Molson Coors Beverage Company

Molson Coors Beverage Company (NYSE: TAP) is a holding company. The Company operates in two segments: Americas and EMEA&APAC. The Americas segment consists of the production, importing, marketing, distribution and sales of its brands and other owned and licensed brands in the United States, Canada and various countries in the Caribbean, Latin and South America. It operates approximately nine primary breweries, five craft breweries and two container operations.

Recent Business and Financial Updates

- Decline in Third Quarter Financial Performance: Molson Coors Beverage Company ("MCBC") reported a significant decline in its financial performance for the third quarter of 2024. Net sales fell by 7.8% year-over-year, driven by a 12.3% decrease in financial volumes, partly offset by a 4.5% favorable impact from price and sales mix. U.S. GAAP income before income taxes decreased 39.1% to USD 331.4 million, while underlying income before income taxes, adjusted for constant currency, declined by 8.7%. The company attributed these decreases to lower financial volumes, macroeconomic challenges in the U.S., and the winding down of a contract brewing agreement.

- Adjustments to 2024 Guidance: In response to these challenges, Molson Coors revised its 2024 top-line guidance, now expecting a decrease of approximately 1% in net sales compared to earlier projections of low single-digit growth. Despite this adjustment, the company reaffirmed its guidance for bottom-line growth, supported by improvements in packaging materials, transportation, and administrative costs. Underlying diluted earnings per share are expected to grow at the higher end of the previously projected mid-single-digit range, aided by an accelerated share repurchase program.

- Performance Across Business Segments: The company's performance varied across regions. The EMEA&APAC segment demonstrated resilience with a 5.1% increase in net sales, driven by premiumization and favorable pricing, despite a 3% decline in financial volumes. The Americas segment, however, experienced an 11% drop in net sales due to softer market demand and reduced U.S. volumes. In Canada, strong portfolio performance contributed to revenue growth and market share gains, while the U.K. market saw continued success with above-premium innovations like Madri and the launch of legacy brands in new markets.

- Strategic Focus and Brand Strength: Molson Coors emphasized its commitment to its Acceleration Plan, focusing on premiumization and innovation. Core power brands, including Coors Light and Miller Lite, retained significant volume share gains in the U.S. despite industry challenges. In Canada and EMEA&APAC, the company leveraged its premium portfolio to achieve growth, providing a template for expansion in the U.S. market. Investments in brand development and operational efficiencies remain central to the company's long-term strategy.

- Shareholder Returns and Financial Position: The company returned USD 717 million to shareholders in the first nine months of 2024 through dividends and share repurchases. Operating cash flow for the period totaled USD 1.4 billion, reflecting a year-over-year decrease due to unfavorable working capital timing. Molson Coors also managed its debt effectively, refinancing €800 million in senior notes to maintain liquidity and financial flexibility.

- Leadership Outlook: CEO Gavin Hattersley expressed confidence in the company’s long-term growth potential, highlighting strong performances in Canada and EMEA&APAC as evidence of progress in premiumization goals. CFO Tracey Joubert reaffirmed the company's commitment to achieving its financial and strategic objectives, despite near-term challenges such as shipment timing and contract brewing volume reductions. Both leaders emphasized the importance of sustaining investments in innovation and shareholder value creation.

