Dr. Reddy’s Laboratories Limited

Dr. Reddy’s Laboratories Limited (NYSE: RDY) is an India-based pharmaceutical company. Its products and services are spread across its core businesses of active pharmaceutical ingredients (APIs), generics, branded generics, biosimilars and over the counter (OTC) pharmaceutical products. It works in the areas of gastrointestinal, cardiovascular, diabetology, oncology, pain management and dermatology.

Recent Business and Financial Updates

- Acquisition and Strategic Expansion: In Q2FY25, the company completed the acquisition of the Nicotine Replacement Therapy (NRT) portfolio, excluding the United States market, with an upfront cash payment of GBP 458 million. Furthermore, the partnership between Dr. Reddy’s and Nestlé Health Science Limited was operationalized in August 2024, marking an important step toward expanding the business of nutraceutical products and supplements within India and Nepal. This partnership involved the transfer of 49% of the subsidiary’s shares to Nestlé India. These strategic initiatives underscore the company’s commitment to enhancing its portfolio and expanding its presence in key markets.

- Regulatory Approvals and Market Authorization: The company achieved significant regulatory milestones during Q2FY25, including securing Marketing Authorization from the European Commission for its rituximab biosimilar following a favorable opinion from the CHMP of the European Medicines Agency. Additionally, the United States Food and Drug Administration (USFDA) granted approval for an Investigational New Drug (IND) application for AUR-112, a novel and selective inhibitor of MALT1 intended for the treatment of lymphoid malignancies. A non-exclusive patent licensing agreement with Takeda was also finalized, enabling the company to commercialize Vonoprazan, a new gastrointestinal drug, in India. These achievements reflect the company’s proactive approach in expanding its biosimilar and novel drug portfolio.

- Environmental, Social, and Governance (ESG) Recognitions: The company received notable accolades for its ESG performance in Q2FY25. It was recognized among India’s 'Top 15 Most Sustainable Companies, 2024' by Businessworld India. Additionally, KPMG India awarded the company the 'ESG Excellence Award' in the 'Large-cap Pharmaceuticals & Healthcare' category. In a further commitment to quality, the company’s two formulations manufacturing facilities in Duvvada, Visakhapatnam, received a 'Voluntary Action Indicated' (VAI) classification from the USFDA after routine GMP inspections. The company’s R&D center in Hyderabad also underwent a routine GMP inspection by the USFDA, resulting in zero observations. These acknowledgments emphasize the company’s adherence to high standards in sustainability and operational practices.

- Financial Performance and Revenue Growth: The consolidated revenues for Q2FY25 reached ₹80.2 billion, reflecting a year-on-year (YoY) increase of 17% and a sequential growth of 4%, driven largely by the performance in global generics markets. For H1FY25, consolidated revenues stood at ₹156.9 billion, a 15% YoY increase attributed to strong sales in global generics, especially in North America, India, Emerging Markets, and the Pharmaceutical Services and Active Ingredients (PSAI) segments. These figures highlight the robust growth trajectory supported by strategic product launches and market expansion efforts.

- Segment-wise Revenue Analysis: The Global Generics segment reported Q2FY25 revenues of ₹71.6 billion, marking a YoY growth of 17% and a sequential growth of 4%. This growth was broad-based across all markets, driven by higher sales volumes and new product introductions, particularly in the Emerging Markets and Europe. For North America, revenues reached ₹37.3 billion, a 17% YoY increase attributed to higher sales volumes, despite some price erosion. Europe generated ₹5.8 billion in Q2FY25 revenues, with YoY growth fueled by new product launches, notably in Germany, which saw a 21% YoY increase. In India, revenues for Q2FY25 were ₹14.0 billion, supported by the vaccine portfolio and new product launches. Emerging Markets recorded revenues of ₹14.6 billion, with Russia alone contributing ₹6.9 billion, showcasing strong market share growth and increased volumes.

