Teck Resources Limited

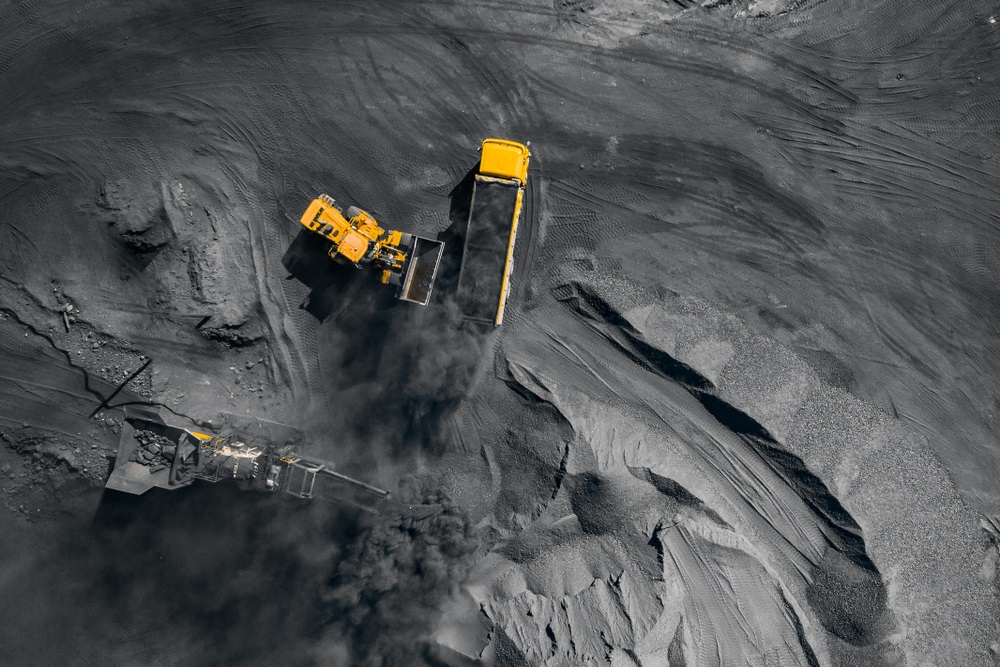

Teck Resources Ltd (TSX: TECK.B) is a diversified miner with coal, copper, zinc, and oil sands operations in Canada, the United States, Chile, and Peru. Metallurgical coal is Teck's primary commodity in terms of EBITDA contribution, followed by copper, zinc, and oil sands.

Why Should Investors Book Profit?

Source: REFINITIV, Analysis by Kalkine Group

Valuation Methodology (Illustrative): EV to EBITDA

Stock recommendation

The Company’s Q2 2021 results reflected excellent numbers, with adjusted earnings increasing 281% compared to the same period last year, thanks to strong performance at operations and major projects against the backdrop of strengthening market circumstances. However, it expects slight upward pressure on cash unit costs in the second half of 2021, as a result of cost escalation in essential supplies. Furthermore, the company is having higher cash cycle days and lower liquidity ratios which could lead to poor liquidity profile. Also, the stock is trading on highly stretched valuation against the industry median along with lower margin profile. Moreover, the technical indicator suggests that stock is perhaps overbought and due for a price correction or a consolidation. Therefore, based on the above rationale, we recommend a “Sell” rating on the stock at the closing price of CAD 31.67 on September 07, 2021.

Aecon Group Inc

Aecon Group Inc (TSX: ARE) is a Canada-based company that operates in two major segments: Construction and Concessions. The Construction segment includes various aspects of the construction of public and private infrastructure projects, mainly in the transportation sector. Its concessions segment is primarily engaged in the development, financing, construction, and operation of infrastructure projects.

Why Should Investors Book Profit?

Source: REFINITIV, Analysis by Kalkine Group

Valuation Methodology (Illustrative): Price to Earnings

Stock recommendation

Recently the company reported its Q2 2021 results with significant year-over-year increases in revenue, Adjusted EBITDA, and earnings per share but also shared the caution on its future revenue, which could be impacted due to cautious operating environment. It also witnessed decline in backlog which confirm the scenario. Furthermore, the company reported lower margin profile v/s Industry along with higher average accounts receivables day against an industry median, exhibiting the pressure on company and balance sheet risk. Additionally, the technical indicators are pointing to a possible price correction or consolidation. As a result, we recommend a “Sell” rating on the stock at the closing price of CAD 21.85 on September 7, 2021, based on the above rationale and valuation.

*The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.