Section1: Company Overview

B2Gold Corp (TSX: BTO) is an international, low-cost, senior gold mining company. It has three operating open-pit gold mines in Mali, Namibia, and the Philippines and numerous exploration projects across four continents. Other significant assets include the Gramalote and Kiaka gold projects. The company focuses on acquiring and developing interests in mineral properties with a primary focus on gold deposits as gold production forms all its revenue. This Report covers the Investment Highlights, Key Financial Metrics, Risks, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

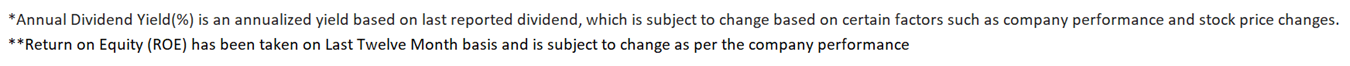

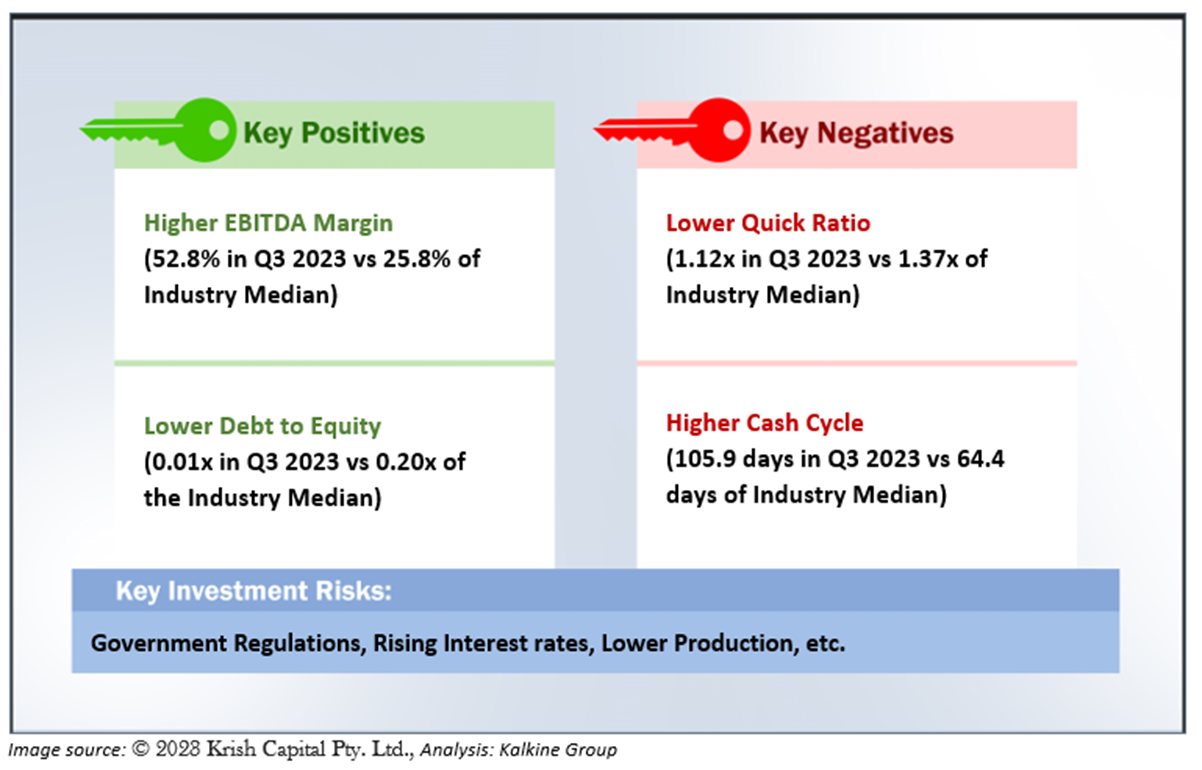

1.1 The Key Positives, Negatives, Investment Highlights, and Risks

Section2: Financial Highlights

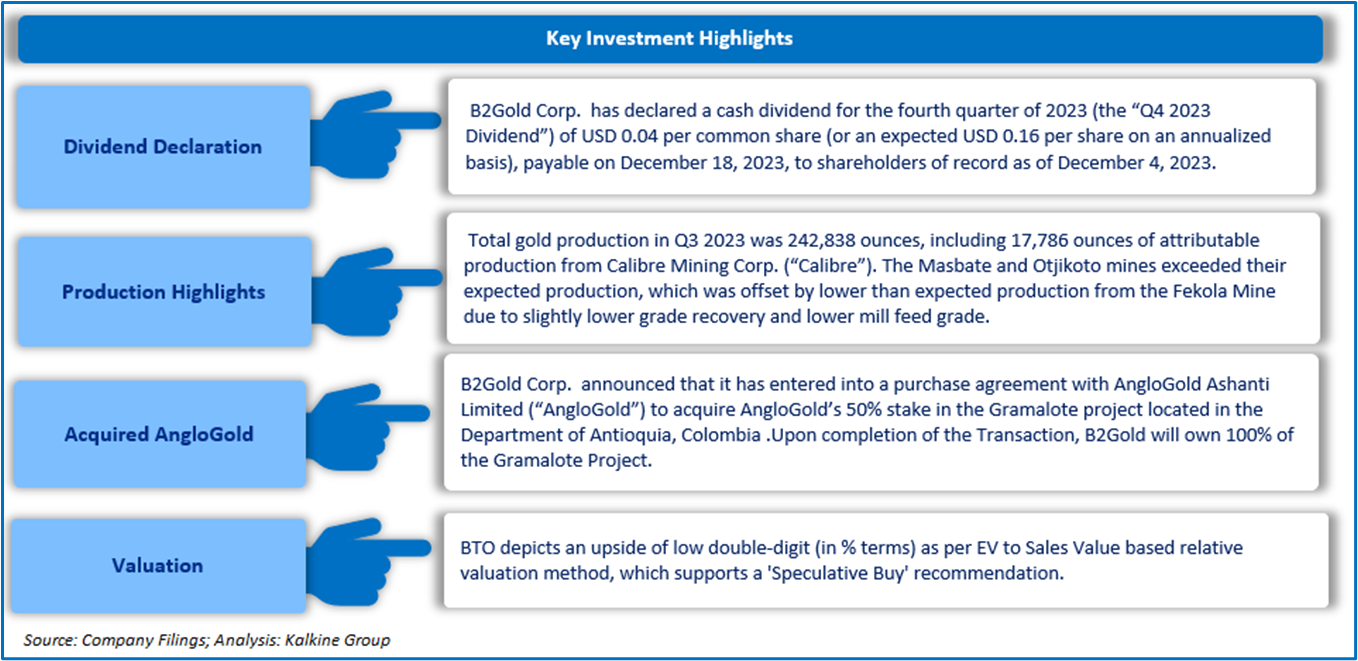

2.1 Key Financial Highlights

Section 3: Stock Recommendation Summary

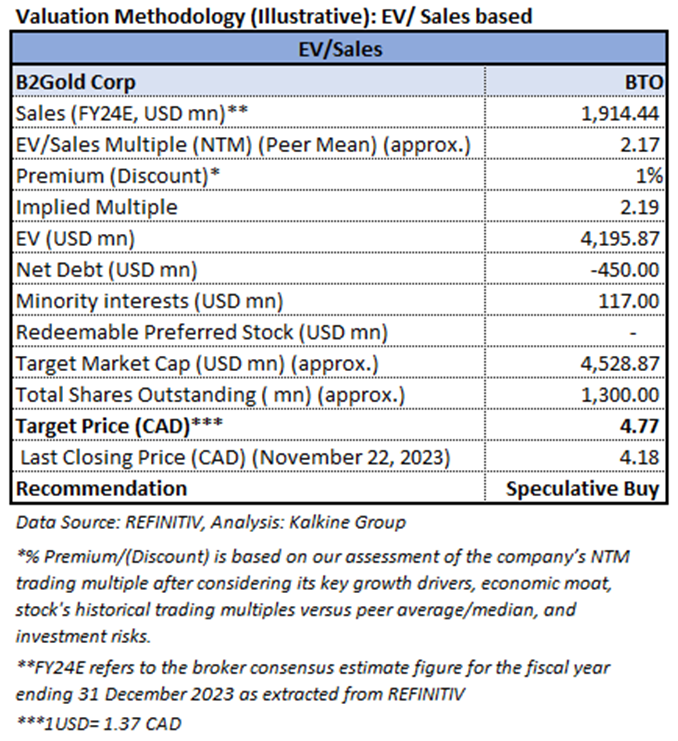

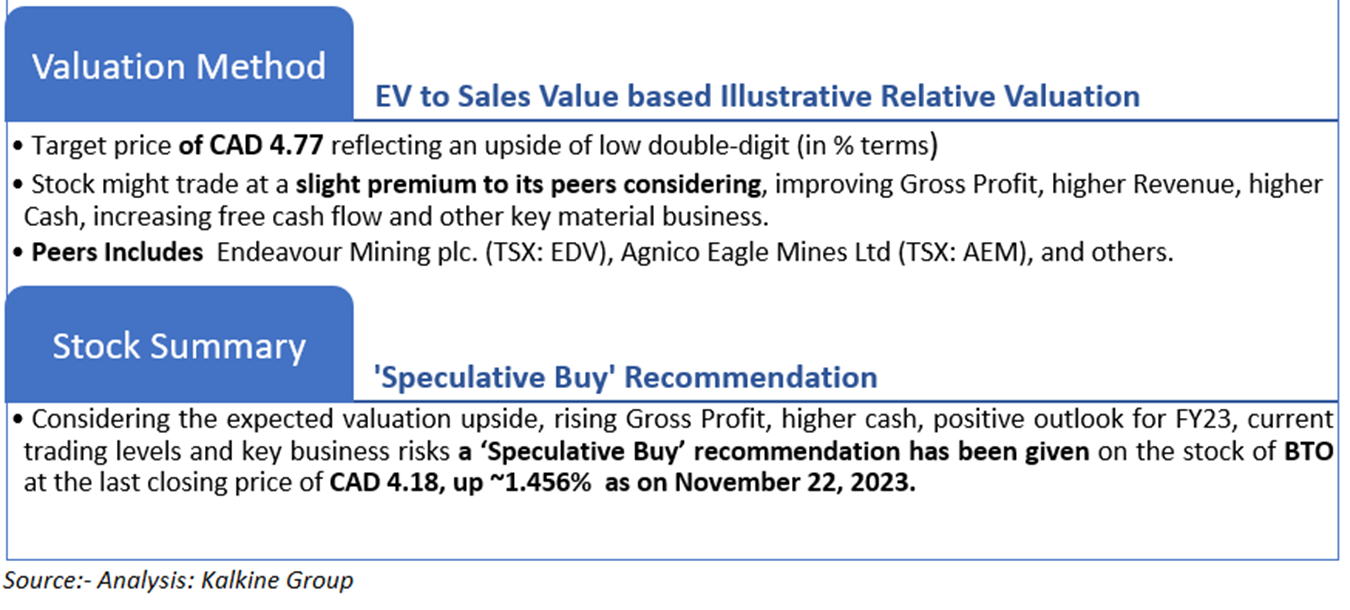

3.1 Valuation Methodology

Valuation Methodology (Illustrative): EV to Sales based.

3.2 Price Performance and Stock Recommendation

The stock has witnessed a downside of ~8.13% in 1 month and of ~1.18% over the last 3 months. Moreover, the