What is an investment?

Investment refers to an asset or an object that is acquired with the expectation of a future stream of income arising from it. An investment can also be made with the intention of gaining an appreciation in the acquired asset.

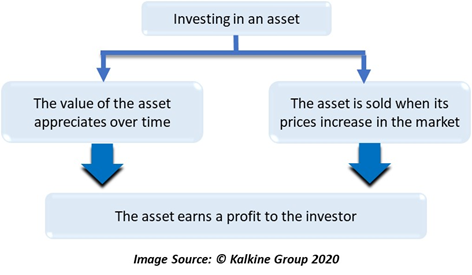

The gains from an investment can come in two ways: one is by way of reselling of the asset when its value has increased over time, the other is by way of an income generating plan, that promises a stream of income after investing a certain amount in it.

Therefore, investments are a way of securing future streams of income by obtaining an item that is expected to become more valuable as time passes. People can invest in equities, property, commodities, hedge funds, government bonds, etc. A lot of people invest in various assets to obtain a secured income during their years of retirement.

How are profits made from investments?

By using the information available in the market, investors can decide where they want to put their money. It is also possible that investments go bad with time if the money is not invested carefully. Therefore, investors need to have complete information about the market to ensure that the money they are investing gives them an assured return.

Investments may not always have a direct income stream attached to them. Sometimes they may aid the income generating process, rather than be the object generating the income. For instance, when a new firm starts their production, they would put their money in land, machinery, and other essential goods. These items do not generate cash flow directly and are prone to depreciate over time, rather than appreciate. Thus, they do not fit the criteria of an investment as specified. However, they aid the firm in producing goods, which helps the firm generate profits. Therefore, they are indirectly facilitating the income generating process of the company.

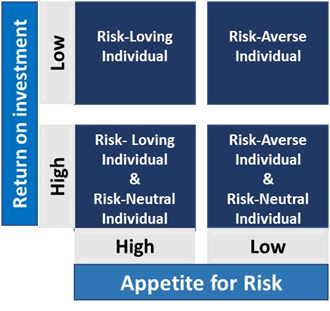

Investments can have a promising cash flow, while they can also be on the riskier side like the in the cash of highly volatile assets. Whether the investment taken up by the investor is risky or not depends on the appetite for risk that the investor has. A risk-loving investor would like to invest in assets that promise higher returns, but these returns may not be assured. Whereas a risk-averse person would steer clear of such investments that do not offer fixed returns and would put his money in investments that offer fixed returns like government bonds and schemes.

Image source: ©Kalkine Group 2020

Thus, an investment can mean different things for different types of investors and may take various forms that are not confined to only one type of asset or object.

ALSO READ: What lies at the cusp of managing personal finances for dummies and Online Trading?

What types of investments are there?

- Fixed-Rate Investments: As mentioned, these investments offer a fixed return over time. Usually, these investments are considered less risky as the counter party involved in such investments are banks or the government. Such investment products include treasury bonds, government backed bonds, mortgage-backed securities, etc.

These may not offer very high returns in a short period of time; instead, they offer fixed returns and usually done for long periods.

- Market-Linked Investments: These investments are highly volatile, and their returns are dependent on market conditions. Fluctuations in the markets make these investments riskier than other types of investments. Some examples of these types of investments are:

-

- Stocks: Equity investment can be made in a company by investing in its stocks. Stockholders receive returns in the form of dividend income or through capital appreciation. Dividend income refers to the cash paid to the stockholders on liquidation, whereas capital gains refer to the appreciation in the value of the stock.

Both Dividend income and capital gains affect the returns positively.

-

- Commodities: Commodity trading allows investing in contracts of gold and other commodities. However, the profits made on these contracts are highly susceptible to any changes in the market.

Profits can be made on commodities like gold, oil, grains, etc by buying and selling contracts on these commodities through various exchanges.

-

- Mutual Funds: Mutual funds pool in money from various investors and use this money to invest in various financial instruments. This type of investment can be considered appropriate for investors who lack knowledge of the market and do not have much experience with investing in financial instruments.

- Exchange Traded Funds: Exchange traded funds involve taking an index fund as a benchmark and trading in a collection of securities. These securities are traded on an exchange platform which offers a regulated environment.

- Investments in Tangible Items: Investments can be made in goods like gold, real estate, etc directly, by buying and selling them. Investing in property allows the investor to either resell the product when prices rise or to make profits by putting it up on rent.

How are financial investments different from other types of investments?

Consider the money spent by a family on educating their child so that the children can make a living for themselves in the future. The money spent on education is made to ensure a future stream of income. However, this is not a financial investment as the investment is not made in a financial instrument.

Here, the investment is made in education and skills which would enable the children to work on their own and make a living using those skills is not a financial investment.

Financial investment has a direct linkage with profits. Any other kind of investment which offers benefits in the form of better health, education, mental peace, can not be considered a financial investment. For instance, if a company puts money in creating a rehabilitation area for its employees to increase their efficiency in the workplace, then it can be considered as a type of investment. However, it is not a financial investment as the company does not know how much of these benefits would translate into profits for them.

Please wait processing your request...

Please wait processing your request...