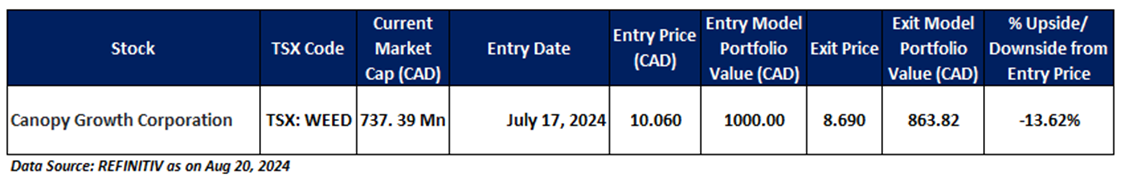

Exit Case: Canopy Growth Corporation (TSX: WEED)

Overview: Canopy Growth Corporation (TSX: WEED) headquartered in Smiths Falls, Canada, is a leading player in the cannabis industry, specializing in the cultivation and sale of both medicinal and recreational cannabis, as well as hemp products. The company operates through a diverse portfolio of brands, including Tweed, Spectrum Therapeutics, and CraftGrow. WEED has been a part of the 'Momentum Model Portfolio' since July 17, 2024. Therefore, an 'Exit' stance from the Momentum Model Portfolio is recommended on the stock at the closing price of CAD 8.69 as on August 20, 2024.

WEED’s Daily Chart

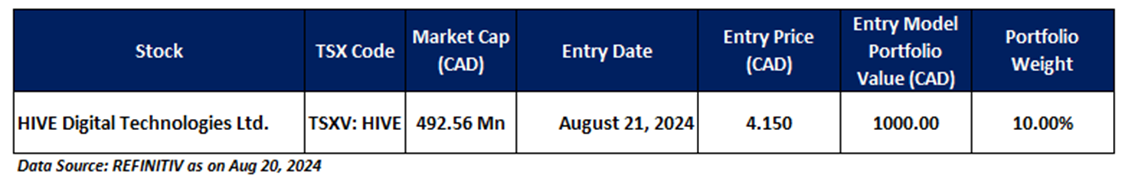

New Entry Case: HIVE Blockchain Technologies Ltd. (TSXV: HIVE)

Overview: HIVE Blockchain Technologies Ltd. (TSXV: HIVE) specializes in delivering infrastructure solutions within the blockchain industry, with a primary focus on the mining of digital currencies. The company is known for its innovative projects, such as the Iceland Cryptocurrency Mining Project, which harnesses the region's unique advantages for efficient and sustainable digital currency mining.

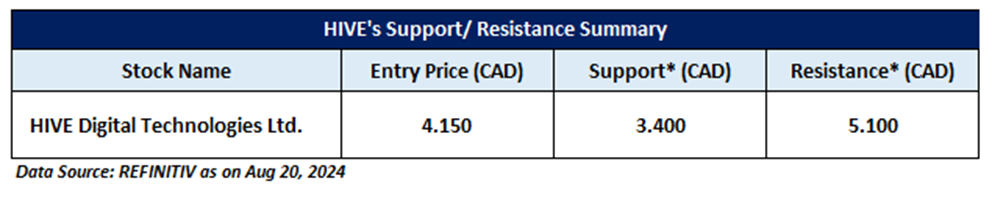

Technical Analysis: On the daily chart, HIVE’s prices are trading above the falling trendline support zone, indicating the possibility of an upside movement hereon. Moreover, the momentum oscillator RSI (14-period) is recovering from the lower levels and is showing a reading of ~45.51. However, the prices are below the trend following indicators 21-period SMA.

HIVE is recommended as a new entry in the 'Momentum Model Portfolio' as on August 21, 2024. Considering the technical analysis, support and resistance levels, an 'Entry' is recommended in the 'Momentum Model Portfolio' at the closing price of CAD 4.15 as on August 20, 2024.

HIVE’s Daily Chart

Support and Resistance Summary (As on August 20, 2024)

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency as of August 20, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings.

Disclaimer

This information should not be relied upon as personal financial advice by Kalkine on (i) the stocks or (ii) the use or suitability of the model portfolios. Only an investor knows about their circumstances to make an investment decision.

Model Portfolio has been prepared for illustrative purpose only and does not take into account the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the information, consider its appropriateness, having regard to their objectives, financial situation and needs. Past performance is not necessarily indicative of future performance results. Actual investment returns will vary, and the value of investments can go up or down.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.