ADMA Biologics Inc

ADMA Biologics, Inc. (NASDAQ: ADMA) is an end-to-end commercial biopharmaceutical company dedicated to manufacturing, marketing and developing specialty biologics for the treatment of immunodeficient patients at risk for infection and others at risk for certain infectious diseases. The Company manufactures and markets three United States Food and Drug Administration (FDA)-approved plasma-derived biologics for the treatment of immune deficiencies and the prevention of certain infectious diseases: BIVIGAM (immune globulin intravenous, human) for the treatment of primary humoral immunodeficiency (PI); ASCENIV (immune globulin intravenous, human - slra 10% liquid) for the treatment of PI, and NABI-HB (hepatitis B immune globulin, human) to provide enhanced immunity against the hepatitis B virus.

Recent Business and Financial Updates

Strong Financial Growth in Q3 2024: ADMA Biologics, Inc. achieved robust financial performance in the third quarter of 2024, underscoring its consistent growth trajectory. Total revenue reached USD 119.8 million, reflecting a 78% year-over-year increase, driven by strong sales of immunoglobulin products such as ASCENIV. The company's GAAP net income surged by an exceptional 1,300% to USD 35.9 million, while adjusted EBITDA grew by 256% year-over-year to USD 45.4 million. These results highlight ADMA’s ability to expand its revenue base and enhance profitability, positioning it as a leader in the biopharmaceutical sector.

Expanded Product Portfolio and Market Position: ADMA’s product portfolio, particularly ASCENIV, contributed significantly to revenue growth, accounting for over 50% of total revenue in Q3 2024. Efforts to increase the availability of ASCENIV are expected to further enhance its contribution in the coming quarters, potentially making it a majority contributor to the company’s overall revenue. Moreover, ADMA’s inclusion in the S&P SmallCap 600 Index has increased its market visibility and share liquidity, solidifying its position in the small-cap equity market segment.

Strategic Governance and Operational Improvements: In a noteworthy move, ADMA transitioned to KPMG LLP as its independent registered public accounting firm during Q3 2024. This shift to a "Big 4" firm reflects the company's enhanced financial profile and governance standards. Additionally, ADMA expanded its ADMAlytics™ artificial intelligence platform to streamline operations and optimize production processes. The integration of ADMAlytics has already demonstrated significant efficiency improvements, supporting the company’s rapid earnings growth and operational excellence.

Revised Financial Guidance for 2024 and 2025: Based on its strong performance, ADMA raised its financial guidance for fiscal years 2024 and 2025. Total revenue is now projected to exceed USD 415 million in 2024 and USD 465 million in 2025. GAAP net income guidance has been increased to more than USD 120 million for 2024 and USD 165 million for 2025, while adjusted EBITDA is expected to exceed USD 160 million and USD 215 million for the respective periods. These upward revisions reflect the company’s confidence in its growth prospects and its ability to achieve sustained profitability.

Advancements in Research and Development: ADMA continues to prioritize innovation, with notable progress in its research and development initiatives. The company successfully produced a pilot-scale batch of its S. pneumoniae hyperimmune globulin program, SG-001, targeting pneumonia prevention. Additionally, the completion of ASCENIV’s pediatric study paves the way for a supplemental Biologics License Application, which could further expand its product portfolio. These advancements underscore ADMA's commitment to addressing unmet medical needs while driving future revenue growth.

Strengthened Balance Sheet and Outlook: ADMA’s financial position remains robust, with working capital of USD 273.3 million as of September 30, 2024. This includes USD 86.7 million in cash and equivalents, USD 171.8 million in inventory, and USD 50.1 million in net accounts receivable. The company’s net leverage ratio has significantly improved, driven by strong cash flow generation and adjusted EBITDA growth. As ADMA looks ahead to Q4 2024 and beyond, it remains well-positioned to capitalize on new opportunities, maximize shareholder value, and sustain its growth momentum through operational efficiency and strategic investments.

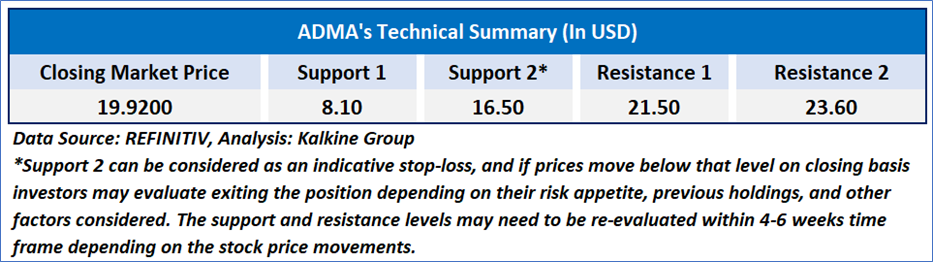

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 49.64, with expectations of a consolidation or an upward momentum if the price sustains above or around USD 19 support level. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

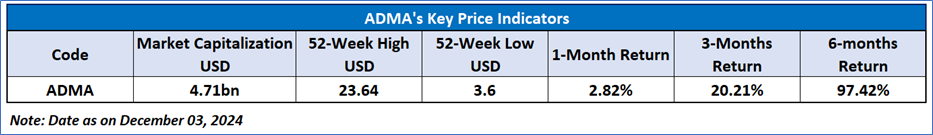

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for ADMA Biologics, Inc. (NASDAQ: ADMA) at the closing market price of USD 19.92 as of December 03, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 03, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.