Mobileye Global Inc

Mobileye Global Inc (NASDAQ: MBLY) is an Israel-based company focused on the development and deployment of advanced driver-assistance systems (ADAS) and autonomous vehicle (AV) technologies. The company's portfolio includes solutions built on custom-designed software and hardware, aimed at making advanced driver-assistance and autonomous driving a practical reality.

Recent Business and Financial Updates

- Financial Performance in Q3 FY24: Mobileye Global Inc. reported its third-quarter financial results for 2024, revealing an 8% year-over-year decline in revenue, totalling USD 486 million. This decrease was primarily driven by a 9% reduction in EyeQ volumes, mainly due to a reduction in shipments to Chinese OEMs and a modest drop in global vehicle production. However, the company saw a sequential improvement, with revenue rising by 11% compared to the second quarter of 2024. The company’s revenue guidance for the full year remains unchanged at the midpoint.

- Profitability and Earnings Performance: The company’s earnings performance reflected significant challenges in the third quarter, as GAAP diluted earnings per share (EPS) was a loss of USD 3.35. This decline was mainly attributed to a non-cash impairment loss related to the Goodwill asset on Mobileye’s balance sheet. Adjusted non-GAAP EPS was USD 0.10, a decrease of 58% from the prior year. Adjusted operating income also fell significantly by 57%, amounting to USD 78 million, compared to USD 182 million in the same period last year. Adjusted operating margin was down by approximately 18 percentage points, reflecting the impact of higher operating expenses on a lower revenue base.

- Impairment of Goodwill: A significant event during the quarter was the non-cash impairment of goodwill, amounting to approximately USD 2.6 billion after tax. This impairment resulted from an interim test triggered by a market capitalization that fell below Mobileye's book equity value. The goodwill impairment loss stems from the 2017 acquisition of Mobileye by Intel, which was subsequently reflected in Mobileye’s balance sheet following its IPO and separation from Intel in 2022. The impairment had a notable impact on the company’s operating income and margin for the quarter.

- Cash Flow and Capital Expenditure: Mobileye generated strong cash flow from operations in the first nine months of 2024, totaling USD 196 million, including USD 126 million in the third quarter. Cash used for purchases of property and equipment during this period was USD 68 million. The company’s ability to generate solid cash flow despite revenue challenges highlights the resilience of its operational model.

- Business Development and Customer Relationships: On the business development front, Mobileye continues to build strong relationships with its top ten customers, which account for over 80% of the company’s volume. These customers represent roughly 50% of the industry’s overall volume. Mobileye has recently secured long-term design wins with many of these customers, extending visibility into the ADAS market through the early 2030s. The company is making significant progress with several advanced product lines, including Surround ADAS, SuperVision, and Chauffeur, with ongoing engagements involving key OEMs, including Volkswagen Group.

- Progress in Advanced Product Programs: Mobileye’s advanced product programs are progressing on schedule, particularly with Volkswagen Group, which is executing production programs for SuperVision, Chauffeur, and Drive. The installation of the EyeQ6-based software and hardware stack into test vehicles has already begun, reflecting the continued evolution of these key projects. These engagements are expected to lead to decision points in the coming months, setting the stage for further growth in ADAS deployment.

- Shift in Lidar Strategy: Mobileye also announced the wind-down of its internal FMCW Lidar development, citing greater confidence in third-party lidar technology. This decision was made following increased clarity regarding the performance of Mobileye’s next-generation computer vision stack and in-house imaging radar technology. The company expects this strategic shift to help manage costs and maintain adjusted operating expenses in 2025 at or below the levels observed in the third quarter of 2024.

- Mobility-as-a-Service and Robotaxi Projects: The company’s mobility-as-a-service (MaaS) initiatives, including the development of robotaxi solutions, are also advancing. Mobileye’s Drive product, which is intended for use in autonomous ride-hailing services, is making progress with closed user-group testing in projects with Volkswagen Commercial Vehicles/MOIA, Deutsche Bahn, Holo/Ruter, and Verne. These initiatives highlight Mobileye’s commitment to developing autonomous driving solutions that support the emerging MaaS sector.

- Outlook for the Future: Looking ahead, Mobileye is focusing on its core strategic objectives for the next two years, including strengthening its ADAS market position outside of China, furthering its relationship with top customers, and executing its EyeQ6-based product line. Despite the near-term growth challenges, the company’s objectives are centered on medium- and long-term opportunities, which are expected to become more evident in the coming months as the market for autonomous driving and advanced driver-assistance systems continues to expand.

- Sustainability Achievements: Mobileye's inaugural Sustainability Report highlights its commitment to road safety, sustainability, and community impact. Key achievements include LEED Platinum certification for its Jerusalem headquarters, widespread deployment of its EyeQ™ system in 170 million vehicles, USD 1.2 million in charitable contributions, and significant waste diversion efforts. The company continues to focus on product stewardship, data protection, and improving the well-being of its people, driving positive societal impact and sustainable growth.

- Autonomous Partnership: Lyft and Mobileye have announced an alliance to accelerate the commercialization of autonomous vehicle services through partnerships with leading fleet operators.

Technical Observation (on the daily chart):

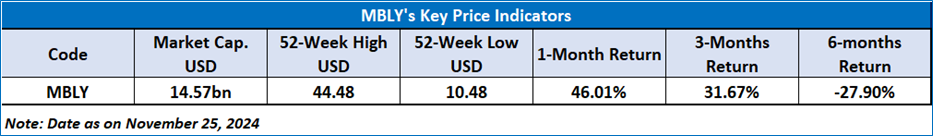

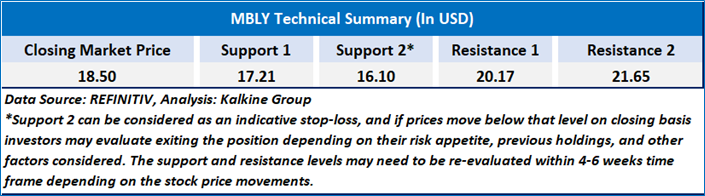

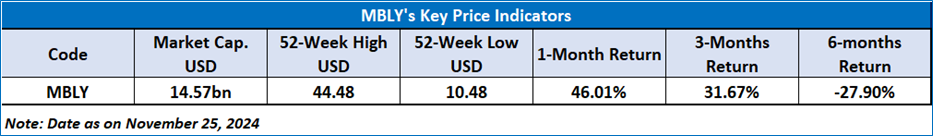

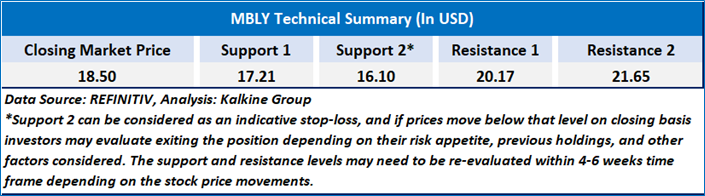

MBLY stock is showing significant weakness, with the RSI reaching the overbought zone, signalling a potential reversal. The stock is facing resistance at current levels, reinforcing the bearish momentum. If this resistance is broken, the price could continue to rise. While MBLY is trading above the 50-day and 21-day SMAs, these moving averages now act as resistance. This technical setup indicates that investors should closely monitor the stock for further developments before making any new investment decisions.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Mobileye Global Inc (NASDAQ: MBLY) at the closing market price of USD 18.50 as of November 25, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 25, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.