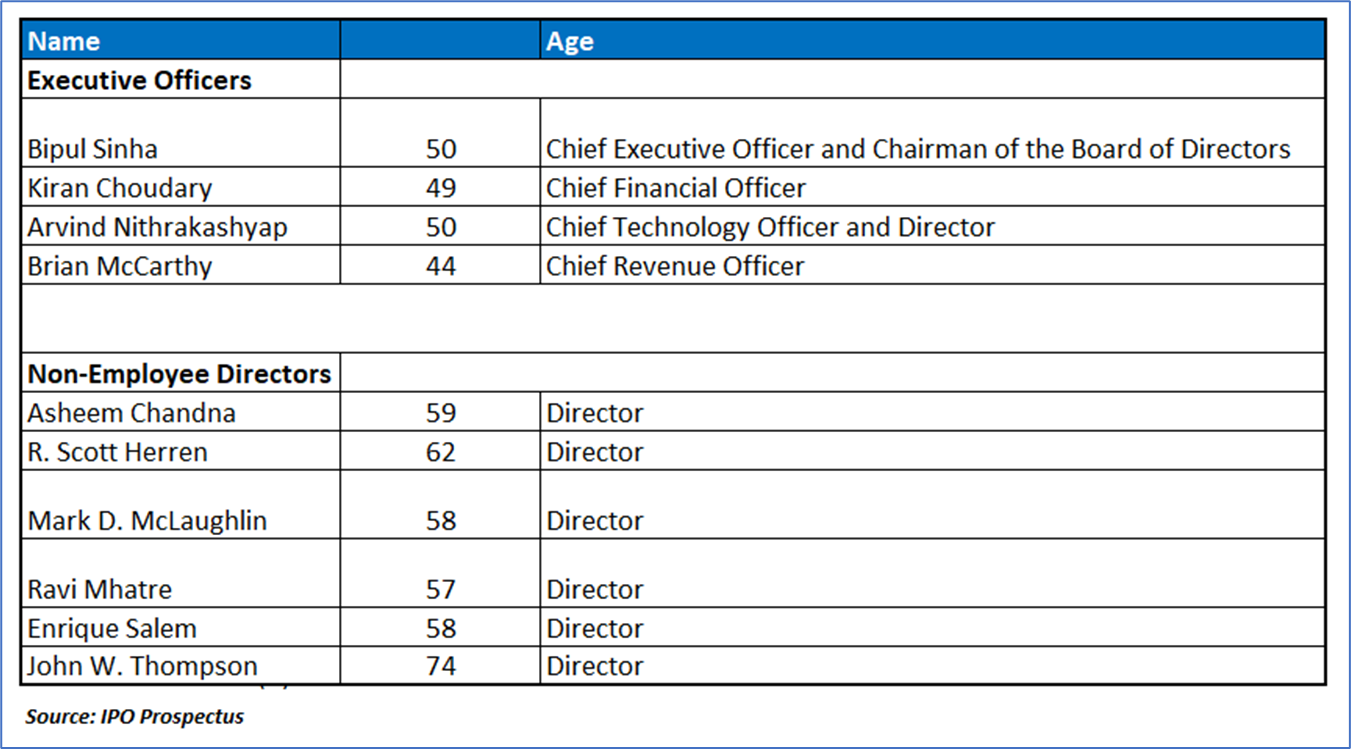

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “RBRK” is exposed to a variety of risks such as:

Market Volatility in Data Security Solutions: RBRK faces the risk of market instability within the data security solutions sector, which could impede its growth and financial performance. The unpredictability of this market, coupled with the evolving nature of cybersecurity threats, presents challenges in forecasting market growth, customer adoption rates, and demand for data security platforms. Factors such as customer acceptance, technological advancements, competitive pressures, and economic conditions significantly influence market dynamics and could lead to reduced customer retention, early terminations, or decreased revenue, thereby adversely affecting RBRK's business and financial results.

Limited Operating History and Revenue Forecasting Challenges: RBRK's limited operating history, particularly concerning its RSC offering, poses uncertainties in accurately forecasting future financial performance. With historical revenue growth not necessarily indicative of future trends, the transition from perpetual licenses to SaaS subscriptions further complicates revenue recognition and forecasting. Customer migration initiatives, though essential for transitioning to a SaaS model, could lead to dissatisfaction or delays, impacting revenue growth rates. Fluctuations in revenue growth, coupled with increased compliance costs and challenges in scaling operations, may hinder RBRK's ability to achieve profitability and sustain financial stability.

Customer Acquisition and Retention Challenges: The acquisition and retention of customers represent critical challenges for RBRK, particularly in persuading organizations to invest in its data security solutions amid evolving market conditions. Economic downturns, decreased cybersecurity spending, or declining cyberattack incidences could deter organizations from adopting RBRK's solutions, affecting revenue generation. Moreover, difficulties in convincing legacy product users to transition to RBRK's offerings or disruptions in customer relationships during migration initiatives could result in customer dissatisfaction or loss, impacting RBRK's financial performance and market competitiveness. Additionally, uncertainties surrounding customer renewals, subscription expansions, or shifts in purchasing behavior further compound the risk of revenue decline and hinder RBRK's growth prospects.

Conclusion

Rubrik aims to revolutionize data security through its Zero Trust Data Security approach, offering the Rubrik Security Cloud (RSC) designed to protect data across various platforms. With a transition towards subscription-based offerings, Rubrik emphasizes recurring revenue streams, showcasing growth potential. The IPO, expected to yield around USD 632.6 million in net proceeds, aims to enhance financial flexibility and establish a public market for its Class A common stock. While Rubrik demonstrates promising subscription growth and customer retention rates, investors should remain mindful of potential risks, including market volatility within the data security sector, forecasting challenges due to limited operating history, and customer acquisition and retention hurdles. Despite Rubrik's innovative solutions and strategic shifts, uncertainties surrounding revenue forecasting and market acceptance pose inherent risks that investors should carefully evaluate before considering subscription to the IPO.

Hence, given the financial performance of the company, market opportunity of RBRK, use of proceeds, and associated risks “Rubrik Inc (RBRK)” IPO seems “Neutral" at the IPO price.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.