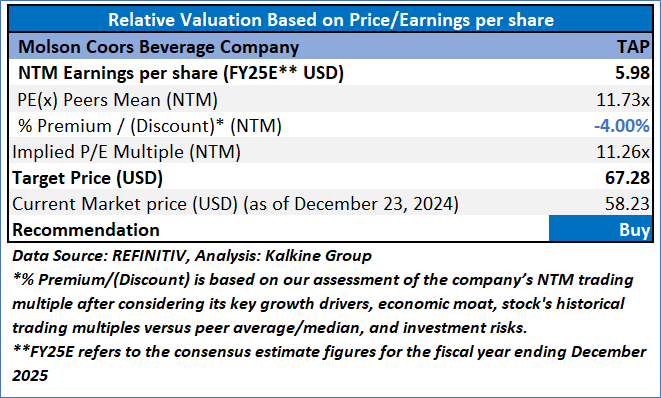

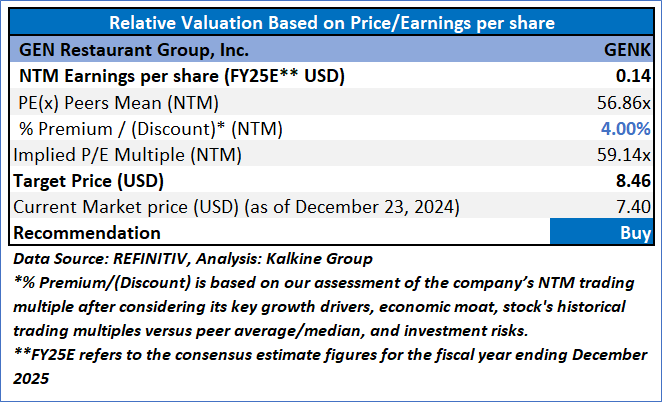

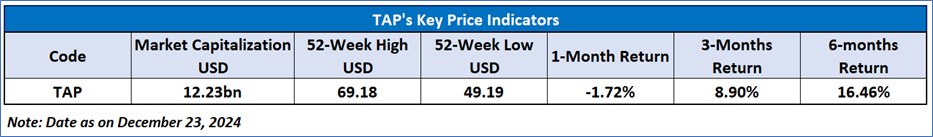

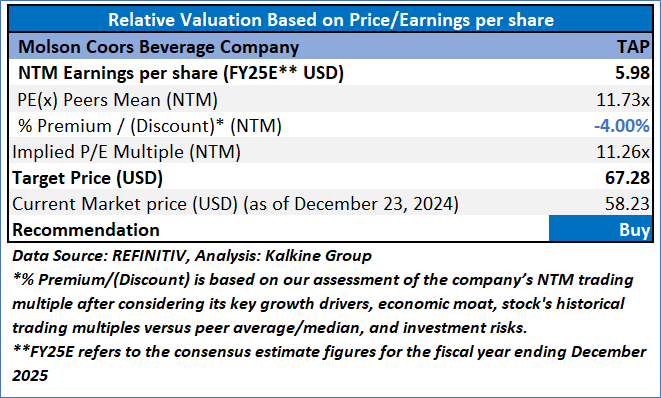

Valuation

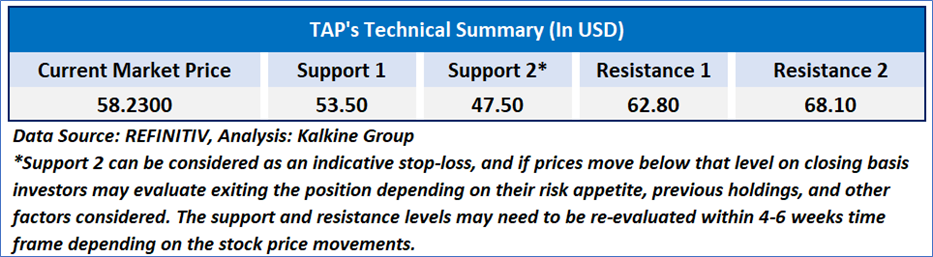

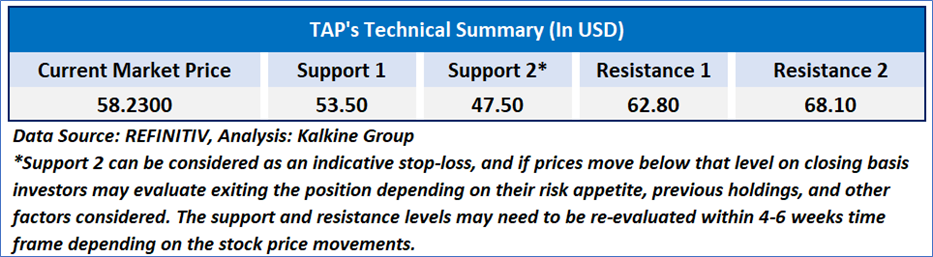

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 38.90, closing near oversold zone, with expectations an upward momentum from the near important support zone of USD 55-USD 60. Additionally, the stock's current positioning is below both the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term resistance levels.

