RY 144.17 0.4529% TD 77.39 0.0517% SHOP 78.87 -1.3878% CNR 171.64 0.5625% ENB 50.09 -0.4769% CP 110.62 0.6277% BMO 128.85 -0.548% TRI 233.58 1.1563% CNQ 103.29 -0.174% BN 60.87 -0.2295% ATD 75.6 -1.447% CSU 3697.0 1.1582% BNS 65.76 -0.3485% CM 66.6 -0.5525% SU 54.21 1.1569% TRP 53.15 0.3398% NGT 58.54 -0.3405% WCN 226.5 0.4123% MFC 35.905 0.9986% BCE 46.75 -0.5954%

Company Overview: Wells Fargo & Company is a bank holding company. The Company is a diversified financial services company. It has three operating segments: Community Banking, Wholesale Banking, and Wealth and Investment Management. The Company offers its services under three categories: personal, small business and commercial. It provides retail, commercial and corporate banking services through banking locations and offices, the Internet and other distribution channels to individuals, businesses and institutions in all 50 states, the District of Columbia and in other countries. It provides other financial services through its subsidiaries engaged in various businesses, including wholesale banking, mortgage banking, consumer finance, equipment leasing, agricultural finance, commercial finance, securities brokerage and investment banking, computer and data processing services, investment advisory services, mortgage-backed securities servicing and venture capital investment.

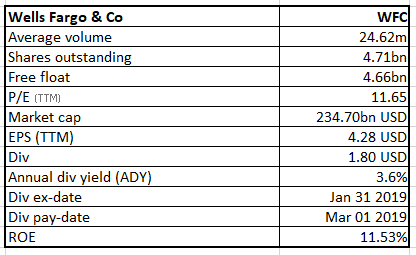

WFC Details

Demonstrating a decent performance through Fourth Quarter 2018: Wells Fargo & Co (NYSE: WFC), which has been at rank 26 on Fortune’s 2018 rankings of America’s largest corporations, is a diversified financial services company that offers retail, commercial, and corporate banking services. Wholesale Banking, Community Banking, and Wealth and Investment Management have been its segments of operation. Meanwhile, the company has declared the quarterly result that was a mixed one. During the fourth quarter of 2018, WFC has delivered the net income of $6.1 billion, which is less than $6.2 billion reported in the fourth quarter 2017, but slightly better than $6.0 billion reported for third quarter 2018. The full year 2018 net income of $22.4 billion is noted and this is above $22.2 billion in 2017. Group’s net interest margin has improved marginally from 2.87% (2017) to 2.91% (2018) and is trying to inch towards the industry levels while pre-tax return on equity touching at 14.2% was above the industry median of 12.4%.

WFC’s adjusted earnings per share was of the order of $1.21 in the fourth quarter of 2018; and this is better than what the analysts’ were expecting (adjusted earnings per share of $1.16). There has otherwise been a 4 percent fall in adjusted revenue that came at $20.98 billion. The reported revenue has missed the analysts’ estimates for topline of $21.73 billion. During the fourth quarter of 2018, net interest income increased by $72 million to $12.6 billion from third quarter 2018, on the back of the benefits of higher average interest rates and also due to favorable hedge ineffectiveness accounting results. However, this was partially offset due to change in the balance sheet mix and also due to lower variable income. Net interest margin during the quarter was flat at 2.94 percent compared to the prior quarter.

Drop in effective income tax rate: For the fourth quarter 2018, WFC’s effective income tax rate has declined to 13.7 percent from 20.1 percent for third quarter 2018 and included net discrete income tax expense as posted in the third quarter. The group stated that re-measurement of initial estimates for the Tax Cuts & Jobs Act (Tax Act), as posted in fourth quarter of 2017 were considered for the income tax expense. Total average loans in the fourth quarter rose by $6.9 billion to $946.3 billion from the third quarter, but fell 1% on yoy basis; and total average deposits rose $2.6 billion to $1.3 trillion, over the prior quarter. The growth in deposits was owing to higher commercial deposits, while this was partially offset by a reduction in consumer and small business banking deposits. This comprised of $1.8 billion of deposits that are related with the sale of 52 branches, which got closed on November 30. However, average deposits declined 3% YoY due to lower Wholesale Banking deposits. Meanwhile, there was a drop in efficiency ratio and WFC ended the year at 65 per cent while the bank had to bear the impact from higher costs given the regulatory fines and legal expenses associated with customer related issues. Additionally, minority interest rose up $11 million due to higher equity gains from venture capital and private equity partnerships.

Net Income Performance (Source: Company Reports)

Credit Quality Improved During the Fourth Quarter: Net charge-offs (Total credit losses) in the fourth quarter rose by $41 million to $721 million driven by higher consumer losses. In the fourth quarter, the quarterly loss rate was 0.30 percent on annualized basis, compared with 0.29 percent in the prior quarter and 0.31 percent posted a year ago. The company has booked the commercial and consumer losses of 0.10 percent and 0.53 percent, respectively. Further, the company’s commercial losses have fallen $20 million. This is due to decline in commercial and industrial loan net charge-offs and also due to the company receiving higher recoveries from the commercial real estate. There has been a rise in the consumer losses by $61 million with higher credit card sales and credit and installment loan charge-offs. Meanwhile, nonperforming assets have fallen 4 percent from third quarter 2018 to $6.9 billion. There has been a decline in nonaccrual loans by $218 million against third quarter 2018 to $6.5 billion with consumer and commercial non-accruals coming at lower levels. The allowance for credit losses as at December 31, 2018, including the allowance for unfunded commitments came at $10.7 billion, representing a fall by $249 million against the figure reported as at September 30, 2018. The last quarter also included a $200 million reserve release at the back of better credit quality related to the loan portfolio.

