What is the meaning of the Binance Coin (BNB)?

Binance Coin refers to a cryptocurrency introduced in July 2017 and trades under the symbol BNB. On the Binance cryptocurrency exchange, Binance Coin could be utilised to trade and pay fees. Binance Coin, which uses the ERC 20 standard, is restricted to 200 million BNB tokens and runs on the Ethereum platform.

Binance Exchange, with over 1.4 million transactions per second as of January 2018, is one of the world's biggest cryptocurrency exchanges.

In addition, the BNB market is where BNB is sold and purchased. Most BNB purchases are made on the secondary market.

Furthermore, BNB offers various valuable benefits to its users, like a discount on transaction fees as an incentive on the Binance Exchange. Binance Coin may also be traded for other cryptocurrencies like Litecoin, Ethereum, and Bitcoin.

Summary

- Binance Coin refers to a cryptocurrency introduced in July 2017 and trades under the symbol BNB.

- Binance Coin, which follows the ERC 20 standard and runs on the Ethereum network, is limited to 200 million BNB tokens.

- Binance utilises 20% of its earnings every quarter to purchase and permanently destroy Binance coins stored in its treasury.

Frequently Asked Questions (FAQs)

What is the usage of Binance Coin?

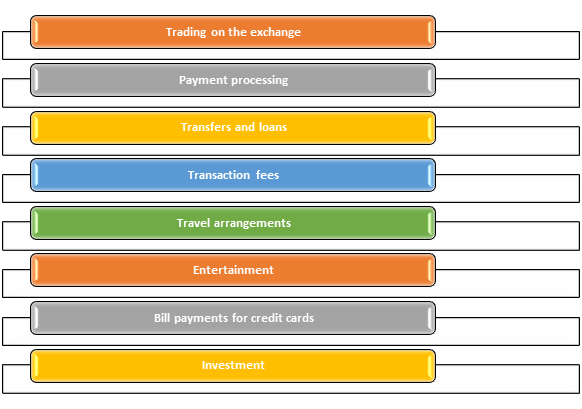

The Binance Coin has various uses beyond the Binance exchange, proving its worth in the crypto world. Let's have a glance at how the Binance Coin is used.

Trading on the exchange: Based on the limits set by the exchange, BNB can be traded for other cryptocurrencies on different exchanges.

Payment processing: BNB has rapidly become one of the most popular payment options for merchants. It enables them to create a consistent payment experience for their customers while also allowing for additional payment method flexibility.

Transfers and loans: Another excellent usage of the Binance Coin is for loan purposes. Users might use Binance Coin as collateral for loans on several platforms. Additionally, some apps allow users to divide expenses and pay family and friends with Binance Coin.

Transaction fees: Users can pay transaction fees on the Binance Exchange with Binance Coin and enjoy a discount as a reward.

Investment: BNB could be used to invest in assets, ETFs, and stocks through several platforms.

Bill payments for credit cards: Credit card payments are another excellent use of the Binance Coin. Crypto.com allows users to pay their cryptocurrency credit card bills.

Travel arrangements: Some travellers prefer to use Binance Coin to book flights and hotels on specific websites.

Entertainment: Binance Coin has become a popular choice among its users since it offers various benefits and serves several purposes in the entertainment sector. Users could use BNB to purchase lottery tickets or virtual gifts.

Source: Copyright © 2021 Kalkine Media

What is Binance Coin's history?

Binance coin was introduced in July 2017 as part of an initial coin offering (ICO). The cryptocurrency industry's equivalent to an initial public offering (IPO) is an initial coin offering. An ICO is a method of raising funding for a firm seeking to develop a new application, coin, or service. However, a keen investor can purchase into the offering and obtain a new cryptocurrency token developed by the firm.

Binance Coin released tokens via an initial coin offering (ICO).

Let's have a look at the list of BNB token allocations provided below.

- Angel investorsreceived 20 million BNB tokens or 10% of the total.

- The founding team received 80 million BNB tokens or 40% of the total.

- The rest 100 million, or 50%, distributed among the contestants.

Furthermore, nearly half of the funds received through the ICO process were meant to be utilised for Binance marketing and branding. At the same time, the remaining one-third was used to develop the Binance platform and implement essential enhancements to the Binance ecosystem.

BNB, on the other hand, was originally built on the Ethereum network, but it has since evolved into the native currency of Binance's blockchain, known as the Binance chain.

Source: © Shahurin | Megapixl.com

What is the burning of Binance Coin?

Binance utilises 20% of its earnings every quarter to purchase and permanently destroy (or "burn") Binance coins stored in its treasury, as stated in the Binance whitepaper.

Permanently withdrawing a crypto token from circulation and reducing the overall supply is known as "burning." Since its inception, Binance has performed quarterly burns.

Binance will continue to do quarterly burns if it meets its goal of purchasing and destroying 100 million Binance coins, or half of the total supply. As a result of this technique, the quantity of Binance Coin stays limited, making it rare and precious.

Source: © 36clicks | Megapixl.com

What factors should you think about before investing in Binance coins?

Let's look at the elements that influence whether you should invest in Binance coins.

- Binance coins could be used to invest in initial coin offerings (ICOs) listed on Binance's Launchpad platform.

- The Binance exchange will add new cryptocurrencies to its list, and the use of Binance coins will offer a smooth marketplace for trading in different virtual tokens.

- Binance will eventually become the decentralised Binance exchange's principal currency.

Please wait processing your request...

Please wait processing your request...