Image Source : Krish Capital Pty Ltd

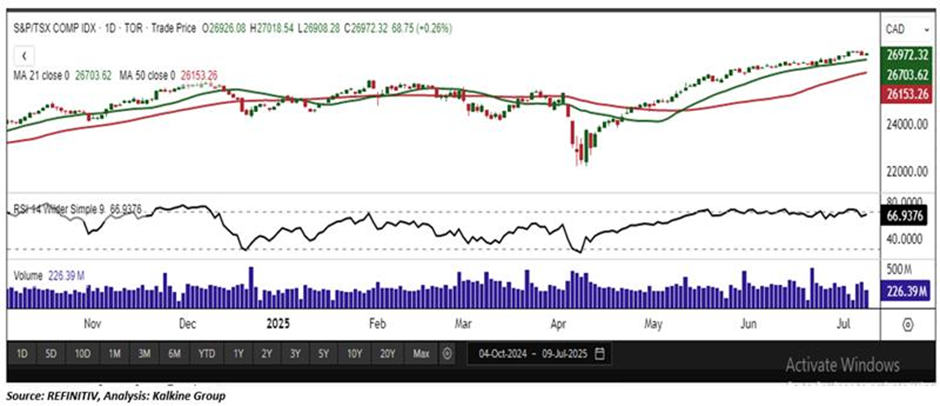

Index Update: After opening a little higher than the previous close, the benchmark S&P/TSX Composite Index today struggled in mid-morning trading. Later, the index gained momentum to reach an intraday high of 27,018.54 after noon. Then, after swinging a little, the index finally settled at 26,972.32, up by 68.75 (or 0.26 %).

Macro Update: The US has extended the reciprocal tariff suspension period from July 9 to August 1. With the UK, China, and Vietnam done with trade agreements with the US, India and the EU are close on the heels. US President Donald Trump's announcement of an additional 10% tariff on the 11-member BRICS nations as well as his plans to impose 50% and 200% levies on Copper and pharmaceutical imports to the US, respectively, has created jitters globally. The Canadian PM is pushing for trade deals with nations other than the US to cut short over-reliance on the US for its exports.

Top Movers: Endeavour Silver Corp (9.06%), First Majestic Silver Corp (5.21%), Fortuna Mines (5.02%), and H&R Real Estate (4.17%) were the prominent gainers.

Our Stance: From a technical standpoint, the index is currently testing a key support zone near 26,700. Holding above this level is crucial to sustain the upward trend. A decisive break below it could open the door for a deeper pullback, with the next notable support levels at 26,400 and 26,200 on the weekly chart.

Commodity Update: The U.S. dollar eased from a two-week high on Thursday after President Trump’s new tariff threats had limited market impact. Gold edged up 0.25% to $3,328.70, silver rose 0.17% to $36.69, and copper gained 0.35% to $9,667.50. Brent crude dipped 0.10% to $70.09 as investors weighed fresh U.S. tariff announcements and a sharp increase in crude inventories, which raised concerns about demand.

Technical Update: On Wednesday, the S&P/TSX Composite Index rose by 68.75 points to close at 26,972.32, marking a gain of 0.26%. The basic materials sector outperformed, adding 0.83% and reflecting renewed optimism in the space. From a technical perspective, the index maintains its bullish structure, trading comfortably above the 21-period Simple Moving Average (SMA). The Relative Strength Index (RSI) stands at 66.93, signaling strong momentum with further upside potential. The index is currently testing a key support zone near 26,700. Holding above this level is crucial to sustain the upward trend. A decisive break below it could open the door for a deeper pullback, with the next notable support levels at 26,400 and 26,200 on the weekly chart.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.