- Financial and Operational Efficiency: The company reported a gross margin of 59.6% for Q2FY25, reflecting an improvement of 92 basis points year-on-year, though slightly lower than the previous quarter by 81 basis points due to changes in product mix. Selling, General, and Administrative (SG&A) expenses totaled ₹23.0 billion for the quarter, with a YoY increase of 22%, driven by acquisition-related costs, and increased investment in brand expansion and new business initiatives. Research & Development (R&D) spending stood at ₹7.3 billion, representing 9.1% of revenues in Q2FY25, as the company continued its focus on generics, biosimilars, and oncology research, underscoring its commitment to innovation in critical therapeutic areas.

- Profitability and Earnings: In Q2FY25, profit before tax was reported at ₹19.2 billion, maintaining stability on a YoY basis while showing a 2% sequential growth. After adjusting for acquisition-related costs and impairment charges, the profit before tax as a percentage of revenues stood at 25.7%. The net income attributable to equity holders declined 15% YoY, resulting in ₹12.6 billion for Q2FY25, influenced by one-time expenses, with a diluted earnings per share of ₹15.04. Excluding these non-recurring impacts, the underlying profit margin demonstrated resilience, highlighting efficient cost management amidst rising expenditures in key growth areas.

- Other Financial Metrics: Additional financial metrics for Q2FY25 indicate a balanced approach to capital deployment. EBITDA for the quarter was reported at ₹22.8 billion, representing a YoY increase of 5% and a sequential increase of 6%. The EBITDA margin as a percentage of revenue was 28.4%, excluding the impact of acquisition-related costs. As of September 30, 2024, the company's capital expenditure was ₹7.4 billion, while its net cash surplus stood at ₹18.9 billion, and the debt-to-equity ratio remained low at 0.06, signifying a strong liquidity position and prudent capital allocation strategy.

Technical Observation (on the daily chart):

