Netcall PLC

Netcall PLC (LSE: NET) is an FTSE AIM All-Share index-listed Company that offers solutions for customer involvement. It creates, develops, and sells workforce management, business process management, and communications software and services to the public, commercial, and healthcare sectors. This Report covers the Key Recommendation Rationale, Conclusion, and Recommendation on the stock.

Key Recommendation Rationale – Sell at GBX 94.75

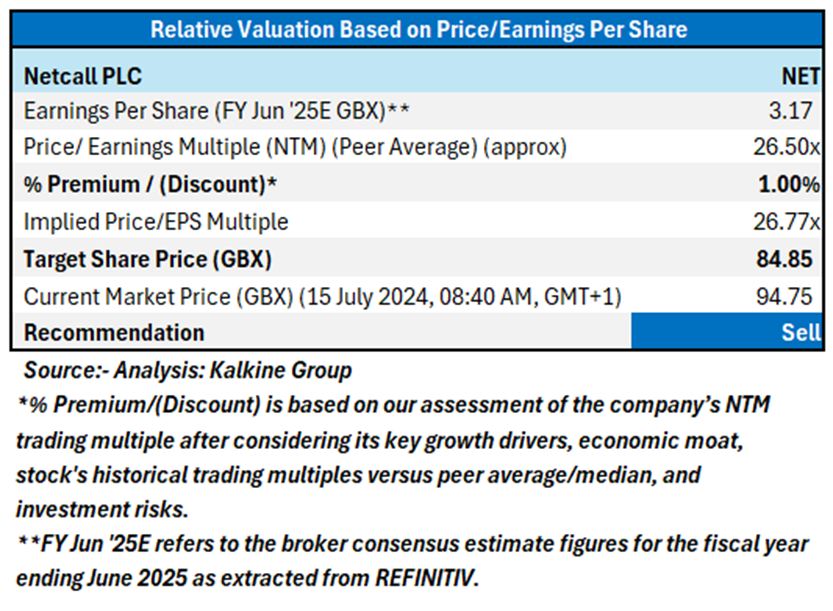

Valuation Methodology: Price/Earnings Approach

Share Price Chart

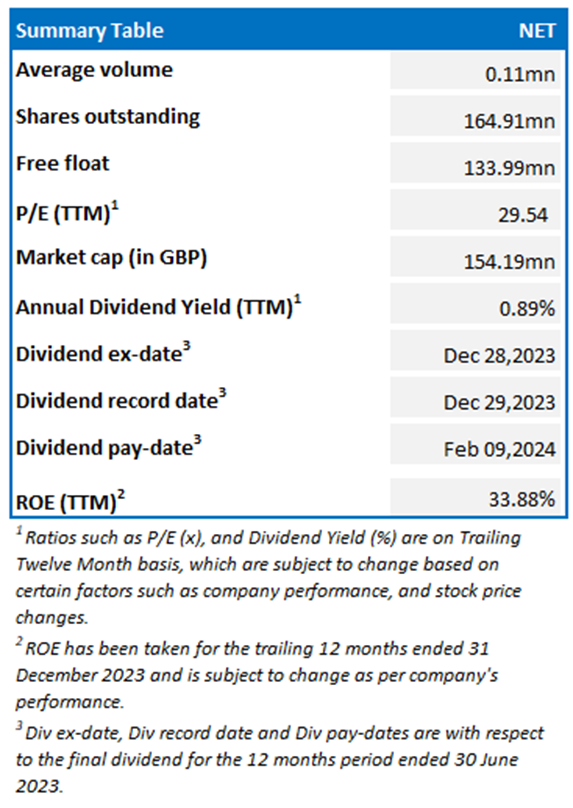

NET is expected to trade at a premium considering the launch of Liberty Converse CX, its next-generation AI- powered contact centre solution, increase in revenue by 8% during H1 FY24 as compared to pcp, and the improving demand for the AI and data centres. For conducting the valuation, the following peers have been considered: Cerillion PLC (LSE: CER), Altitude Group PLC (LSE: ALT), etc.

Given its current trading levels, the recent rally in the share price, relative valuation, and risks associated, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of GBX 94.75, at 08:40 AM GMT +1, as of 15 July 2024.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is 15 July 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level which the stock is expected to reach as per the relative valuation method and/or technical analysis taking into consideration both short-term and long-term scenario.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the London Stock Exchange (LSE) and or REFINITIV. Typically, both sources (LSE and or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

Note 6: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock price.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.