What is Operating Margin?

Operating margin measures the profitability of the firm. It shows how much revenue is left with the company after considering the cost of goods sold (COGS) and operating expenses. The operating margin of a company can be calculated by dividing operating income by revenue. It is a significant parameter that reflects the economic health of a company. It also gives an overview of the company's ability to pay their interest to the potential investors.

For example, let us assume that the total revenue earned by company X in the year 2020 is $100 million. After deducting the cost of goods sold and operating expenses, the operating income of the same company in 2020 is $40 million. Thus, the operating margin can be calculated by dividing the operating income by total revenue, i.e., 40%.

Summary

- Operating margin measures the profitability of the firm.

- It shows how much revenue is left with the company after considering the cost of goods soldand operating expenses.

- The operating margin of a company can be calculated by dividing operating income by revenue.

Frequently Asked Questions (FAQs)

What is Operating Income?

Before going to the depth of operating margin, let us first understand what operating income is. Operating income can be defined as the net profit gained by a company through its primary operating activities after deducting the cost of goods sold, operating expenses, etc.

Operating income is calculated by subtracting the production cost, depreciation and amortisation from the total revenue earned.

As a result of which, the investors and moneylenders pay special attention to the operating margin of an organisation. Operating margin is also commonly known as Return on Sales (ROS) as it indicates the money left with a firm after deducting the operating expenses.

The expert market analysts believe that an inconsistent operating margin leaves a wrong impression on the investors as it indicates high business risk. A stable and consistent operating margin is always favourable for investors and lenders.

Image source: © Skazovdd | Megapixl.com

How to analyse Operating Margin?

Operating margin can be mathematically calculated using the following formula:

Operating margin = (operating income / revenue} X 100

Let us understand the calculation of operating margin with the help of an example.

Assume that company Z has manufactured 100,000 televisions in the year 2020 and has earned $100 million revenue after the sale of the televisions. The revenue includes the money needed for producing the televisions, labour charge, staff salaries, depreciation, amortisation, marketing, and advertising cost which sums up to $65 million. Subtracting $65 million from $100 million, we obtain the operating income, which is $35 million. Therefore, from the formula as mentioned earlier.

Operating margin = 35 / 100 X100 = 35%

Therefore, we can conclude that the operating margin of company Z for the year 2020 is 35%. The company needs to consistently maintain its operating margin similarly to avoid any business risk.

Are Operating Margin and EBIT Margin same?

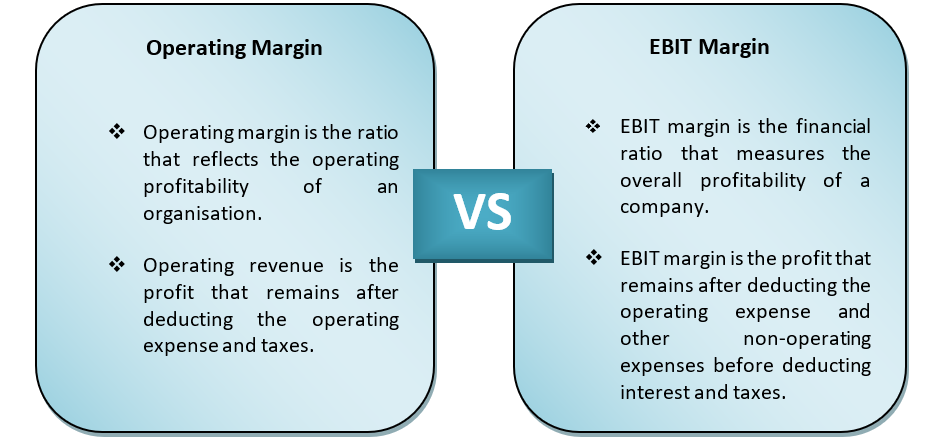

Operating margin and EBIT margin might appear similar yet they are two completely different concepts and can never be considered same. Operating margin can be defined as the ratio that reflects the overall profitability of an organisation. Operating margin can be calculated by dividing operating income by revenue and multiplying the outcome with 100.

Image source: © Zannagap69 | Megapixl.com

On the other hand, EBIT margin is derived by dividing EBIT by revenue and multiplying the outcome with 100. The major distinction between EBIT and operating income is that EBIT includes non-operating income. Hence, the EBIT margin demonstrates overall profitability, operating margin demonstrates only operating profitability.

Image source: Copyright © 2021 Kalkine Media

Why is Operating Margin essential in a business?

As operating income is the primary source of cash in a business, operating margin is an important measure to evaluate the overall commercial performance of a company. Operating margin is an essential aspect for a company for getting investors and lenders. A business that generates profit instead of operating at a loss gives a positive impression to the investors. The operating income earned is utilised for paying interest to the investors and shareholders of the company. A high percentage of operating margin indicates a higher rate of operating income and lesser business risk. At the same time, a low and inconsistent operating margin indicates lower operating income and higher business risk.

What are the limitations of Operating Margin?

Although operation margins are of great importance to both the company and the investors, there are few operating margin limitations. It can only be used to compare companies belonging to the same industries and not otherwise. This is because it is not logical to compare a company's operating margin of a particular business model with a company's operating margin with a completely different business model.

Which industries have high and low Operating Margins?

Industries with high operating margin usually consist of the service industries, which involve fewer assets in production and spend less in manufacturing. For example, a video game software might involve many investments initially to produce it and then sell millions of copies at a low price. On the other hand, a luxury item might be priced high and sell low as it will follow a high profit and low sales strategy.

Industries like automobile and logistics usually have a low operating margin for various reasons. In logistics, there is a chance of fluctuating operating expenses, whereas the automobile industry has high operation cost, competition, and unpredictable market demand.

CA

CA  AU

AU UK

UK US

US NZ

NZ Please wait processing your request...

Please wait processing your request...