RY 139.89 0.8943% TD 76.9 1.2242% SHOP 86.16 -18.5248% CNR 172.89 0.5818% ENB 51.15 1.1269% CP 112.14 0.5199% BMO 127.56 0.9816% TRI 229.43 0.1528% CNQ 105.96 1.0105% BN 60.44 0.683% ATD 75.02 0.4015% CSU 3820.47 1.7341% BNS 65.64 1.4685% CM 66.73 1.3364% SU 53.67 0.4304% TRP 52.0 1.069% NGT 57.07 0.3693% WCN 227.19 0.0528% MFC 33.6 0.9919% BCE 46.16 0.5445%

Global Commodity Market Wrap-Up

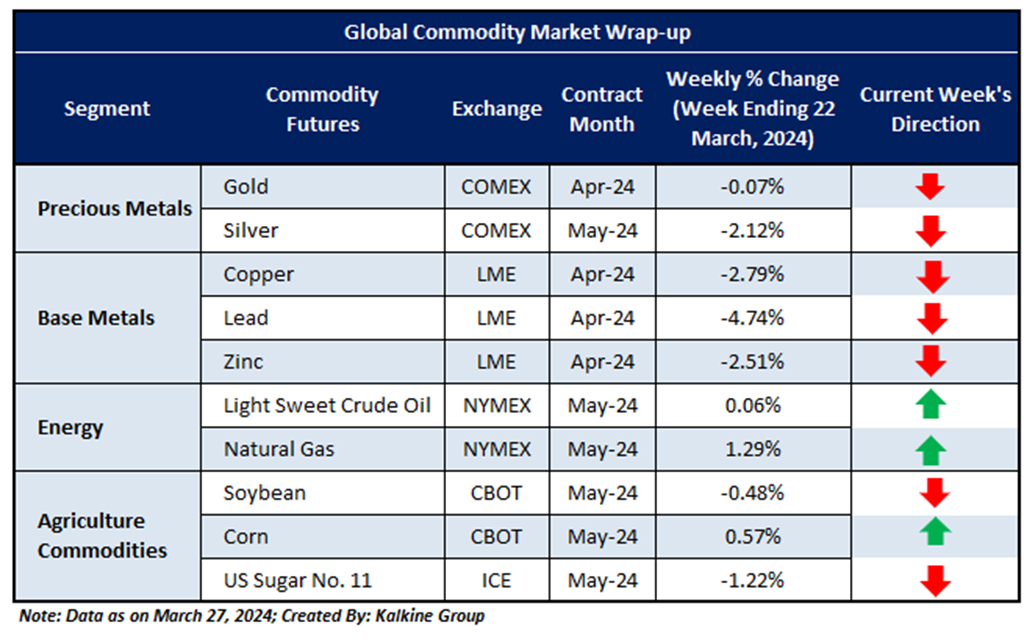

Last week, metal commodities prices witnessed profit booking in higher levels, loosing majority of gains and closed in negative. Gold prices trading in positive range facing resistance in higher levels and settled with a weekly loss of ~0.07%. Moreover, Silver also lost some gains and close of ~2.12% and other base metals faced profit booking. Base metals ended in negative last week. Copper and Zinc prices witnessed a weekly loss of ~2.79% and ~2.51% and Lead closed in negative of ~4.74%.

On the Energy front, Natural Gas prices trading in range bound zone due to weaker demand and settled at a weekly gain of ~1.29%. Moreover, Crude Oil prices also recovered from lower level and settled with a weekly gain of ~0.06%. Meanwhile, agricultural commodities prices traded mixed and closed in negative zone and US Sugar also facing resistance and in negative of ~1.22%.

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.