Section 1: Company Fundamentals

1.1 Company Overview and Performance summary

Company Overview:

Abbott Laboratories (NYE: ABT) is a global healthcare company. The Company’s portfolio of technologies spans the spectrum of healthcare, with businesses and products in diagnostics, medical devices, nutritional and branded generic medicines. Its segments include Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices.

This US Inflation Report covers the Company Overview & Price performance, Summary table, Key positives & negatives, Key metrics, Company details, technical guidance & Stock recommendation, and Price chart.

Price Performance:

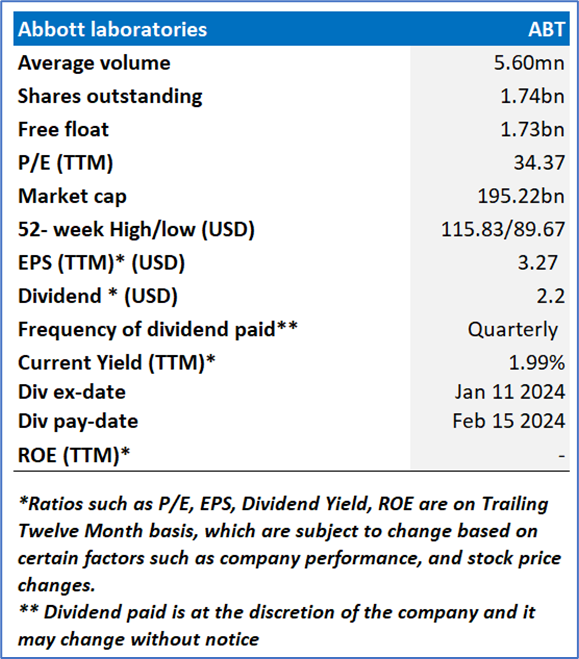

1.2 Summary Table

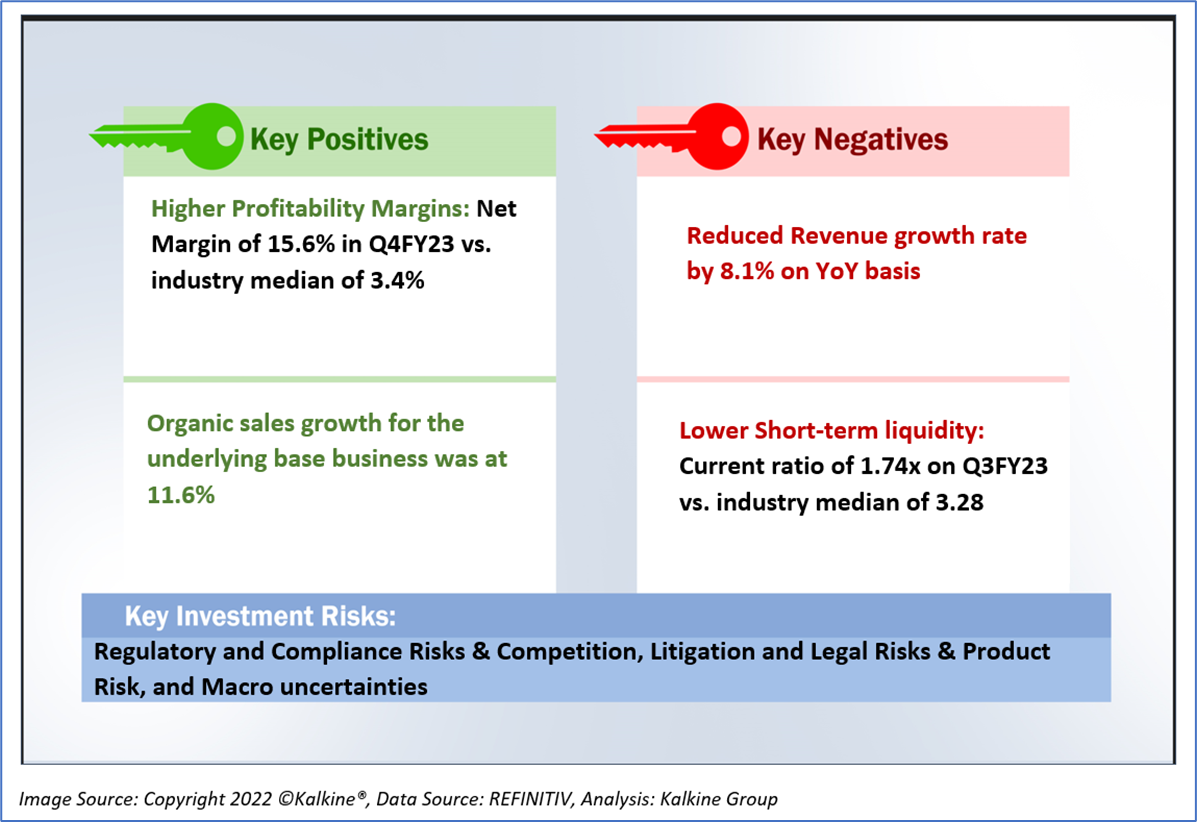

1.3 The Key Positives & Negatives

1.4 Key Metrics

ABT has adeptly controlled its expenditures, effectively preserving revenue stability amidst periods of escalating global inflation. This strategic approach has yielded superior net margins when compared to industry peers. Notably, ABT has made significant strides in augmenting its Return on Equity (ROE) over the preceding year. This judicious financial management underscores ABT's resilience in navigating economic challenges, safeguarding profitability, and securing a favorable position within the competitive landscape. Through the optimization of spending and the fortification of revenue streams, the company has not only upheld its financial well-being but has also enhanced its profitability metrics, as evidenced by the improved ROE. This attests to ABT's unwavering commitment to delivering value to shareholders while effectively confronting economic uncertainties.