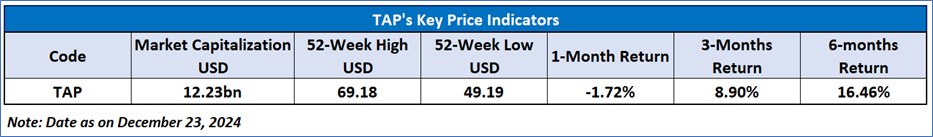

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, valuation upside potential and technical indicators analysis, a ‘Buy’ rating has been given for Molson Coors Beverage Company (NYSE: TAP) at the current market price of USD 58.23 as of December 23, 2024, at 08:45 am PST.

GEN Restaurant Group Inc

GEN Restaurant Group, Inc. (NASDAQ: GENK) operates Asian casual dining restaurant concepts. The Company owns GEN Korean BBQ, which is a cook-it-yourself casual dining concept. The Company offers guests a dining experience where guests serve as their own chefs preparing meals on embedded grills in the center of each table. It offers an extensive menu of traditional Korean and Korean-American food, including meats, poultry, seafood and mixed vegetables. Its restaurants have Korean pop music playing in the background.

Recent Business and Financial Updates

- Operational Developments in Q3 2024: GEN Korean BBQ expanded its footprint by opening one new location during the third quarter and an additional two locations in October 2024. Further enhancing its customer engagement strategy, the company introduced gift cards at participating Costco locations, strategically positioned within five miles of most GEN regions across the United States.

- Financial Performance Highlights: The company recorded a year-over-year increase in total revenue, reaching USD 49.1 million, a 7.8% growth compared to the third quarter of 2023. Restaurant-level adjusted EBITDA margins remained strong, exceeding 18% of revenue. Adjusted EBITDA for the quarter stood at USD 3.4 million, representing 7.0% of revenue, which included pre-opening expenses amounting to USD 1.8 million. Net income was reported at USD 0.2 million, translating to USD 0.01 per diluted share of Class A common stock, while adjusted net income reached USD 0.9 million, or USD 0.03 per diluted share.

- Strategic Expansion and Liquidity: As of September 30, 2024, GEN Korean BBQ reported cash and cash equivalents of USD 22.1 million, reflecting investments in self-financing new restaurant openings. The company reaffirmed its objective to open 10 to 11 new locations by the end of 2024, ensuring sustained expansion while operating without significant long-term debt, aside from USD 4.4 million in government-funded EIDL loans.

- Management’s Outlook: David Kim, Co-Chief Executive Officer of GEN, underscored the company’s focus on operational excellence and its ability to sustain restaurant-level adjusted EBITDA margins exceeding 18%. He highlighted the success of the premium menu in driving up-selling at the restaurant level and the positive reception of GEN gift cards launched at Costco, which reflects strong consumer demand. Kim emphasized the company’s confidence in achieving sustained growth and profitability, bolstered by its robust cash position and commitment to scaling operations into new markets.

- Revenue and Comparable Sales Analysis: Total revenue for the third quarter of 2024 increased by 7.8% to USD 49.1 million compared to USD 45.6 million in the same period of 2023. However, comparable restaurant sales declined by 9.6%, reflecting the broader market challenges faced during the quarter.

- Operating and Administrative Expenses: Restaurant operating expenses, excluding pre-opening costs, increased to 85.4% of revenue, an 80-basis-point rise compared to the third quarter of 2023. Cost of goods sold improved by 50 basis points year-over-year due to enhanced food cost controls. Payroll and benefits costs decreased by 120 basis points, while occupancy costs saw a modest increase of 10 basis points, largely attributed to new restaurant openings. Other operating costs rose by 160 basis points, while depreciation and amortization increased by 80 basis points year-over-year. Pre-opening expenses escalated to USD 1.8 million, reflecting an increased number of restaurant projects in progress. General and administrative expenses amounted to USD 4.5 million, or 9.1% of revenue, driven by additional personnel and higher insurance costs.

- Profitability Metrics: Net income for the quarter was USD 0.2 million, or USD 0.01 per diluted share, compared to USD 2.6 million, or USD 0.08 per diluted share, in the same period of 2023. The decrease was primarily due to increased expenditures associated with new restaurant development. Adjusted net income, which includes non-cash stock-based compensation, reached USD 0.9 million, or USD 0.03 per diluted share. Adjusted EBITDA was USD 3.4 million, representing 7.0% of revenue and incorporating pre-opening expenses of USD 1.8 million.

