What is an Interim Dividend?

An interim dividend is a percentage of a company's income distributed to shareholders before calculating the company's annual earnings. It is often paid to stockholders of a company's common stock, usually quarterly or semi-annually.

The declaration of the company's interim dividend is in the hands of the Board of Directors, but it is up to shareholders to accept or reject it.

Summary

- An interim dividend is a payout to shareholders announced and paid before a company's full-year earnings have been calculated.

- The firm’s Board of Directors announces an interim dividend, but it is up to shareholders to accept or reject it.

- Interim dividends are given from retained capital, and final dividends are provided from current earnings.

Frequently Asked Questions

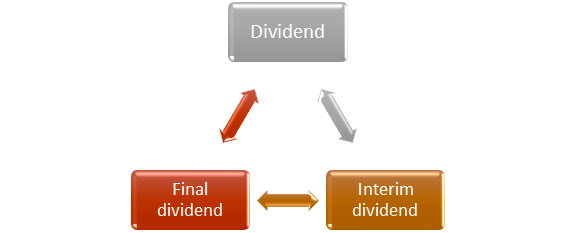

What is a dividend?

A dividend is a payment of a portion of a company's earnings to a class of shareholders decided by the board of directors of the company.

More often, the company distributes its profits to equity owners in the form of cash dividends. That isn't the only way to distribute dividends. Some businesses offer their equity shareholders dividends in the form of shares rather than cash. Dividends distributed in stock are referred to as stock dividends.

A final dividend is a dividend declared by the firm at its general meeting at the end of the fiscal year, as suggested by the board of directors.

The board of directors declares an interim dividend between two general meetings at which the company receives excess revenue.

Source: Copyright © 2021 Kalkine Media Pty Ltd

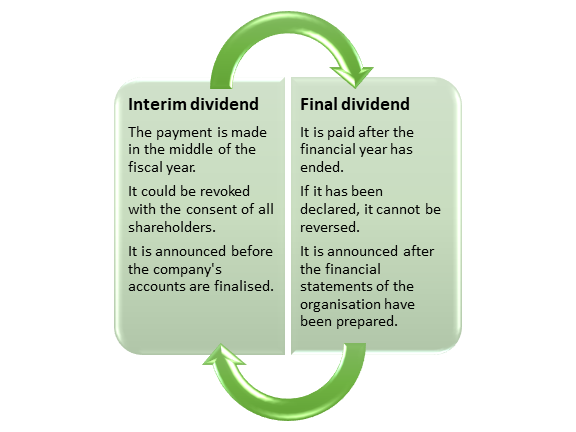

What is the distinction between the interim and final dividends?

The firm’s directors declare an interim dividend before determining the firm’s annual profit or loss and holding its annual general meeting (AGM), i.e. at some point between two consecutive AGMs.

The word "final dividend" refers to a dividend declared by a corporation after its financial condition and profitability have been calculated and the company's financial statement for the fiscal year has been presented at its annual general meeting (AGM). It is also called a year-end dividend.

The interim dividend is announced by the board of directors at any time during the fiscal year, between the end of the fiscal year and the AGM. In comparison, after assessing benefit, the board of directors recommends a final dividend to be declared by the members at the AGM, where it is voted on and accepted.

Before the company's reports are finalised, an interim dividend is announced. The final dividend, on the other hand, is declared after the company's financial statements have been prepared.

The interim dividend may be cancelled with the approval of all shareholders, but the final dividend cannot be revoked once it has been declared.

The interim dividend is paid only for a certain period of the year, usually six months. Interim dividend rates are often lower than final dividend rates.

The interim dividend may only be declared if the company's articles of association clearly state so. In the case of the final dividend, however, there is no such condition.

Source: Copyright © 2021 Kalkine Media Pty Ltd

What is the purpose of the interim dividend?

When it comes to stock market investments, many people take one of two approaches: dividend investing or growth investing. Dividend investors are investing in a prosperous and profitable business that has been around for a long time in the hopes of earning a steady income in the form of dividends.

The company's interim financial statements are normally accompanied by this announced dividend. Payments are made in two parts, with the interim dividend being the smaller of the two.

The board of directors may decide to pay an interim dividend that is less than the dividend paid following the company's annual financial results are released so that the interim dividend does not jeopardise the company's ability to function if the annual results are lower than anticipated. They may announce an interim dividend at any time during the fiscal year; It is, however, subject to shareholder approval.

Interim Dividends are paid out of either retained earnings in the profit and loss account or income from the financial year in which the dividend is sought to be declared.

When the corporation has a loss based on financial statements from the previous year, the interim dividend rate should not be higher than the company's average dividend declared for the previous three years. If the dividend is announced, the balance of the proposed dividend must be credited in a separate account within five days of the declaration date.

When is an appropriate time to declare an interim dividend?

The payment of interim dividends is not subject to approval by the general meeting. Once declared, an interim dividend shall constitute a debt and is not recoverable.

So, before announcing an interim dividend, the board of directors must be satisfied that the company's financial status permits payment of such a dividend from its attributable income. When the organisation has made substantial profits for a portion of the year and has optimistic future goals for the rest of the year, an interim dividend can be declared.

CA

CA  AU

AU UK

UK US

US NZ

NZ Please wait processing your request...

Please wait processing your request...