1. Exit Case: Celestica Inc.

Overview:

Celestica Inc. (TSX: CLS) offers supply chain solutions and operates in two segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS). ATS segment consists of the ATS end market and is comprised of A&D, Industrial, Energy, HealthTech, and Capital Equipment businesses. Capital Equipment business is comprised of semiconductor, display, and power & signal distribution equipment businesses. CCS segment that derives majority revenue consists of Communications and Enterprise end markets.

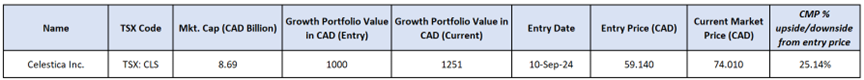

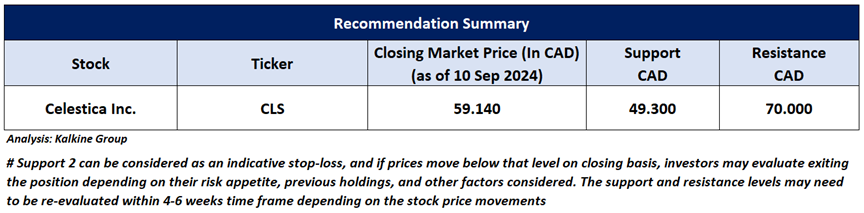

CLS has been a part of the ‘Growth Portolio’ since 10 September 2024, however, considering the recent rally, trading above resistance levels in the stock, support & resistance levels, and ~25.14% upside from the entry price, an ‘Exit’ is recommended from the stock at the price of CAD 74.01, (as on 7th October 2024).

Celestica Inc. (TSX: CLS) is a part of Kalkine’s Growth Portfolio, has breached its resistance level around which an exit case emerges.

1.1 Support and Resistance Summary as provided in our last published report dated 10 Sep 2024.

1.2 Celestica Inc. (TSX: CLS)

2.New Entry Case: North American Construction Group Ltd. (TSX: NOA)

Overview:

North American Construction Group Ltd. (TSX: NOA) is Canada's provider of heavy civil construction and mining contractors. The company has provided services to the oil, natural gas and resource companies.

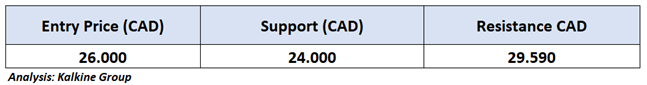

Technical Analysis: On the daily chart, NOA prices are trading above an ascending trendline, indicating positive momentum. The 14-period Relative Strength Index (RSI) stands at approximately 56.47, reflecting strong buying interest. Additionally, prices are positioned above the 21-period Simple Moving Average (SMA), which could serve as a support level. The key support for the stock is at CAD 24, while the critical resistance level is at CAD 29.59.

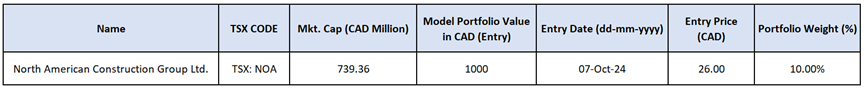

Considering the above mentioned factors, technical analysis, support & resistance levels, key risks and outlook an ‘Entry’ is recommended in the ‘Growth Portfolio’ at the current market price of CAD 26.00, as on (as on 7th October 2024).

North American Construction Group Ltd. (TSX: NOA) has been identified as the new entry to our Growth Portfolio.

2.1 Support and Resistance Summary (as on 7th October 2024)

2.2 North American Construction Group Ltd. (TSX: NOA)

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency as of (7th October 2024). The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings.

Disclaimer

This information should not be relied upon as personal financial advice by Kalkine on (i) the stocks or (ii) the use or suitability of the model portfolios. Only an investor knows about their circumstances to make an investment decision.

Model Portfolio has been prepared for illustrative purpose only and does not take into account the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the information, consider its appropriateness, having regard to their objectives, financial situation and needs. Past performance is not necessarily indicative of future performance results. Actual investment returns will vary, and the value of investments can go up or down.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.