Parameters for Credit Quality (Source: Company Reports)

Mixed Business Performance during the fourth quarter: Primary consumer checking customers grew 1.2 percent to 23.9 million from a year ago. The purchase volume of debit card point-of-sale rose 8 percent to $89.8 billion while the purchase volume of general purpose credit card point-of-sale was up 5 percent to $20.2 billion on a year-over-year basis. WFC at the end of the quarter has 29.2 million digital active customers, that included 22.8 million mobile active users. Digital active customers consisted of both mobile & online customers. Moreover, Home Lending Originations declined to $38 billion from $46 billion in the prior quarter and this trend found base from factors such as seasonality. Home Lending Applications also fell down to $48 billion from $57 billion in the prior quarter. Home Lending Application pipeline, at quarter end, declined to $18 billion from $22 billion at September 30, 2018. On the other hand, there was a 9% growth in Automobile originations to $4.7 billion in the fourth quarter compared to the prior year; and even student loan originations also rose 16 percent to $258 million. Small Business Lending originations during the fourth quarter grew 19 percent $595 million from the prior year. Additionally, total assets under management (AUM) declined 8 percent to $466 billion, from prior year in view of lower market valuations, equity and fixed income net outflows, and sale of Wells Fargo Asset Management's ownership stake in The Rock Creek Group, LP and removal of the associated AUM. However, higher money market fund net inflows tried to balance out the figure to some extent.

Transformational Changes Undertaken during 2018: WFC has undertaken transformational changes during 2018, that comprise of the significant progress on the six goals. WFC has made significant improvements related with the management of the risk across the company, particularly related with the operational and compliance risk. The customer service has been improved and helped in achieving the ‘Customer Loyalty’ and ‘Overall Satisfaction with Most Recent Visit’ branch survey scores, which have touched a 24-month high in December. WFC has completed over 318,000 branch customer experience surveys during fourth quarter 2018; and its voluntary team member attrition has also improved in 2018 to the lowest level in about six years. With the launch of numerous customer-focused innovations (such as online mortgage application, Control TowerSM, Pay with WFC, and the new Propel Card), the group has been able to gain more traction. As a result, WFC has exceeded the target of donating $400 million to people across the U.S. Moreover, WFC has met the 2018 expense target. Additionally, at the end of fourth quarter 2018, WFC has 5,518 retail bank branches, which reflect the consolidations of 93 branches in the fourth quarter and overall 300 consolidations in 2018. The company has completed the previously announced sale of 52 branches in the fourth quarter 2018; and these branches have been in Indiana, Michigan, Ohio, and part of Wisconsin. The group is also working through its regulatory issues after the Federal Reserve rejected the bank's plan to prevent more consumer abuses; along with a cost-cutting plan (that takes into account up to 10 percent cut in employee head count).

Capital Management: WFC has declared to pay a dividend of 45 cents per share, which is a rise of 2 cent per share or 5 percent rise from the prior quarter. The company will be paying dividend on March 1st, 2019 to shareholders of record on February 1, 2019. This increase of dividend amount is according to the company's 2018 capital plan. The company for this had received non-objection from the Federal Reserve earlier in June. Otherwise, the company has paid a quarterly common stock dividend of 43 cents per share during the quarter. Moreover, in the fourth quarter 2018, WFC had repurchased 142.7 million shares of the company’s common shares, which net of issuances, led to the reduction of the common shares outstanding by 130.3 million. Overall, WFC had returned a record $25.8 billion to shareholders in 2018, which is an increase of 78% from 2017. Meanwhile, in the fourth quarter, WFC’s capital has continued to exceed the company’s internal target while company’s Common Equity Tier 1 ratio (fully phased-in) has declined to 11.7 percent from 11.9 percent in the prior quarter.

Outlook and Stock Recommendation: For FY19, WFC currently expects the effective income tax rate to be about 18 percent. WFC is targeting efficiency ratio to be in the range of 55 per cent to 59 per cent in the long term, excluding litigation costs. Further, the company has planned cost reductions of US$4 billion by the end of 2019. Given the banking sector scenario and interest rates, the group is expected to improve its performance in the long run. WFC stock is trading at a price of $50.12 and has support at $44 level and resistance around $52. WFC has delivered mixed results in the fourth quarter of 2018 but looks poised for growth going forward with a healthy dividend payout. In fact, the single digit dividend growth rate over 5 years and Return on assets of 1.19 percent with return on equity of 11.53 percent (as per full year results), demonstrate an improvement in performance. Group’s return on average tangible common equity (ROTCE) of 13.73 percent has also been noted. Given the changing dynamics, we put a “Buy” recommendation on the stock at the current price of $ 50.12.

WFC Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.