The Offer

Company Overview

The premium electric motorbike and bicycle manufacturer and supplier SODR is situated in California and specializes in electric mobility. To provide high-quality products at affordable pricing points, SODR develops its products with both the customer and production processes in mind. Since 2015, SODR has delivered more than 63,000 units in 72 countries, playing a crucial part in the development of the e-bike category by designing, producing, and marketing one of the first large-scale e-bikes both domestically and abroad.

Key Highlights

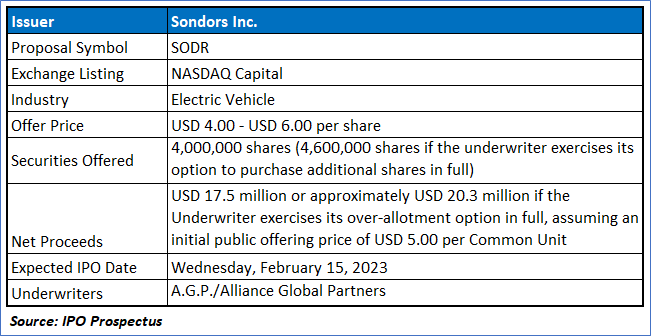

Primary Offering: The firm is issuing 4,000,000 shares along with an additional 600,000 shares to the underwriter, who will have a 45-day option to acquire all these extra shares at the initial offering price less the underwriting discount. A warrant having an exercise price equal to 125% of the price of the first public offering will be given to the underwriter by SODR in an amount equivalent to 4% of the total number of shares of common shares sold in the offering.

Use of proceeds:

Assuming an initial public offering price of USD 5.00 per share of common stock, which is the midpoint of the price of the IPO range, after deducting estimated underwriting markdowns and commissions and projected offering expenses payable by the company, SODR estimated that the net proceeds from its issuance and sale of 4,000,000 shares of the common stock in the offering will be around USD 17.5 million. After subtracting the projected underwriting discounts and commissions as well as the anticipated offering costs owed by the firm, SODR calculated that the net proceeds from the offering will be around USD 20.3 million if the underwriter fully exercises its option to acquire further shares.

Currently, SODR plans to use USD 5.9 million of the net proceeds of the subscription to repay the portion of the Senior Secured Notes (including interest thereon) that is not converted into shares of common stock at the closing of the offering, and USD 11.6 million of the net proceeds to fund the research and development of new products and expansion, existing products, and international markets.

Dividend policy: On its capital stock, the corporation has never declared or distributed any cash dividends. The capital stock of either SONDORS Electric Bike Company or SONDORS Electric Car Company has never been declared or paid a cash dividend. Currently, SODR plans to keep all cash in hand and any potential future earnings in order to build its business and pay off debt. As a result, the corporation does not envision itself paying any cash dividends anytime soon. The board of directors will decide whether to pay dividends in the future based on the outcomes of operations, the financial situation, the need for capital, and other considerations, including contractual commitments.

Industry and competitive analysis

Financial Highlights (Expressed in USD):

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “SODR” is exposed to a variety of risks such as:

Conclusion

In comparison to the same period in 2021, net loss for the nine months that ended September 30, 2022, was USD 4.225 million compared to USD 1.784 million, an increase of USD 2.44 million. This worsening was primarily the result of rising cost of revenue, stock-based compensation expenses, labor costs, and professional services & audit costs. When compared to the same time in 2021, operating revenue was USD 11.2 million, it increased by USD 5.6 million or 49% to USD 16.8 million for the nine months that concluded on September 30, 2022. Additionally, a respectable CAGR is predicted for the market for E-bikes and other SODR's goods both in the United States and internationally. Even though SODR was successful in keeping topline revenue flow steady, other operational costs and revenue costs have increased because of macroeconomic factors such rising inflation. Up to 2023, the company's costs are expected to be impacted by the high level of inflation, which will raise costs even more and lower profitability. Although SODR would be able to accomplish the IPO's objectives with the money raised, given the macroeconomic climate at the moment, investment in this IPO appears to be quite risky.

Hence, given the financial performance of the company for the nine months ending September 30, 2022, consistent revenue, worsened net loss, industry analysis, use of proceeds, and associated risks “Sondors Inc (SODR)” IPO seems “Neutral" at the IPO price.

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.