Intel Corporation

Intel Corporation (NASDAQ: INTC) specializes in the design and production of semiconductors, operating through three primary segments: Intel Products, Intel Foundry, and All Other. The Intel Products segment encompasses the Client Computing Group (CCG), Data Center and AI (DCAI), and Network and Edge (NEX).

Recent Business and Financial Updates

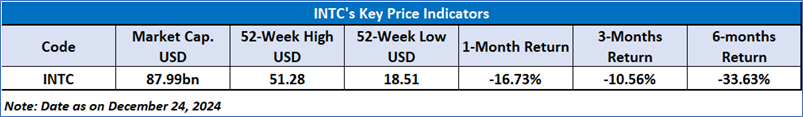

Valuation Methodology (using P/E Approach)

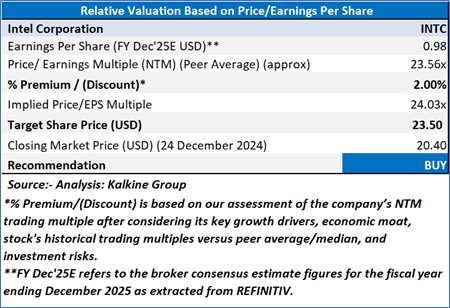

Technical Observation (on the daily chart):

Intel Corporation's stock has been in a sustained downtrend over the past year, with the price currently trading below both the 21-day and 50-day moving averages, indicating bearish momentum. The Relative Strength Index (RSI) at 42.28 suggests neutral momentum, with no immediate overbought or oversold conditions. Recent price action shows consolidation around $20.40, potentially forming a short-term support level, while the 50-day moving average at $22.65 acts as resistance. Volume has declined recently, reflecting reduced trading activity. A breakout above the 50-day moving average could signal a reversal, while a break below support may extend the downward trend.

Investment Rationale

Intel is strategically positioning itself in the quantum computing landscape as part of its broader effort to innovate and regain market leadership, particularly after facing challenges in other tech sectors like AI. Here's how Intel is making a comeback through quantum computing:

Research and Development: Intel has been investing heavily in quantum computing research, focusing on silicon-based qubits, which leverage the company's existing expertise in semiconductor manufacturing. Intel's approach involves using silicon quantum dots, which are similar to transistors but operate at the quantum level. This strategy aims at scaling quantum computing by utilizing Intel's advanced manufacturing processes, including 300mm CMOS manufacturing techniques, to produce qubits with high uniformity and fidelity.

Quantum Hardware Development: Intel has developed notable quantum computing hardware, such as the Tunnel Falls chip, which features 12 qubits and is designed to be scalable using standard semiconductor practices. This chip, along with others like Tangle Lake, indicates Intel's commitment to creating hardware that could potentially lead to commercial quantum computing solutions. Intel's focus is not just on increasing the number of qubits but also on improving their quality, connectivity, and error correction capabilities.

Software and Ecosystem Building: Intel has released the Intel Quantum SDK, which allows developers to write quantum algorithms in C++, thus making quantum programming more accessible. This SDK is part of Intel's broader strategy to foster a quantum computing ecosystem, providing tools like simulators and compilers that help developers prepare for future quantum hardware. Intel also collaborates with academia and other research institutions to advance quantum software development, aiming to bridge the gap between theoretical quantum algorithms and practical applications.

Collaborations and Partnerships: Intel collaborates with various institutions and companies, such as QuTech in the Netherlands, to accelerate quantum computing research. These partnerships help in sharing knowledge, resources, and speeding up the development process. Intel also makes its quantum hardware, like the Tunnel Falls chip, available to researchers to encourage innovation and application development in quantum computing.

Market Potential and Strategic Focus: Intel sees quantum computing as a significant growth area, with projections indicating the quantum computing market could exceed $131 billion by 2040. By focusing on this technology, Intel aims to not only diversify its product offerings but also to lead in a field where competition is still emerging, potentially positioning itself as a pioneer in practical quantum computing solutions.

In summary, Intel is leveraging its deep knowledge in silicon manufacturing, investing in both hardware and software development, and forming strategic partnerships to make a notable impact in the quantum computing field. This multi-faceted approach is part of Intel's broader strategy to reclaim its place at the forefront of technological innovation.

As per the above-mentioned price action, recent key business and financial updates, and technical indicators analysis, a ‘Buy’ rating has been given to Intel Corporation (NASDAQ: INTC) at the closing market price of USD 20.40 as of December 24,2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 24,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.