RY 139.14 0.5492% TD 75.13 0.4412% SHOP 105.68 3.7502% CNR 172.48 2.0773% ENB 50.14 0.8245% CP 111.43 2.145% BMO 127.18 1.9152% TRI 228.41 1.3714% CNQ 103.87 1.7336% BN 59.7 2.3838% ATD 75.25 0.3467% CSU 3750.01 3.0786% BNS 64.82 1.0759% CM 66.11 0.9159% SU 53.13 1.6648% TRP 51.39 -0.0972% NGT 56.61 1.7434% WCN 227.64 1.3355% MFC 33.42 1.7042% BCE 45.86 -0.2176%

Section 1: Company Overview and Fundamentals Insights

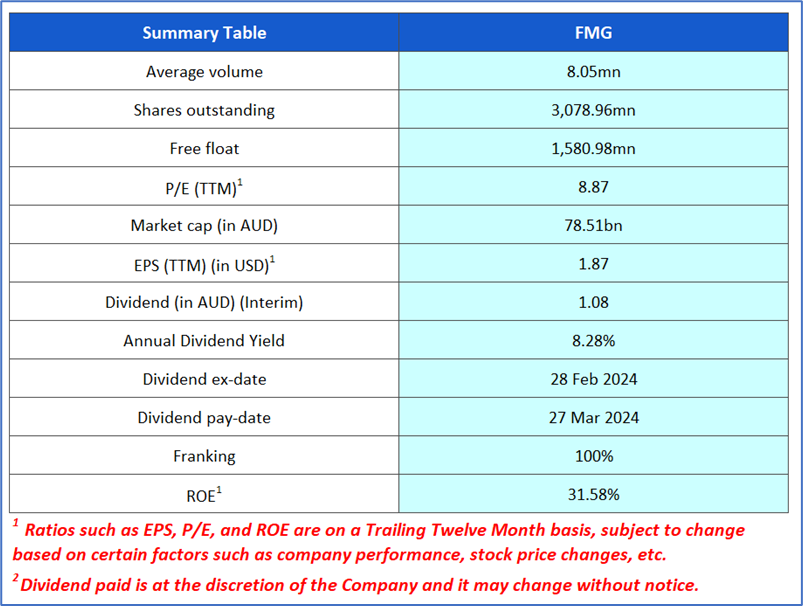

Company Overview: Fortescue Limited (ASX: FMG) engages in the exploration, development, production, Processing, and sale of copper, gold and lithium deposits, and rare earth elements, which own and operates the Chichester Hub and the Solmon Hub mining projects located in the Hamersley ranges of Pilbara, Western Australia. Kalkine’s Global Fully Charged Report covers the Investment Highlights, Management Insights, Key Financial Metrics, Risks, and Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

1.2 The Key Positives, Negatives, Investment Highlights, and Risks

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.