- Financial Position and Growth Strategy: As of September 30, 2024, GEN Korean BBQ maintained a cash position of USD 22.1 million, down from USD 29.2 million at the end of the previous quarter, primarily due to self-financing restaurant openings. Despite this decrease, the company remains financially resilient and continues to focus on its strategic expansion while operating without significant long-term debt, apart from minimal EIDL loans.

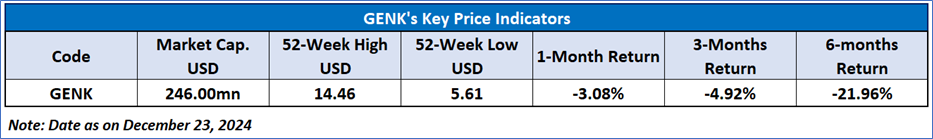

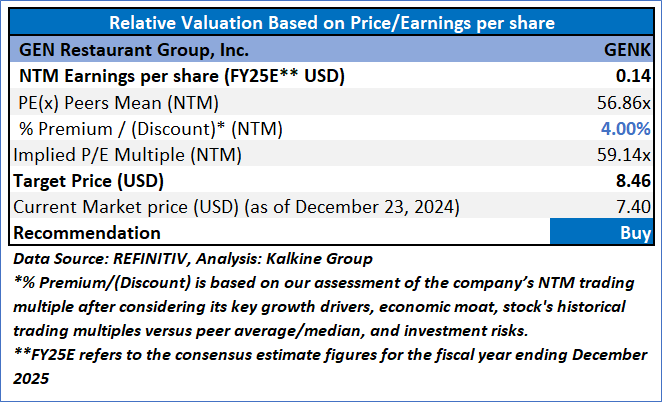

Valuation

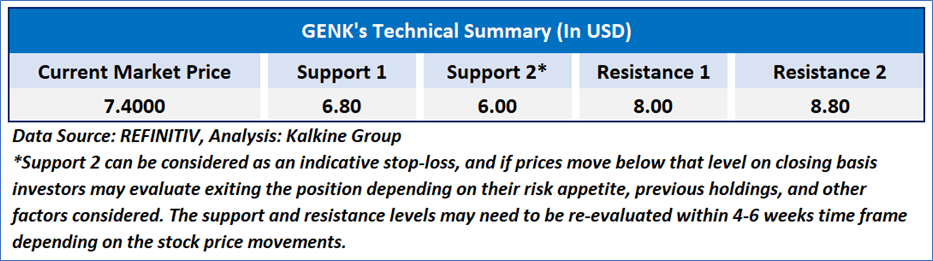

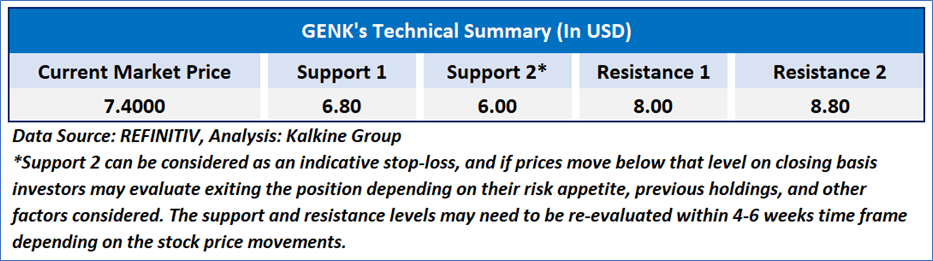

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 37.72, moving towards oversold zone, with expectations an upward momentum from the near important support zone of USD 7.00-USD 7.50. Additionally, the stock's current positioning is below both the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term support levels.

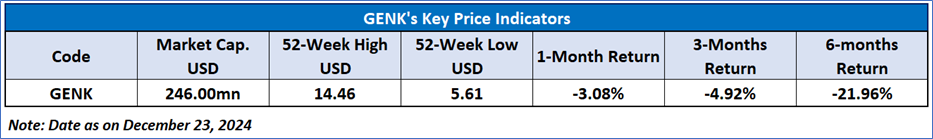

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given for GEN Restaurant Group, Inc. (NASDAQ: GENK) at the current market price of USD 7.40 as of December 23, 2024, at 09:25 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 23, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

_12_23_2024_17_41_55_357575.jpg)