stock is trading below the average 52-week high price of CAD 5.87 and 52-week low price of CAD 3.81 providing an opportunity to accumulate the stock. BTO Gold Corp. (TSX: BTO) was last covered on 07th November 2023.

3.3 One-Year Technical Price Chart

One-Year Technical Price Chart (as of November 22, 2023). Source: REFINITIV, Analysis: Kalkine Group

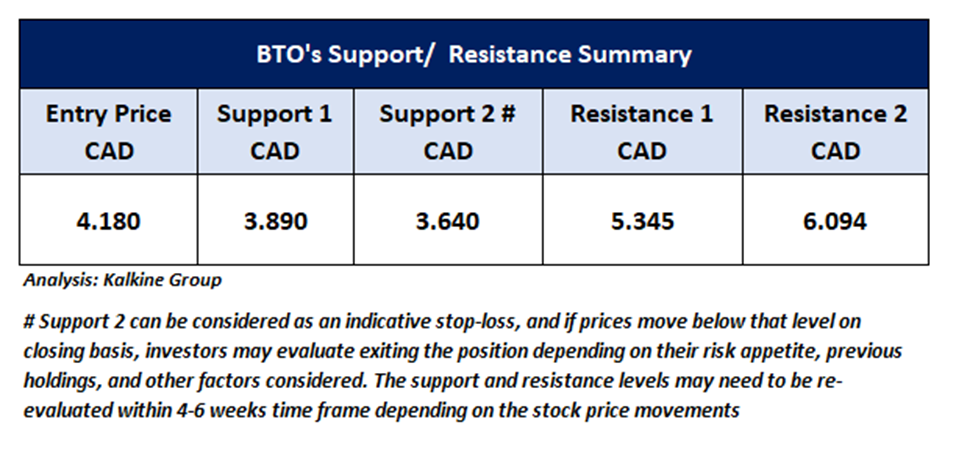

3.4 Technical Summary

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels as on November 22, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and the uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.