What is a blind trust?

A blind trust is a revocable or irrevocable living trust that gives the trustee (another party) complete control over the assets. A blind trust's trustee cannot be the trustor (owner). Instead, the trustee must be a neutral third party with no personal connections to the trustor. This is required for a blind trust to accomplish its goals of maintaining high levels of secrecy and avoiding conflicts of interest.

The trustor can suspend the trust at any moment, but they have no influence over the trust's actions and receives no reports from the trustees while the blind trust is in effect. Blind trusts are frequently used when people seek to avoid conflicts of interest between their investments and jobs.

Summary

- A blind trust is a financial contract in which a person's assets are managed without awareness.

- The trustee oversees the trust's investments and assets, as well as any income generated.

- When people seek to avoid conflicts of interest between their investments and their jobs, they create blind trust.

Frequently Asked Questions (FAQs)

How does a blind trust function?

The trustor hires a trustee to function as the fiduciary in a blind trust, which means the trustee has overall management of the assets and is responsible for upholding the trust agreement, such as dispersing the assets after the trustor's death.

Furthermore, the trust can hold various investments, including bonds, real estate, and equities. The trustor and trustee are frequently in contact with one another, and the trust's beneficiary is generally aware of the trust and its assets.

Source: © Skypixel | Megapixl.com

While the trust is being created, the trustor can specify the trust's parameters, such as the aims for any investments kept in the blind trust or the beneficiaries. However, once the trust instrument, a written agreement that authorises the trust, is signed and finished, the trustor and beneficiaries will have no more contact with the trustee regarding asset management.

What are the different kinds of blind trusts?

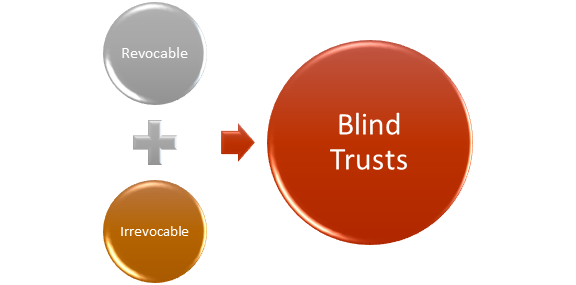

A blind trust is a type of living trust that might be revocable or irrevocable. It can be a revocable trust, which means that the trustor can modify the trust and the trustee and dissolve the trust. The trustor may, for example, add assets to the trust while removing others, select a new trustee, bring beneficiaries to the trust, or select a new trustee.

Blind trust may be an irrevocable trust, which means that the trustor cannot change it once it is made. The trustor would create a revocable or irrevocable trust depending on the scenario and the trust's aim.

An irrevocable trust, for instance, can be created such that assets are no longer the trustor's legal property, prohibiting the government and creditors from collecting the assets.

Source: Copyright © 2021 Kalkine Media

What are the reasons for forming a blind trust?

Trustors may face conflicts of interest in certain circumstances; the goal of a blind trust is to avoid those conflicts.

A retired company executive, for xample, could be on the board of directors. All potential conflicts of interest should be avoided because board members have a fiduciary responsibility to shareholders. A conflict of interest exists when a board member stands to profit from a policy decision and owns business stock.

If the board member's shares are kept in a blind trust, the conflict of interest will be avoided because they will not know how the decision will affect their ownership.

This is especially important for an investor who is deemed an "insider" and may be charged with insider trading, which is the act of trading stocks based on reports that are unavailable to the general public and is sometimes prosecuted as a crime.

What factors should be considered to set up a blind trust?

Here are a few factors to look at while creating a blind trust.

- Consulting with a knowledgeable attorney to determine whether a blind trust is required and which laws must be followed to form one.

- If necessary, involving a financial advisorin the process.

- Know the funding process and how to build trust.

- Choosing which assets will be entrusted to the trust.

- Gathering important assets-related documents, such as real estate deeds or stock certificates.

- Appointing a trustee could be an individual or a financial institution such as a wealth managementagency.

- Choosing between a revocable and irrevocable trust.

- Creating the trust document and funding it with assets is the first step.

Who can create a blind trust?

Anyone could theoretically create a blind trust. However, it only utilises when persons need to separate themselves from their assets to avoid professional conflicts of interest.

Source: © Alekseiveprev | Megapixl.com

Putting assets in a blind trust can help government officials and politicians avoid conflicts of interest by keeping their personal and professional lives separate to some extent.

Individuals and corporate executives who serve on a board of directors may also establish a blind trust for asset management to prevent a similar situation. As a result, they may avoid any financial dealings that could lead to a conflict of interest.

Federal regulations for corporate insiders prohibit insider trading and unlawful activities. By establishing a blind trust, the trustee would sell or acquire shares of business stock held in the trust, enabling the executive to avoid breaking any federal trading regulations.

Please wait processing your request...

Please wait processing your request...