Company Overview: Baytex Energy Corp. (TSX: BTE) is an oil and gas company. Geographically, the group operates in Canada and the United States. The company derives a majority of revenue from Canada. Its Canada segment includes the exploration, development, and production of crude oil and natural gas in Western Canada. Prime Mining Corp. (TSX: PRYM) is engaged in the acquisition, exploration, and development of mineral resource properties, primarily targeting high-value and specialty metals. This Report covers the Price Action, Technical Indicators Analysis along with the Stop Loss Levels, Target Prices, and Recommendations on these two stocks.

Canada Market Round-Up

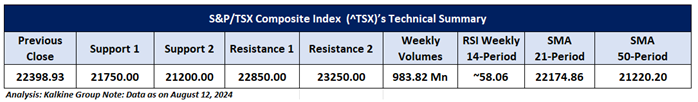

The benchmark S&P/TSX Composite Index (TSX: ^TSX) started last week on a positive note and maintained a bullish momentum for the entire week. The S&P/TSX composite index advanced by 83.67 points (0.38%) to 22311.30 for the week ending August 09, 2024. On August 12, 2024, the index closed at 22398.93, up by 87.63 points or ~0.39%. Energy and Base Metals were the leading sectors, While Real Estate, Financials, Industrials, Healthcare, Technology, and Utilities were the lagging sectors on Monday. As per the data published by Statistics Canada, Canadian the total value of building permits in Canada fell 13.9% to $9.9 billion in June. The weekly chart indicates that the index prices are trading above the horizontal trendline support zone. Moreover, prices are sustaining above the 21-period & 50-period SMAs, which may act as a support level for the index. The immediate resistance for the index is around 22850, while the immediate support exists at 21750. On the weekly time frame, RSI is reading at ~58.06 levels.

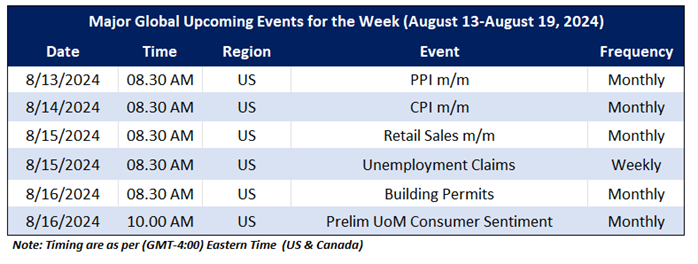

On the macro front, the upcoming major economic events that may impact the Canadian market sentiment include US PPI m/m, U.S Retail Sales m/m and U.S Unemployment Claims.

Global Markets Wrap-Up

For the week ending August 09, 2024, the Nasdaq composite closed at 16745.30, down by ~0.18%. Moreover, the Russell 2000 was down by ~1.35% and settled at 2080.92 According to the weekly data published by the U.S. Department of Labor, the seasonally adjusted initial US initial jobless claims decreased by 17,000 to 233,000 for the week ending August 03, 2024, against the initial claims at 250,000 in the prior week. .

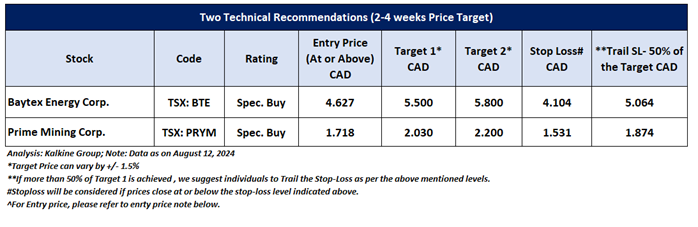

Taking into the US market's performance over the last week, following the major global macros and data front, based on the technical analysis of the S&P/TSX Composite Index, the two TSX listed stocks fit the maximum criteria on the technical framework. The recommendations are based on the generic insights, entry price, target prices, and stop-loss for Baytex Energy Corp. (TSX: BTE) and Prime Mining Corp. (TSX: PRYM) for the next 2-4 weeks.

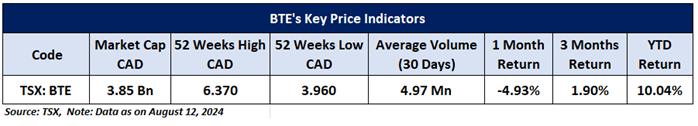

Baytex Energy Corp. (TSX: BTE)

Price Action Analysis (on the Daily Chart)

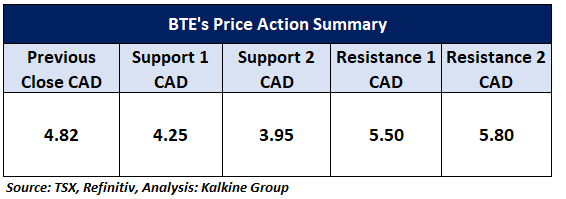

On the daily chart, BTE stock prices are sustaining above the rising trendline support level and continuously taking support from the trendline. The recent upside movement in the stock is backed by increasing volumes, further supporting a positive bias. The next resistance level is plotted around CAD 5.50, and the stock may test that level in the short term (2-4 weeks).

