Hudbay Minerals Inc.

Company Overview:

Hudbay Minerals Inc (TSX: HBM) is a Canadian mining company with its operations, property developments, and exploration activities across the United States. The major mines that Hudbay operates are in Manitoba, Canada, Arizona, United States, and Peru. The company is principally focused on the discovery, production, and marketing of base and precious metals. Hudbay produces copper concentrate, which contains copper, gold, and silver, as well as zinc metal.

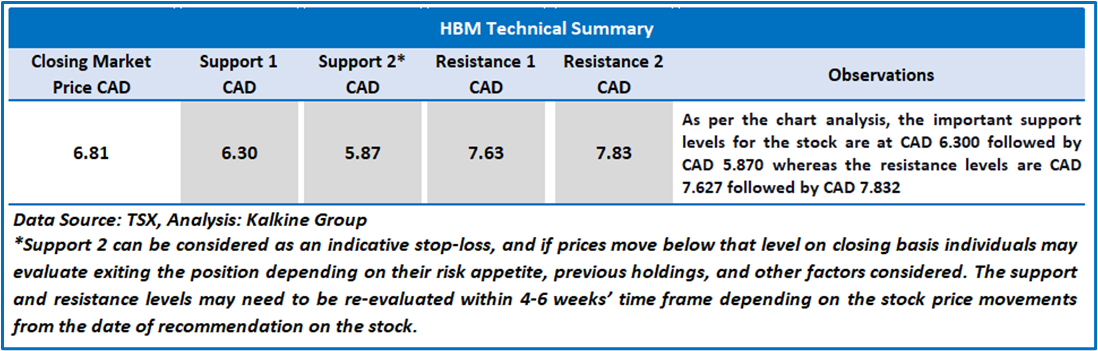

As per the previous Report published on “HBM” as on 11th December 2023, Kalkine provided an “Attractive” stance on the stock at CAD 6.81.

Noted below are the details of support and resistance levels provided in the previous report:

HBM Daily Chart

HBM, Daily Technical Price Chart, Source: REFINITIV; Analysis: Kalkine Group

Considering the resistance, current trading levels and risks associated, it is prudent to book profits at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the closing market price CAD 7.29 (20 December 2023).

Note: This report may be updated with details around fundamental and technical analysis, price/ chart in due course, as appropriate.

Hudbay Minerals Inc (TSX: HBM) is a part of Kalkine’s Earnings Hunter Report

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level as on 20th December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level which the stock is expected to reach as per the relative valuation method and technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: Dividend Yield may vary as per the stock price movement.

Note 6: ‘Kalkine reports are prepared based on the stock prices captured either from the Toronto Stock Exchange (TSX) and or REFINITIV. Typically, both sources (TSX and or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.