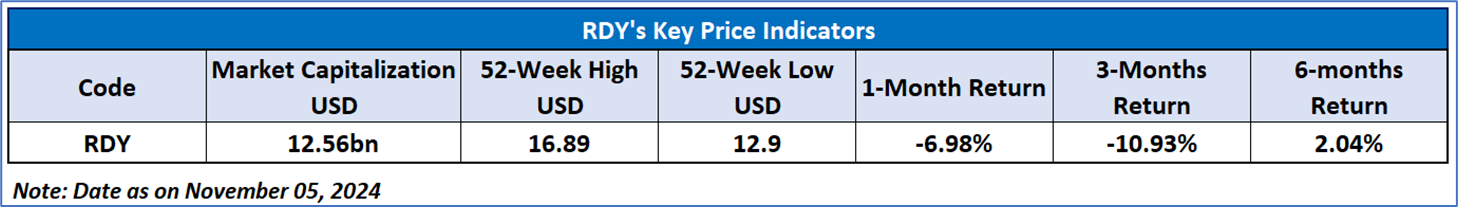

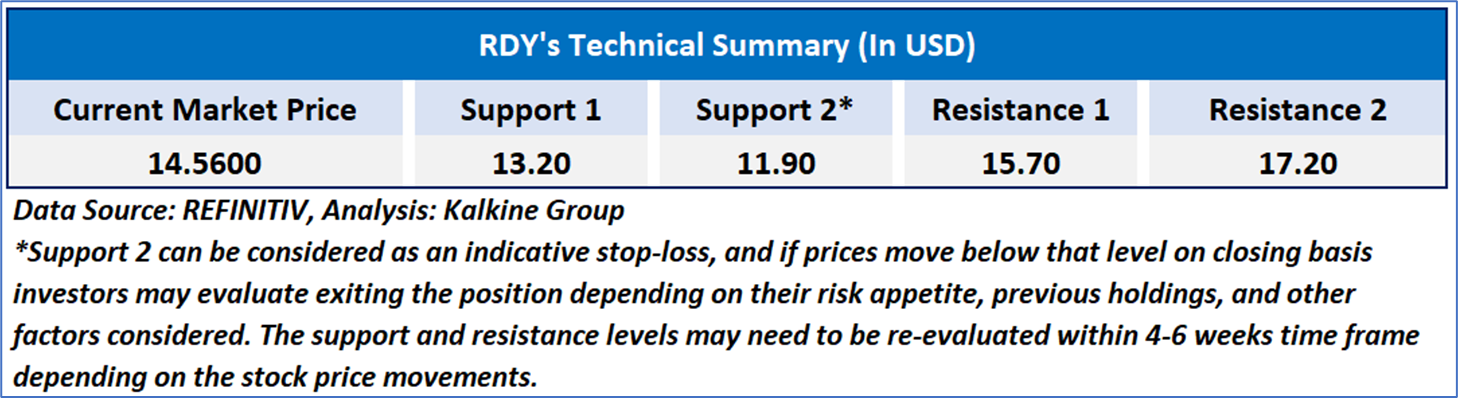

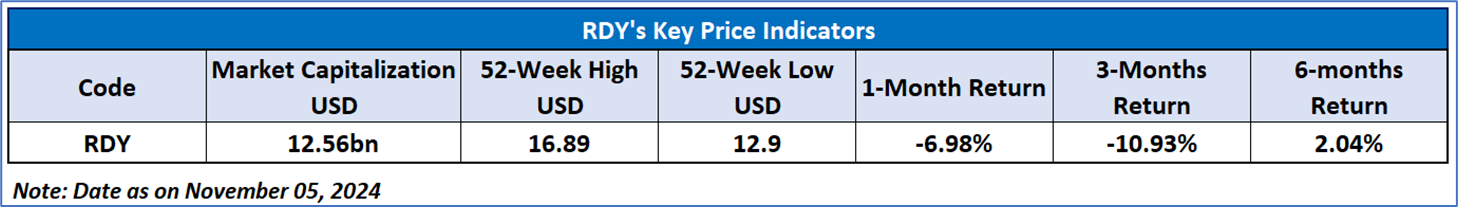

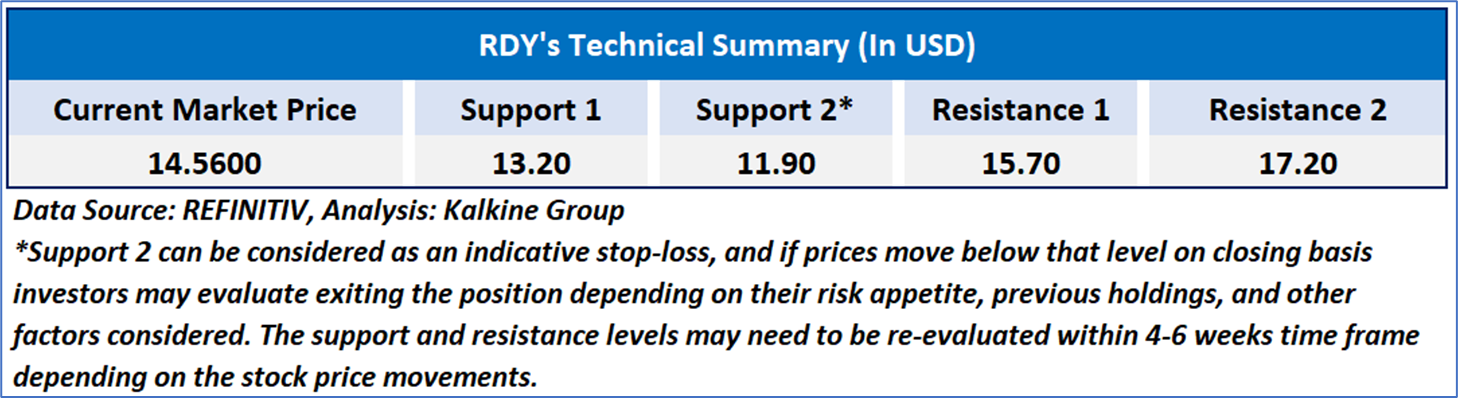

The Relative Strength Index (RSI) over a 14-day period stands at a value of 30.85, currently downward trending nearing oversold zone, with expectations of a consolidation or an upward momentum if USD 13.50-USD 14.00 support range holds. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for Dr. Reddy’s Laboratories Limited (NYSE: RDY) at the current market price of USD 14.56 as of November 05, 2024, at 07:15 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 05, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.