Technical Analysis (On the Daily Chart)

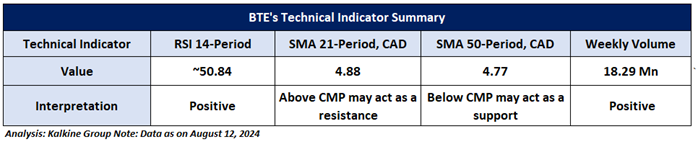

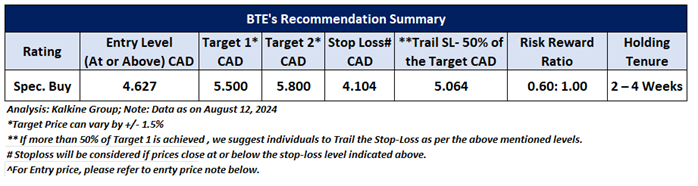

On the daily chart, the momentum oscillator RSI (14-Period) is showing a reading of ~50.84 levels, indicating positive momentum. Moreover, the weekly volumes also seem supportive of the upside movement. Further, the stock is trading above the 50-period SMA, which may act as a support level.

General Recommendation:

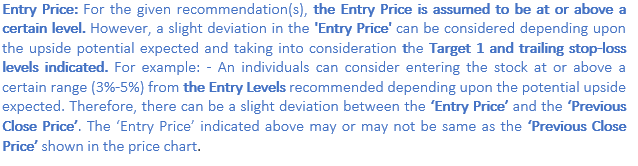

As per the above-mentioned price action and technical analysis, Baytex Energy Corp. is looking technically well-placed on the chart, and a ‘Speculative Buy’ recommendation has been given on the stock. Investment decisions should be made depending on an individual’s appetite for upside potential, risks, and any previous holdings.This recommendation is purely based on technical analysis, and fundamental analysis has not been considered in this report. Baytex Energy Corp. (TSX: BTE) was last covered in a report dated '11 July 2024'.Below is the summary of our recommendation.

Prime Mining Corp. (TSX: PRYM)

Price Action Analysis (on the Daily Chart)

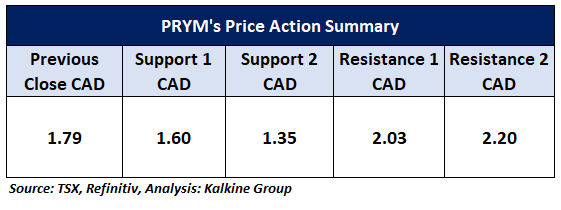

On the daily chart, PRYM stock prices are trading above the downward sloping trendline support level and continuously taking support from the trendline. The recent upside movement in the stock is backed by increasing volumes, further supporting a positive bias. The next resistance level is placed around CAD 2.03, and the stock may test that level in the short term (2-4 weeks).

Technical Indicators Analysis (On the Daily Chart)

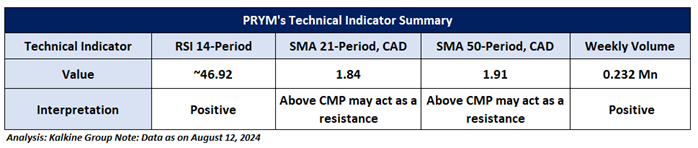

On the daily chart, the momentum oscillator RSI (14-Period) is showing a reading of ~46.92 levels, indicating positive momentum. Moreover, the weekly volumes also seem supportive of the upside movement. However, the stock is trading below the 21-period SMA, which may act as a resistance level.

General Recommendation:

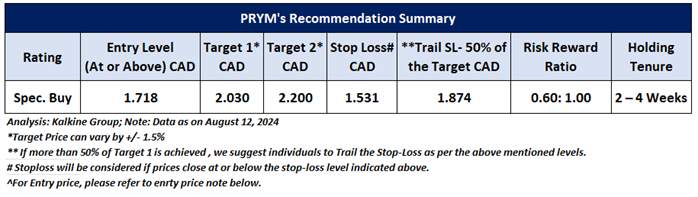

As per the above-mentioned price action and technical analysis, Prime Mining Corp. looking technically well-placed on the chart, and a ‘Speculative Buy’ recommendation has been given on the stock. Investment decisions should be made depending on an individual’s appetite for upside potential, risks, and any previous holdings.This recommendation is purely based on technical analysis, and fundamental analysis has not been considered in this report. Prime Mining Corp. (TSX: PRYM) was last covered in a report dated '18 July 2023'. Below is the summary of our recommendation.

Upcoming Major Global Economic Events

Market events occur on a day-to-day basis depending on the frequency of the data and generally include updates on employment, inflation, GDP, consumer sentiments, etc. Noted below are the upcoming week's major global economic events that could impact the S&P/TSX Composite Index and listed stocks' prices.

Related Risks: This report may be looked at from high-risk perspective and recommendations are provided are for a short duration. Recommendations provided in this report are solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Individuals can consider exiting from the stock if the Target Price or Stop loss mentioned as per the technical analysis has been achieved and subject to the factors discussed above.

Note 2: How to Read the Charts?

The Green color line reflects the 21-period moving average, while the Red color line indicates the 50-period moving average. SMA helps to identify existing price trend. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The Black color line in the chart's lower segment reflects the Relative Strength Index (14-Period), which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status, while a reading of 30 or below suggests an oversold status.

The Blue color bars in the chart's lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume. Liquidity in stocks helps in easier and faster execution of the order.

The Orange color lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Risk Reward Ratio: The risk reward ratio is the difference between an entry point to a stop loss and profit level. This report is based on ~60% Stop Loss of the Target 1 from the entry point.

A trailing stop-loss is a modification of stop-loss in case of favourable movement in the price to protect the gains. Individuals can Trail the Stop-Loss as per the aforementioned levels if the stock price achieves more than 50% of the Target 1. individuals should consider exiting from the position as per the Trailing Stop-Loss level if the price starts moving downwards after achieving more than 50% of the Target 1.

The reference date for all price data, currency, technical indicators, support, and resistance levels is August 12, 2024. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

CAD: Canadian Dollar

RSI: Relative Strength Index

Note: Trading decisions require a thorough analysis by individuals. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.