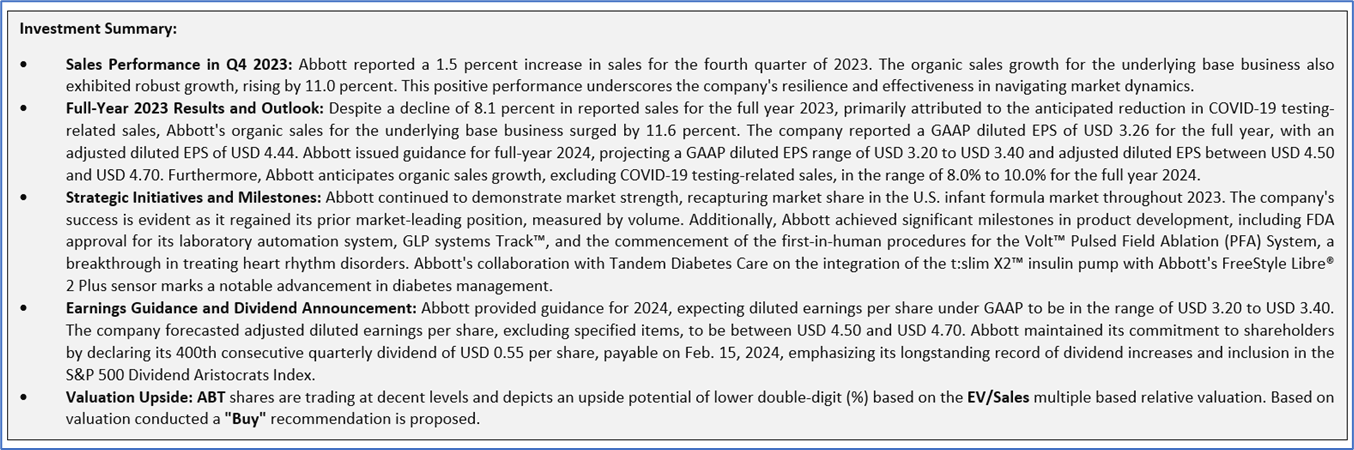

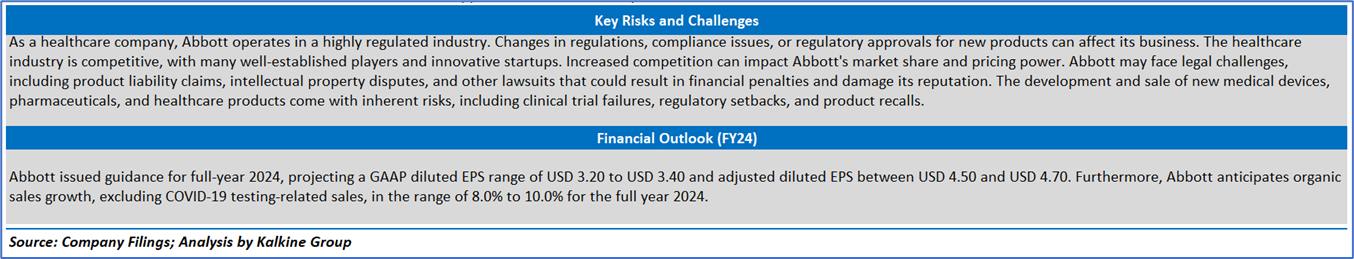

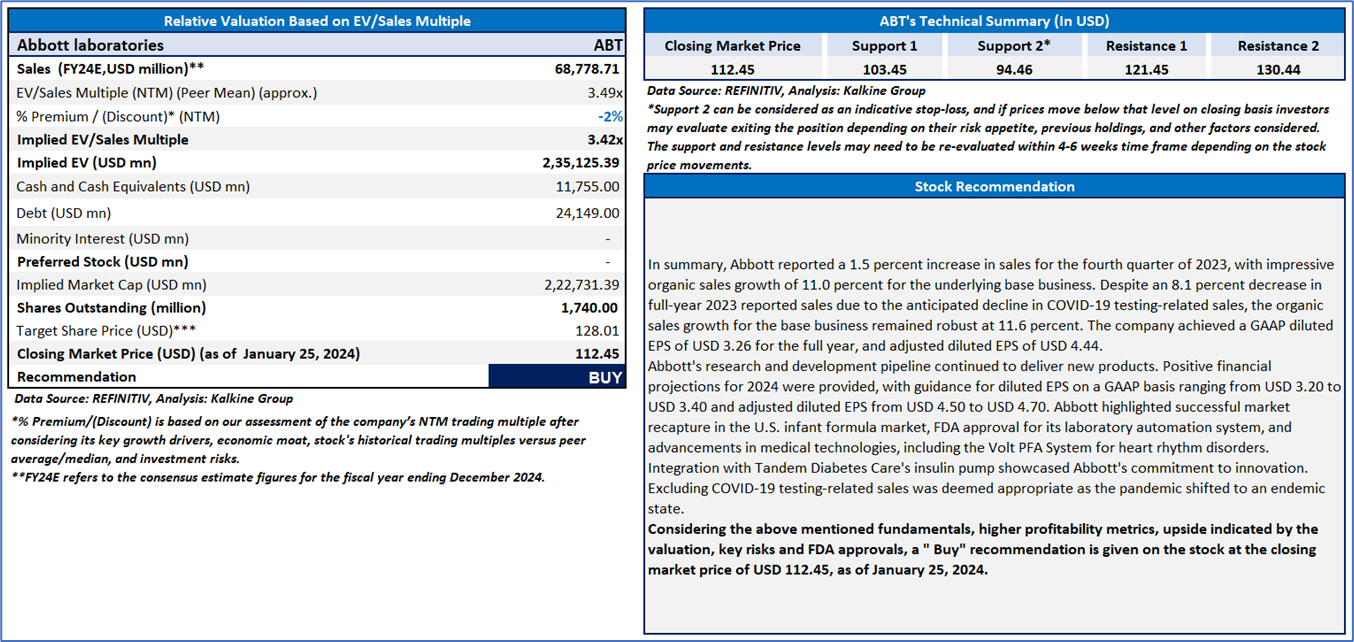

Section 2: Abbott laboratories (“Buy” at the closing market price of USD 112.45, as of January 25, 2024)

2.1 Company Details

2.2 Technical Guidance and Stock Recommendation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is January 25, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stocks prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.